Online banking with no overdraft fees.

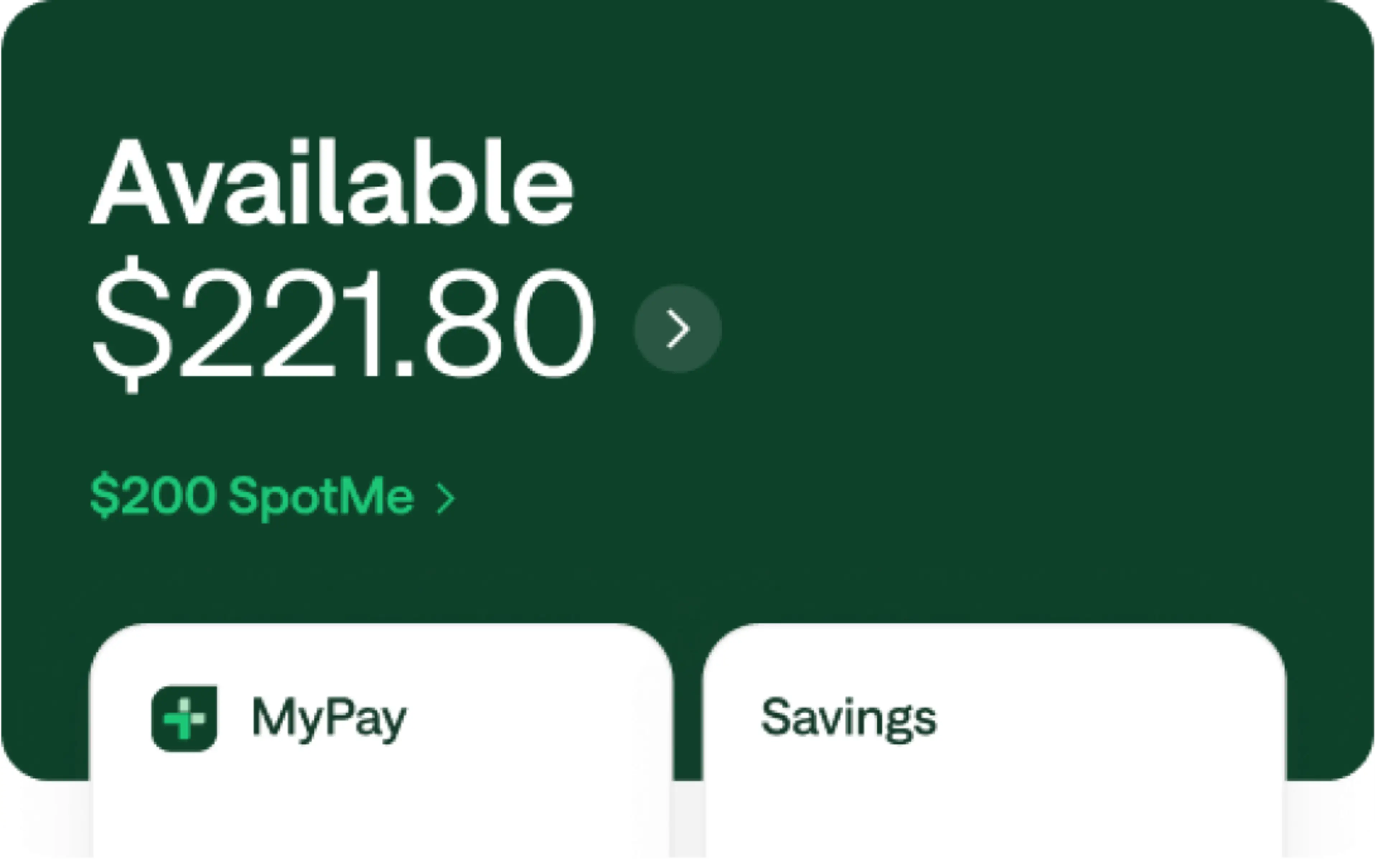

Overdraft up to $2001 without fees

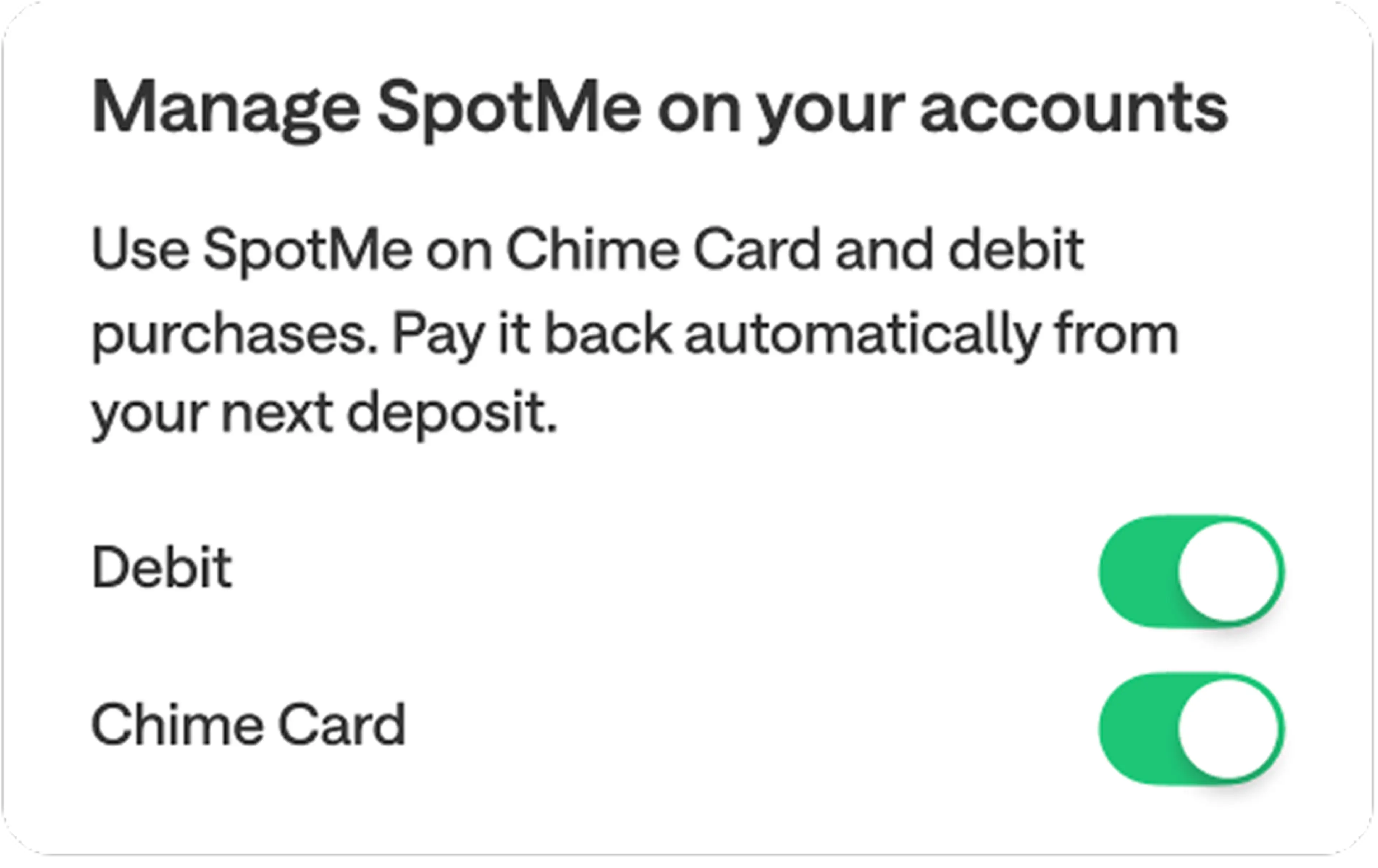

Get spotted on debit and credit card transactions, plus cash withdrawals

Increase your SpotMe limit with SpotMe Boosts2 from family and friends

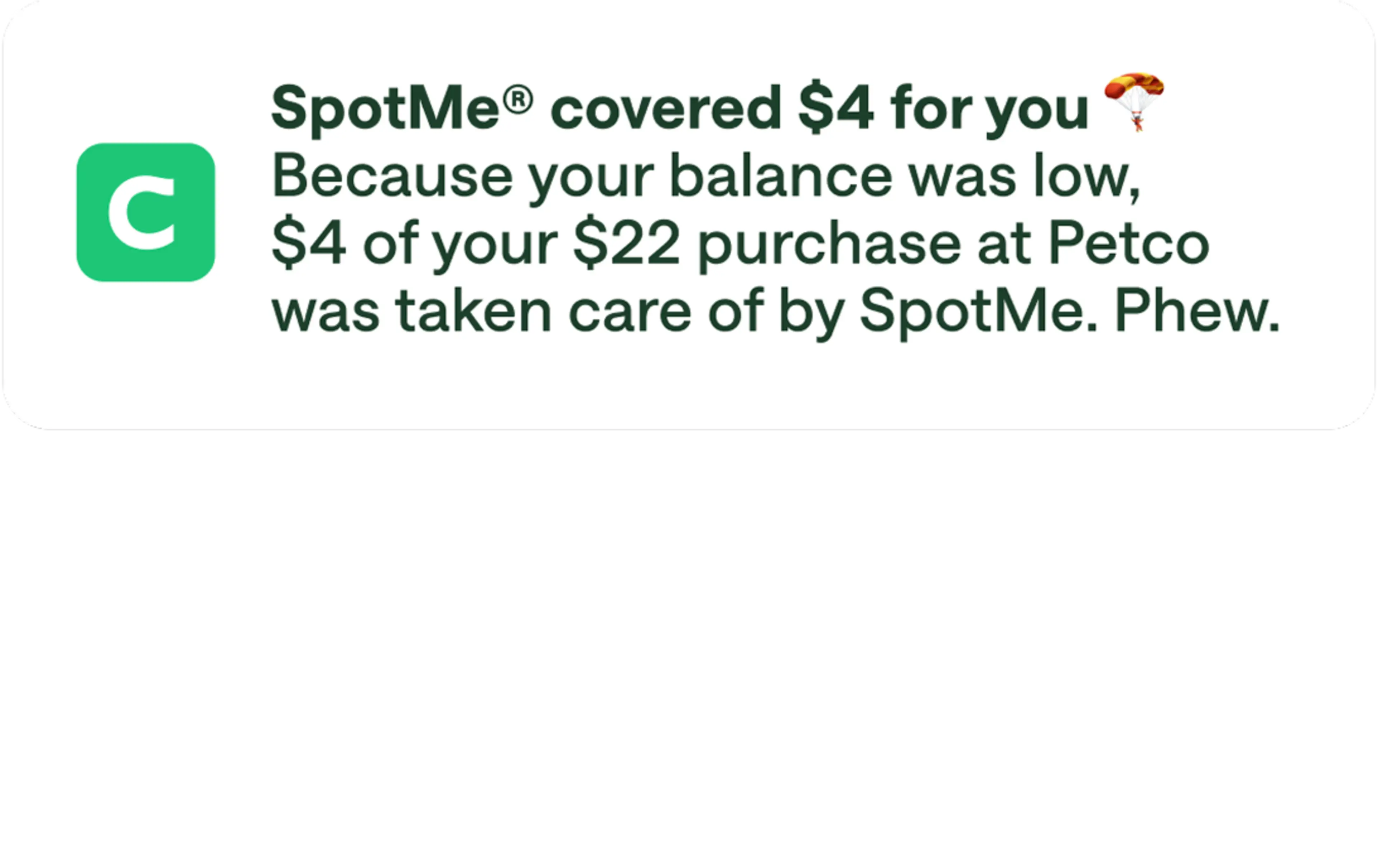

SpotMe® Fee-Free Overdraft

Learn how we collect and use your information by visiting our Privacy Notice ›

What is overdraft coverage?

Overdraft coverage ensures you can withdraw cash or make purchases that exceed your available balance in your account without incurring expensive overdraft fees.

No overdraft fees.

Through Chime, you’re always covered. We’ll spot you up to $200 on debit and credit card transactions, and cash withdrawals with no overdraft fees.1 Just use your Chime Visa® Credit Card and your next deposit goes toward the balance.

SpotMe® Boost each other.

Eligible members enjoy complimentary SpotMe® Boosts,2 which you can send to friends to increase their SpotMe limit by $5.

Pay it forward.

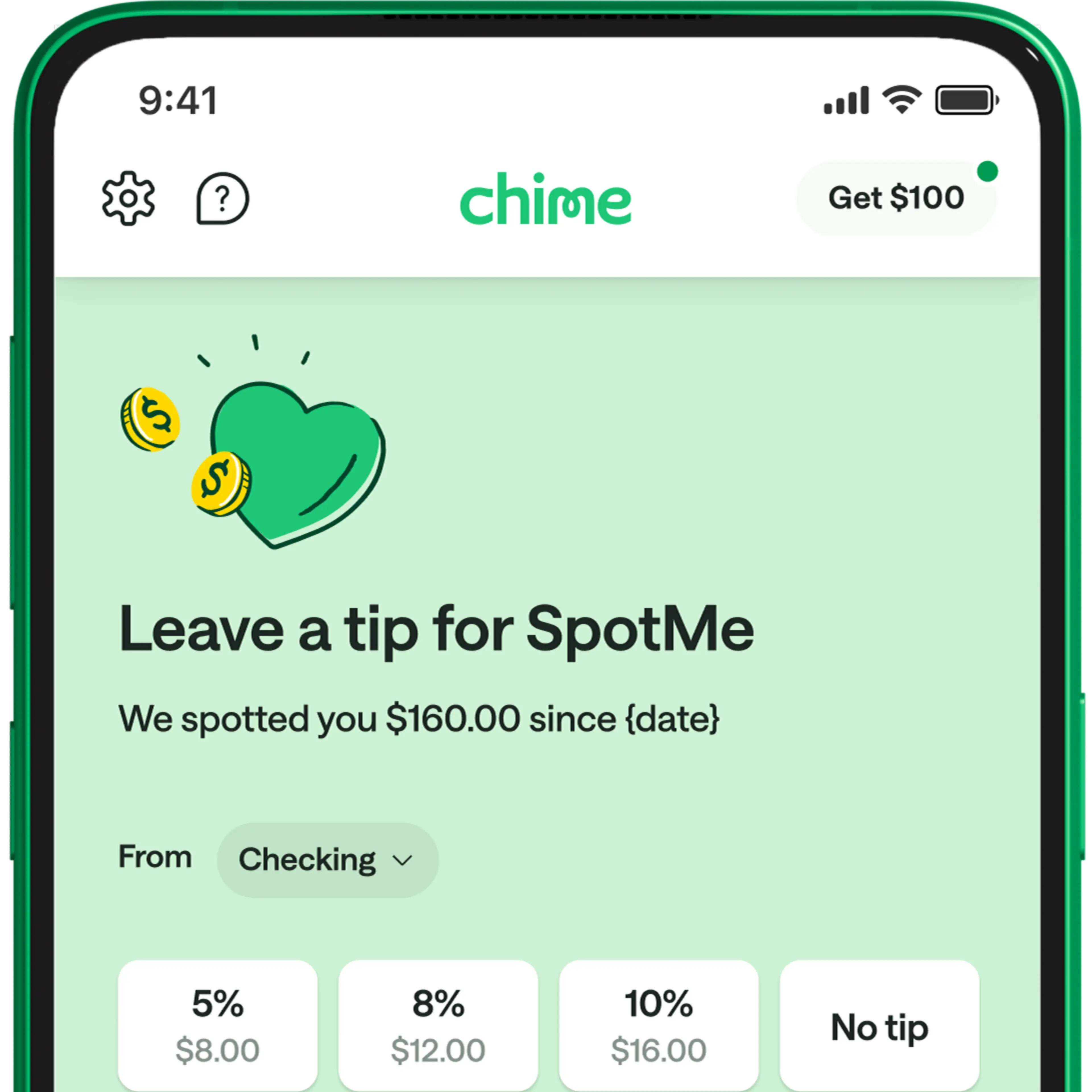

Optional tips* are invested back into the service to keep SpotMe fee-free for our members!

You’ll have the choice to tip after you’ve repaid your negative balance.

*Tipping or not tipping has no impact on your eligibility for SpotMe.

Billions Saved In Overdraft Fees.

Join millions of Chime members who enjoy fee-free overdrafts1 and peace of mind.

I love Chime for so many reasons - I get paid a day earlier, I can track my money and payments, [and] send money and pay people with ease and confidence.

Bryan P.

SpotMe? It's great, it's saved your life so many times... Chime has made my life so easier and has been the reason I can continue to pay bills on time and feel accomplished. 🙌

Alyssa L.

I love the SpotMe Boost feature! Since joining Chime, I've met several people who also use the service. We boost each other every month... I love having it there if needed.

Shyanne D.

There is nothing like having SpotMe at your disposal for those unexpected and random occasions. It's a game changer and the peace of mind it provides is the best part.

Jaime A.

SpotMe has saved me when I've needed a lil extra cash right before payday!

Debra H.

Real Member. Paid Testimonial.

Chime SpotMe vs. traditional overdraft fees

$0

Chime SpotMe Fees

$0

$0

Chime SpotMe Fees

$27

Traditional Banks3

$27

$27

Traditional Banks3

Direct deposit unlocks SpotMe® and more, with Chime+

Unlock even more of Chime plus exclusive benefits, for free with your qualifying direct deposit4.

How to use Chime's SpotMe.

Sign up for direct deposit.

Direct deposit your paycheck into your Chime account & we will notify you to enroll in the fee-free SpotMe program.

We spot you money.

Once you activate your Chime Card, we'll spot you up to your limit when you make a purchase that exceeds your balance.

Balance your balance.

We apply your next direct deposit to your negative balance. That's it! We never charge fees or interest for using SpotMe.

Kiss Overdraft Fees Goodbye.

Chime has your back with fee-free overdraft up to $2001

FAQs

What is an overdraft fees?

An overdraft fee is a fee that a bank or credit union charges you when a purchase or other transaction exceeds the available balance in your checking account. Overdraft fees can be charged on in-store purchases, online shopping, bill payments, cash withdrawals, and other transactions. Learn more about overdraft fees on our blog.

How do I avoid overdraft fees?

Make sure to read your bank’s terms and conditions before choosing a bank account. While banks are no longer allowed to automatically charge overdraft fees without your consent, it’s possible to opt in for overdraft protection without realizing it.

Read more about how to avoid overdraft fees on our blog.

Additionally, you can avoid overdraft fees by banking through Chime and opting into SpotMe to cover any debit or credit transactions or cash withdrawals that would result in a negative balance in your Chime Account.

Will I ever be charged an overdraft fee through Chime?

No. If you do not have sufficient funds in your Chime Checking Account or your secured Chime Visa® Credit Card Secured Deposit Account, or have reached your SpotMe limit (if enrolled), then your Chime Visa® Debit Card or Chime Card will be declined. There is no fee for declining transactions or for utilizing SpotMe.

What is Chime’s SpotMe?

SpotMe is a completely free service for eligible Chime members who overdraft their checking account or Chime Card™.

Once you’re eligible, enroll in SpotMe (it’s fee-free!), and we’ve got your back when you overdraft your account by up to $200.1

Who is eligible for SpotMe?

Any Chime members who currently have Chime+4 and have activated their Chime debit card or Chime Card are eligible for SpotMe.

How do I enroll in SpotMe on Chime?

Activate your Chime card.

Open the Settings tab in your Chime app to find out if you’re eligible for the SpotMe feature (make sure you have the latest version of the app).

Once you agree to the SpotMe Terms and Conditions, you are officially enrolled in SpotMe!

Is there anything SpotMe does not cover?

You can use SpotMe for:

Debit card transactions

Credit card transactions

Cash-back transactions

ATM withdrawals

SpotMe does not cover:

Pay Anyone transfers

Direct debits, such as automatic bill payments, from your Checking Account

Transfers to your Savings Account

Transfers to apps like Venmo and Cash App

Chime Checkbook transactions

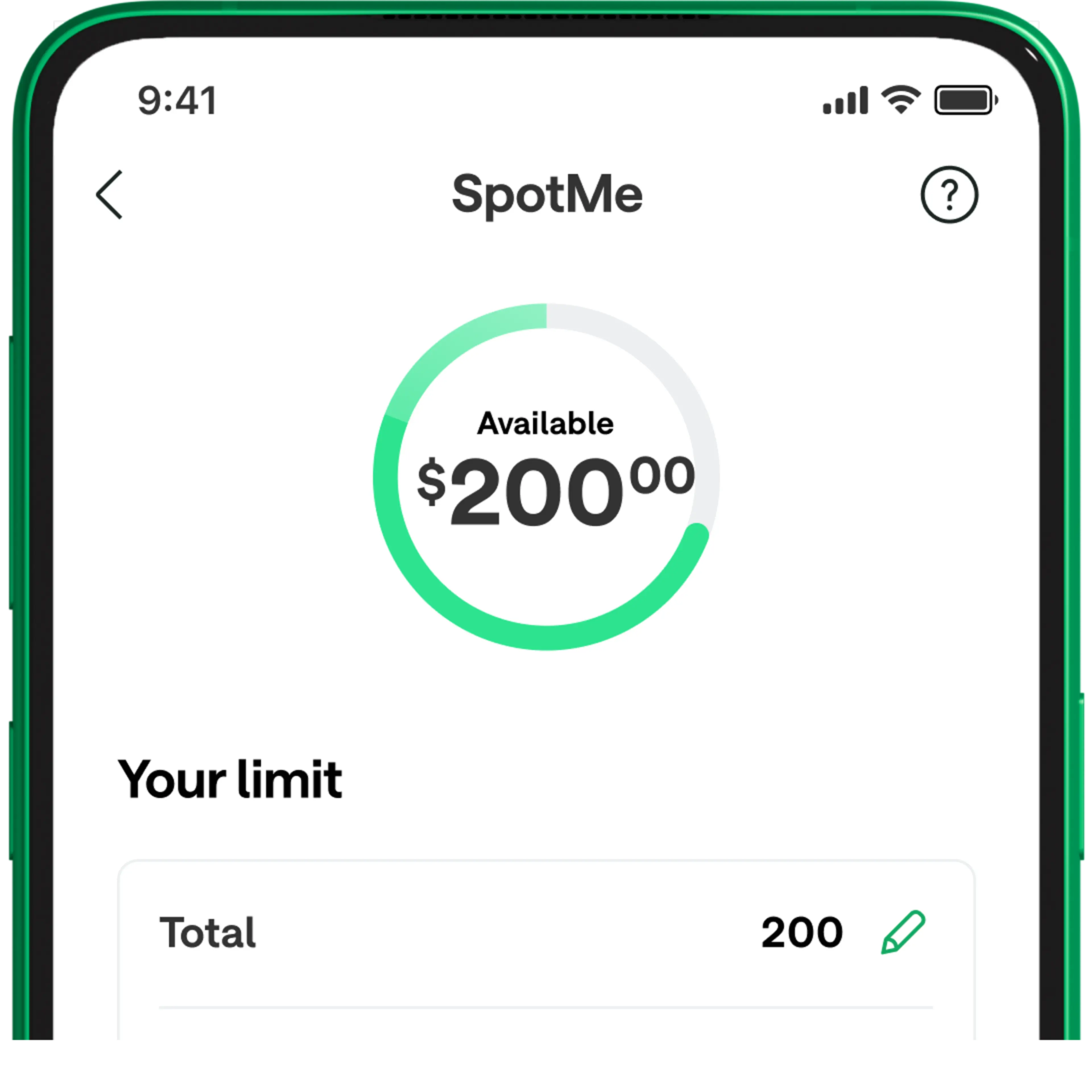

How much can I overdraft with SpotMe?

Your SpotMe limit starts at $20 and may go up to $200 depending on your account activity, history, and other risk factors. Receiving bonuses and SpotMe® Boosts1 from friends with Chime can temporarily increase your SpotMe limit.

Note: Chime Member Service agents cannot increase your SpotMe limit for you.

How do I change my Chime SpotMe limit?

Your Chime SpotMe limit is set automatically by a variety of factors related to how you use your Chime account. This may include how long you’ve been a member, your account history, and how much you direct deposit per month. We’ll notify you if and when you qualify for a higher limit.

Your limit may be affected by your use of other Chime products like Instant Loans or MyPay. This helps make sure you don’t borrow more than you can manage or lose too much of your qualifying direct deposit to repayment.

If you want to manually lower your limit to a personal max you can do so by opening your Chime app > Scrolling down in your Home feed > Tapping Settings > and adjusting your limit.

If SpotMe covers me, how do I pay it back?

The next time money is deposited into your Checking Account or Chime Card secured deposit account, we’ll automatically apply it to your negative balance or owed amount. You’ll be in the clear, without having paid any overdraft fees.