In our

Community.

A closer look at our members’ communities and how we support them.

At Chime, our mission is to help everyday people Unlock Financial ProgressTM. To do that, we create helpful and easy-to-use products that help our members move forward.

But financial services are just one piece of the puzzle. To ignite and sustain long-lasting change for the people we serve, we invest heavily in improving our industry, empowering individuals, strengthening communities, stepping in when our members need us most, and fostering a culture of giving back.

We’re honored to be The Most Loved Banking App®, and we’re even prouder of our positive impact on our communities.

Progress

through products.

Innovative banking tools and services

To earn our members’ loyalty, we obsess over their needs and build innovative products that meet them. We’ve helped our members access $30B in fee-free overdraft through SpotMe+ and raise their credit scores an average of 30 points.1

Basic banking without monthly fees.

We were one of the first to partner with banks to provide checking and high-yield savings without any monthly fees or minimum balance fees, which helped push more industry players to do the same.

Helping members build credit**—without the barriers.

With no credit check required, Chime secured credit cards can help members increase their credit scores by an average of 30 points1—while earning 1.5% cash back§§ on rotating categories with a qualifying direct deposit.

Financial flexibility.

When members are in a crunch, they can rely on SpotMe® fee-free overdraft to “spot” them up to $200.+ And through MyPay® members can access up to $500 of their pay before payday.^

Progress in

financial education.

In-app, online, and in our communities

To empower individuals, we provide extensive financial education tools and resources—with the goal of reaching 10 million people by 2027. That Feels like ProgressTM.

In-app financial education.

We provide engaging, best-in-class financial education content directly into our app, so every Chime member can use it.

Free comprehensive resources.

Open to anyone, our In the Green® blog provides helpful, in-depth information on everything from banking basics and credit building to smart budgeting.

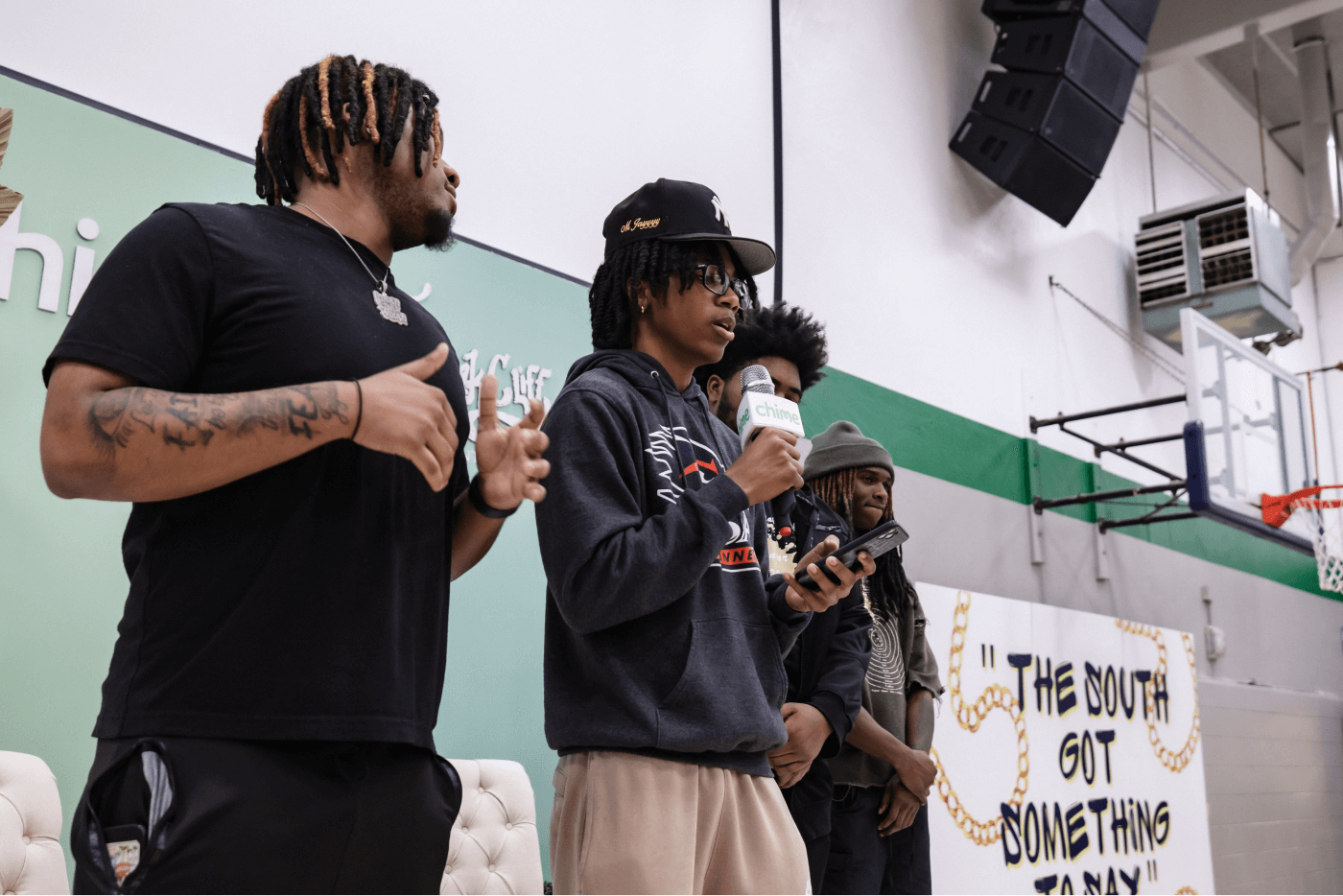

Local events.

Throughout the U.S., we host in-person events to help members and non-members alike learn how to manage their money to achieve their goals.

Powerful partnerships.

Through Chime’s partnership with Zogo®, anyone can access bite-sized, fun lessons and earn real rewards for learning about financial wellness.

Learn more about the partnership here.

Progress toward

higher (L)earnings.

Chime Scholars Foundation®

To help everyday Americans achieve their big dreams, we’ve joined the Pledge 1% Coalition, committing 1% of our total equity to fund college, apprenticeship, and trade school scholarships.

About CSF.

Through the Chime Scholars Foundation (CSF), we’re helping the next generation of learners move into higher-paying careers and build more financially stable lives.

Meet the Scholars.

We welcome nontraditional students, like those who are mid-career, single parents, community college transfers, part-time or returning, and those from low-income or marginalized communities.

Apply to join.

Learn more about the process and timeline for this year’s application.

Progress in the face

of adversity.

Support and career opportunities for Chime members

To keep our members and their communities on the path to progress, we step in to help when the unexpected hits and provide job training, counseling, and career growth opportunities.

Having our

members’ backs.

If a Chime member misses a direct deposit or a bill, we’ll check in to make sure they’re doing okay—and see if we can help.

Disaster recovery

and support.

When a natural disaster hits, Chime members can get home rebuilding assistance, help navigating insurance claims, and more through our partnership with SBP®.

Job training.

By partnering with organizations that are driving nontraditional pathways to higher-income jobs, we’re creating new jobs and paths to professional growth. That Feels like ProgressTM.

Career opportunities with Chime partners.

By connecting Chime members with opportunities in our broader partner network, we help members reach their earnings goals.

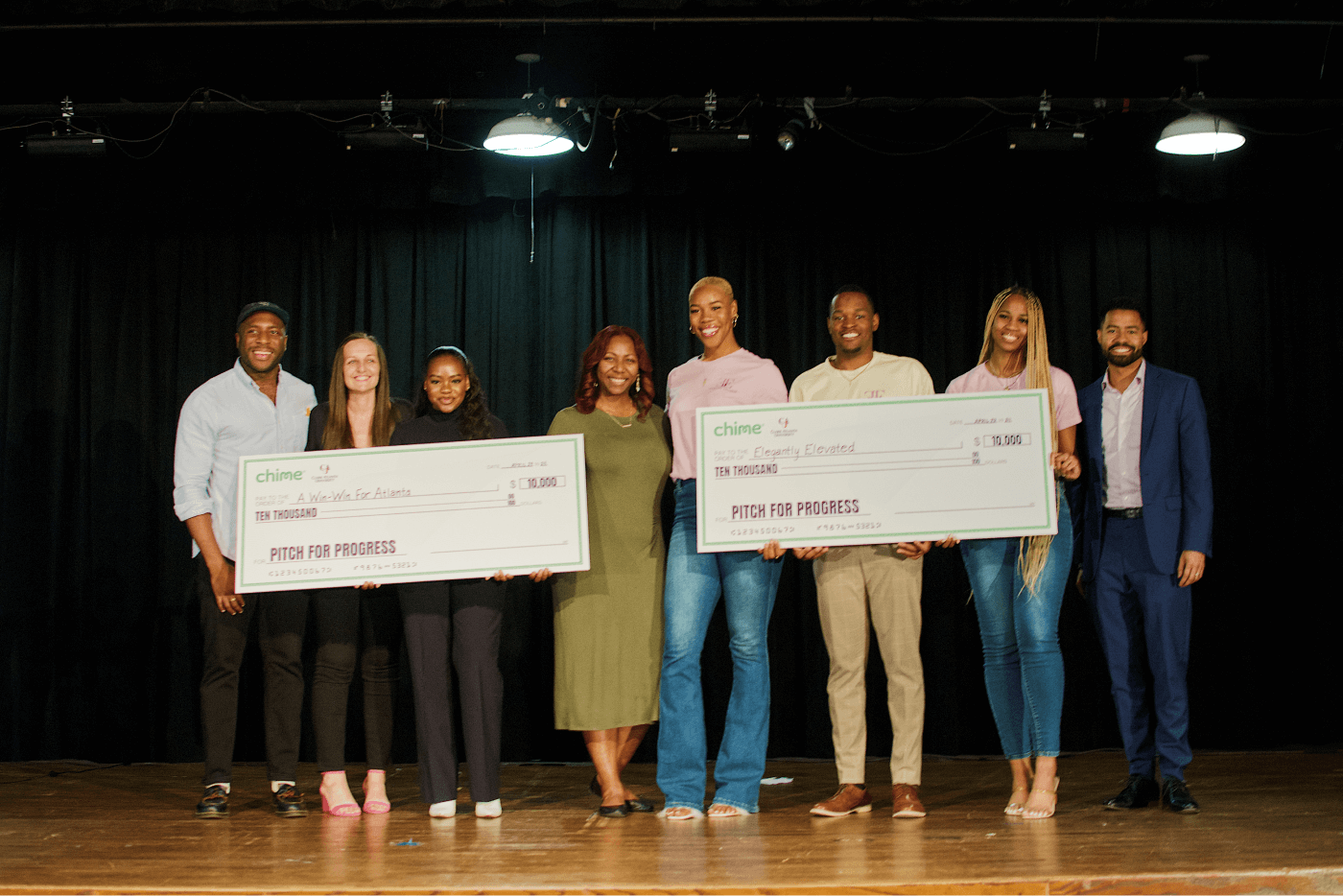

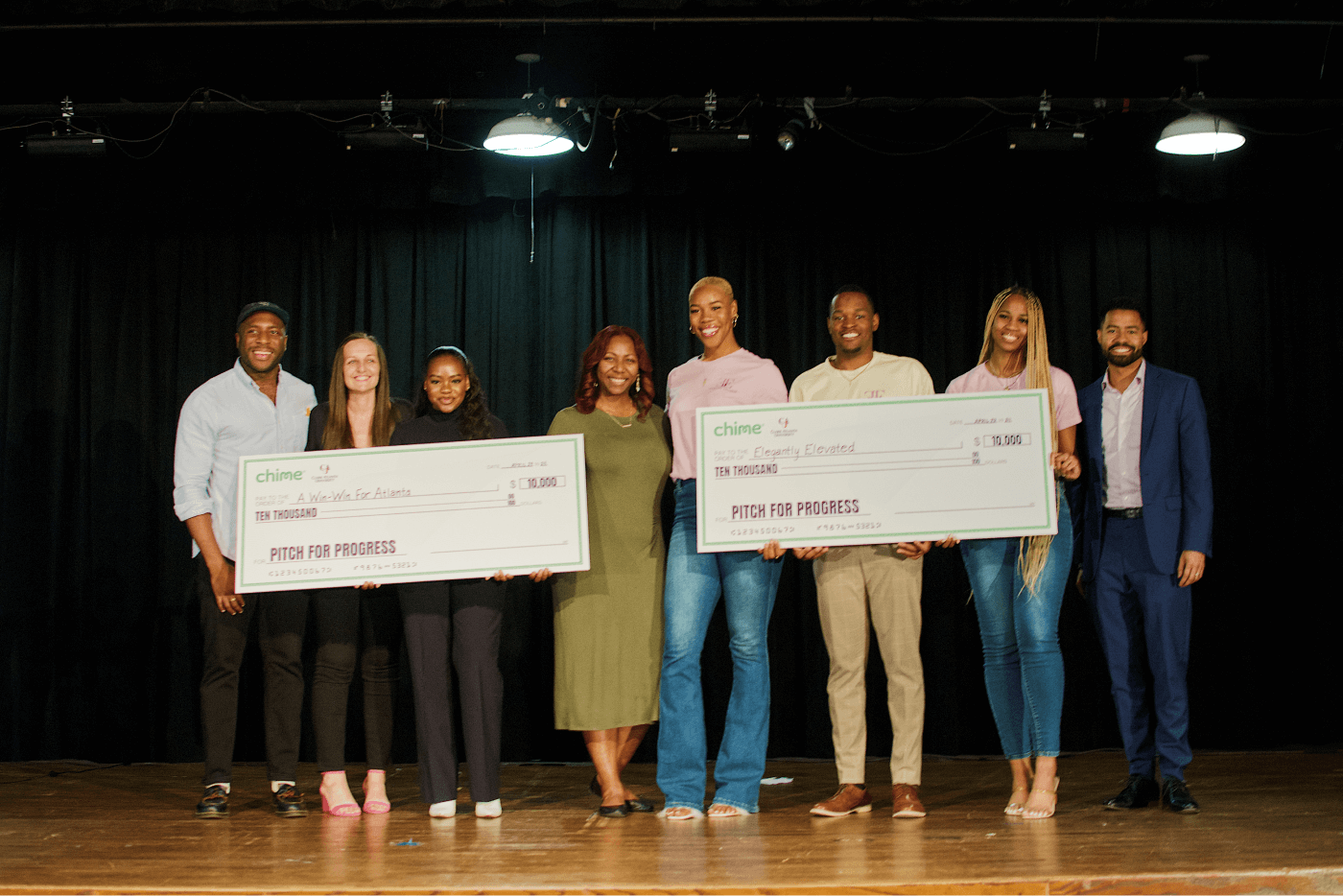

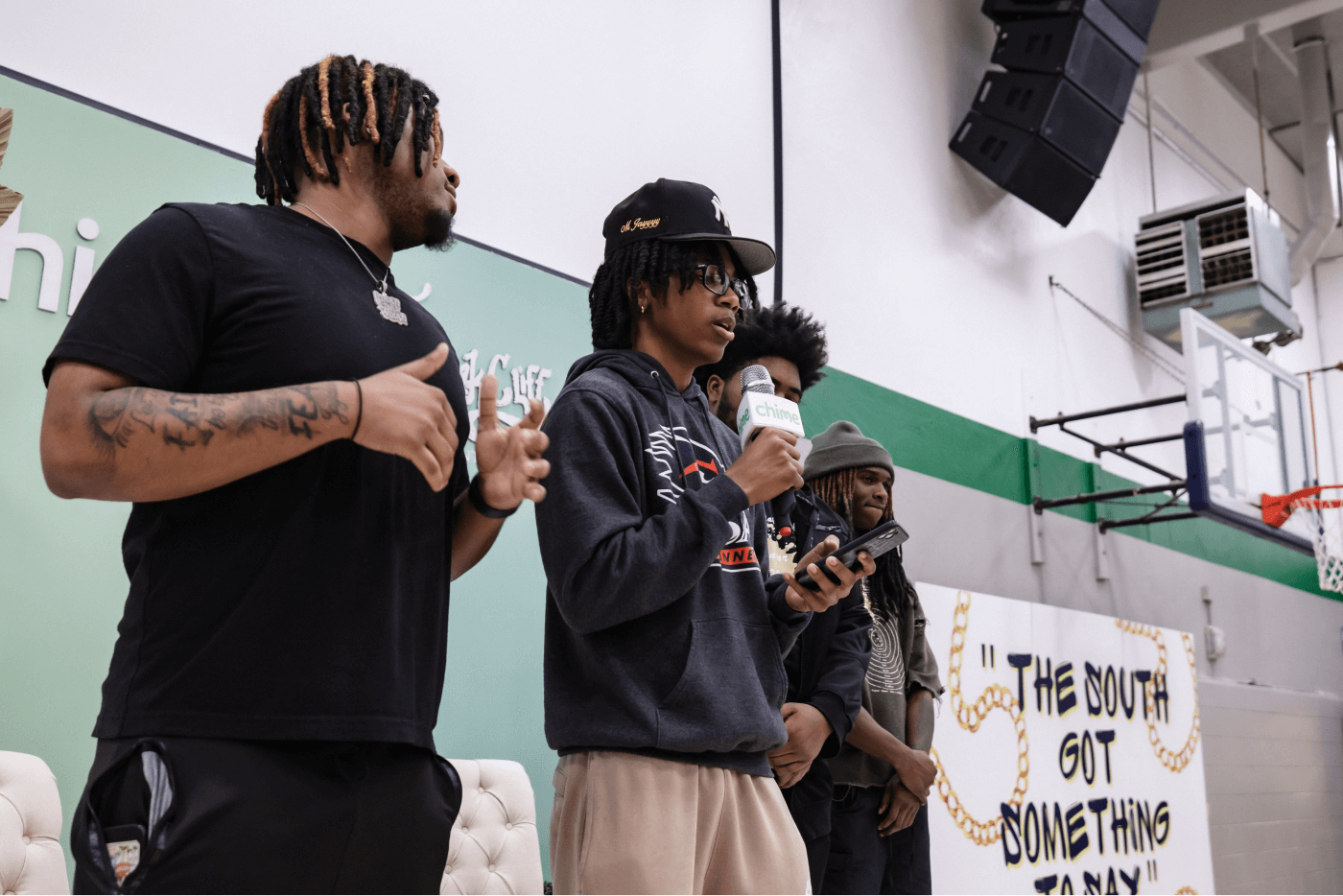

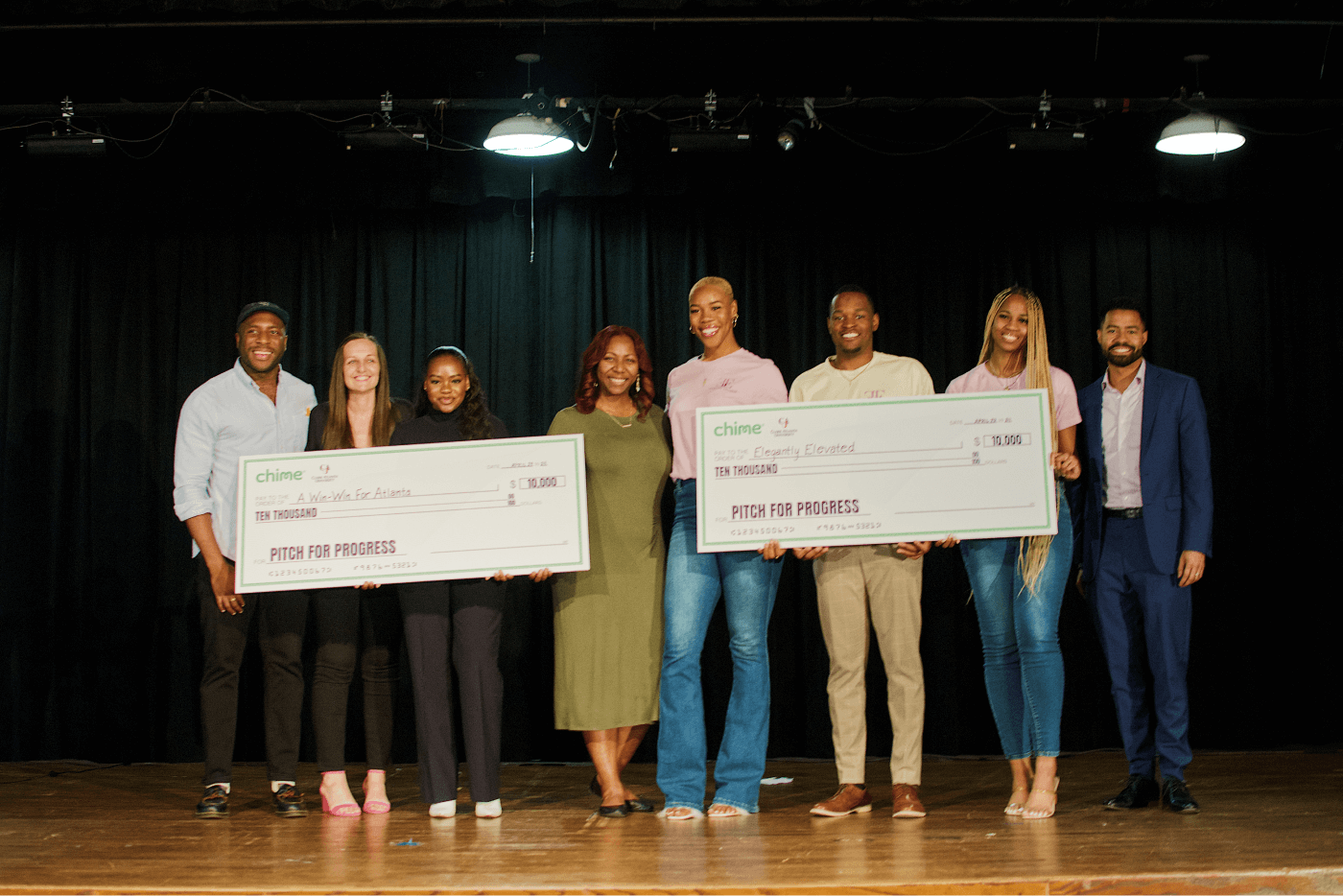

Progress against systemic barriers.

Investment in local innovators

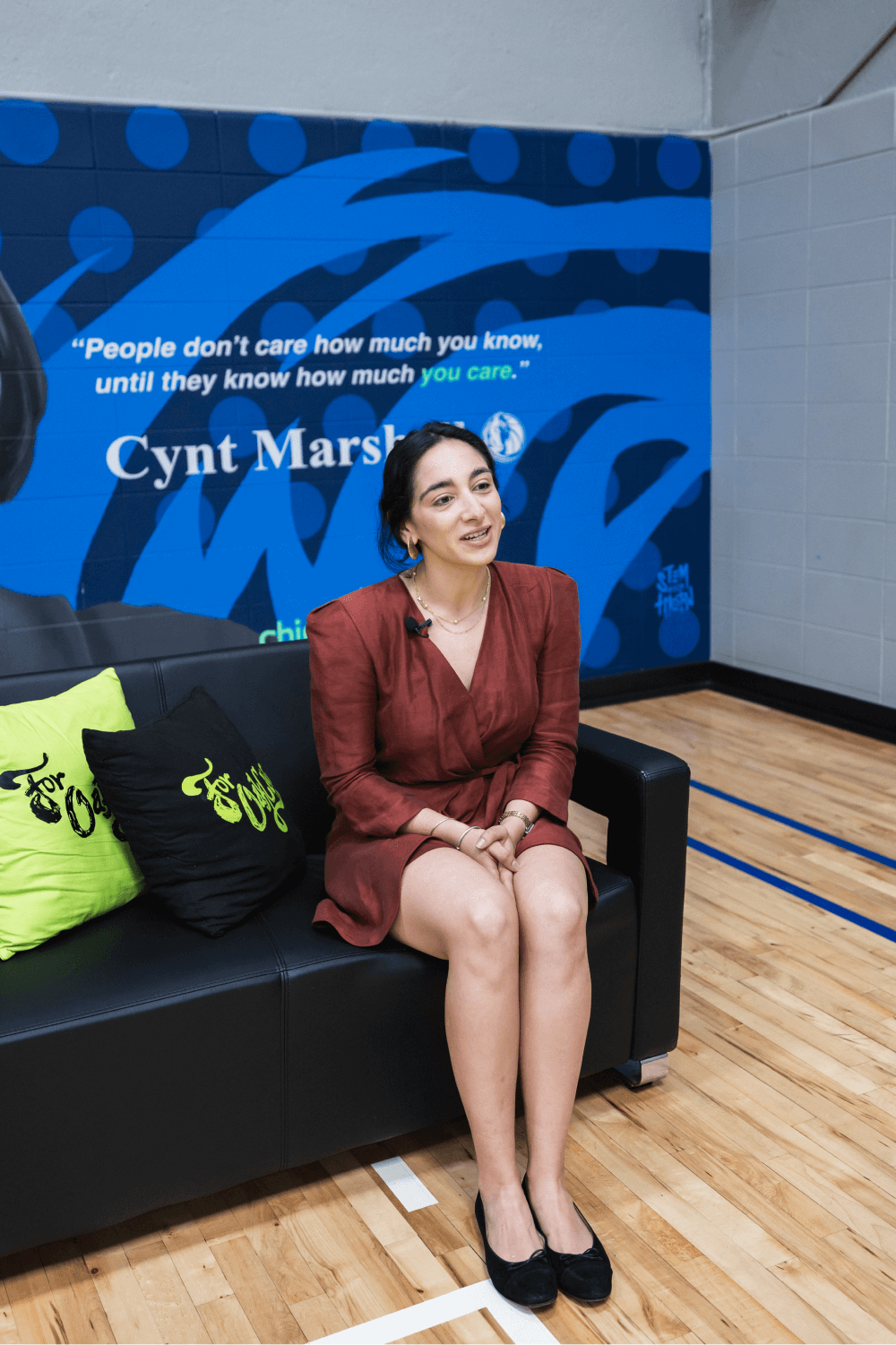

To strengthen communities, we invest in visionary up-and-coming entrepreneurs and innovators throughout the U.S. through our Chime Community ChangemakersTM program, giving them the funds, mentorship, and support they need to make a difference.

Josue De Paz, founder of First

Tech Fund.

First Tech Fund equips underserved students in urban areas for lifelong success through careers in tech by providing tech upskilling, access to technology, networking, mentorships, and more.

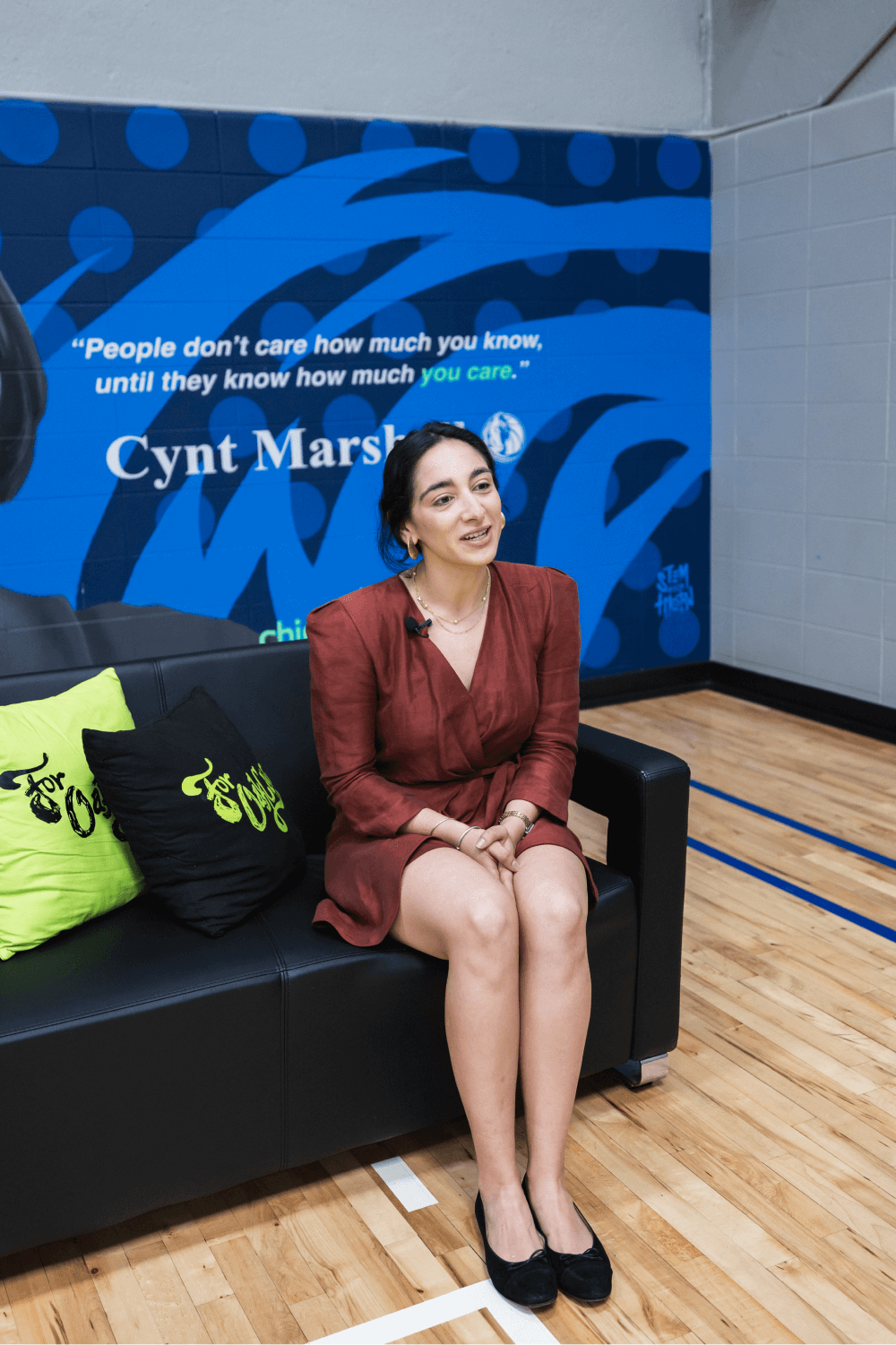

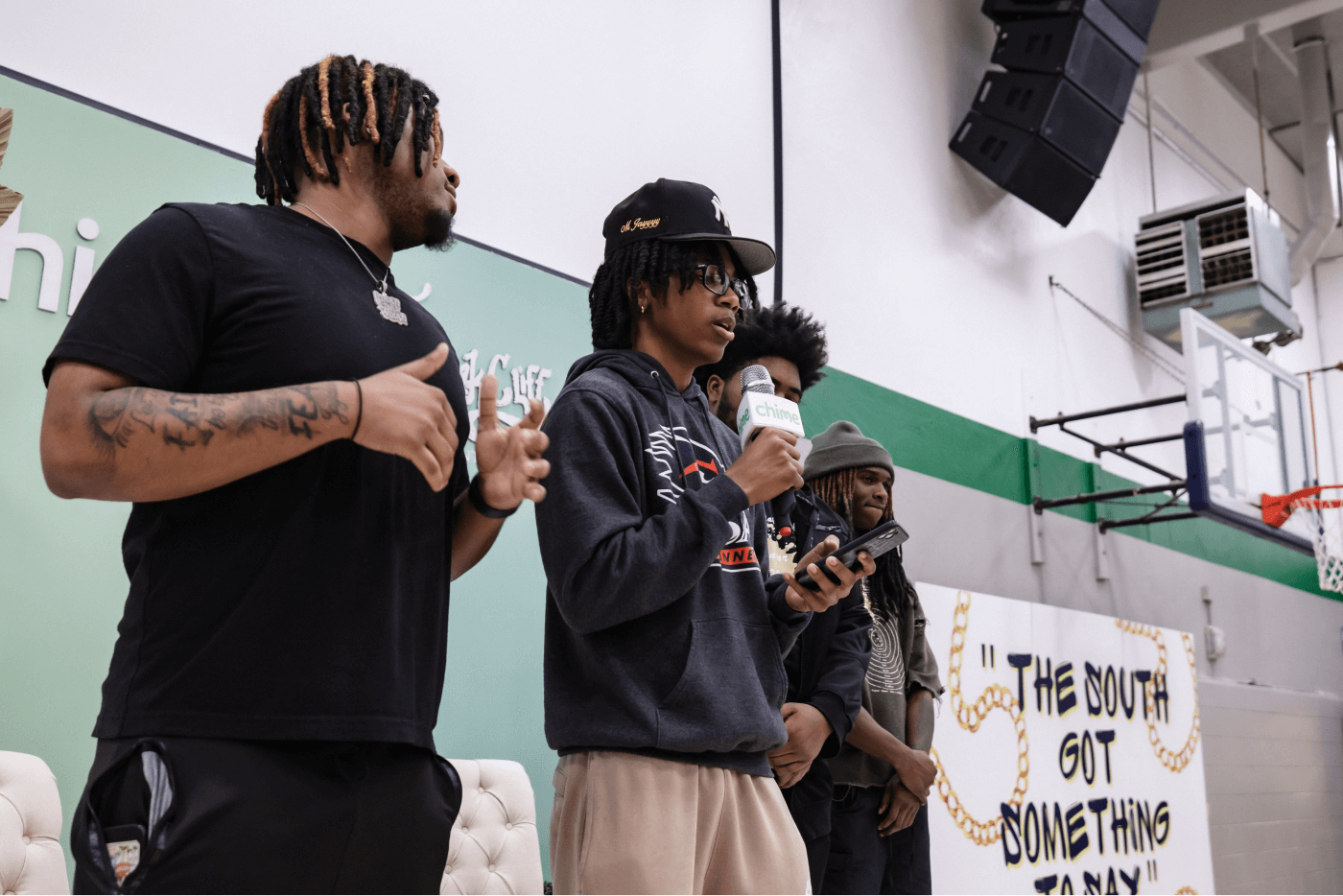

Taylor Toynes, founder of For

Oak Cliff.

For Oak Cliff provides integral services and support across Dallas through multigenerational programming, job training, grocery giveaways, youth initiatives, and more to break the cycle of poverty.

John Roussel, founder of Colorwave.

Colorwave® is focused on bridging social capital gaps within the innovation economy by connecting underrepresented professionals with career opportunities in the venture-backed ecosystem across more than 80 cities in the US.

Hope Wollensack, founder of Georgia Resilience Opportunity Fund.

The GRO Fund builds bold, evidence-based, and community-led solutions to address poverty and narrow the racial wealth divide across metropolitan and rural areas of Georgia.

Progress through Chimer volunteerism.

A core part of our culture

To connect with the people we serve, Chimers volunteer both individually and collectively. Last year, our employees donated 1,500 hours to the communities where we live and work.

Our volunteering commitment.

Each year, Chime employees are asked to spend 24 hours volunteering. Additionally, we combine team-building and team volunteerism as often as possible—giving back to the communities where we work, while we work.

Chimer + Chime Scholars Foundation volunteering.

Chimers take pride in our Chime Scholars and participate in career panels, career coaching sessions, resume reviews, and informational interviews to help our scholars progress toward their big dreams.

San Francisco: Farming Hope partnership.

Our partnership with San Francisco nonprofit Farming Hope has fed thousands of San Francisco families, while reducing food waste and offering job training opportunities to Apprentice Chefs.

Progress for

our industry.

Supporting fairness and equity

To push our industry forward, we continuously improve and evaluate our own product offerings, ensuring they’re secure, accessible, equitable, and effective.

Reducing bias; increasing access.

We’ve partnered with FairPlay® to reduce potential bias in algorithmic decision-making for Chime’s products and services.

Measuring and maximizing our economic impact.

Our impact studies provide a roadmap on how to improve our own services—and digital financial services as a whole.

Log in

Log in