Save money on overdraft fees.

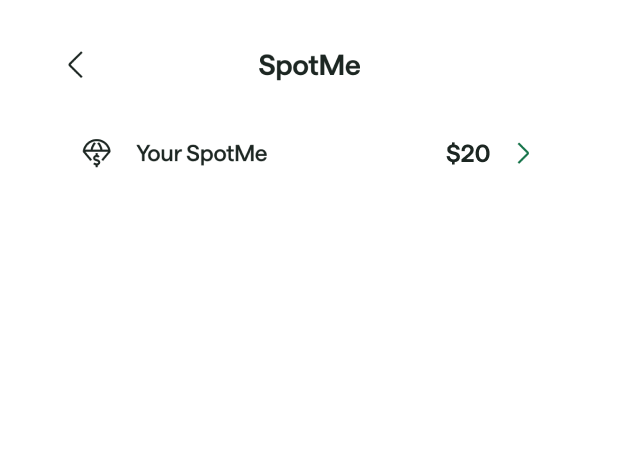

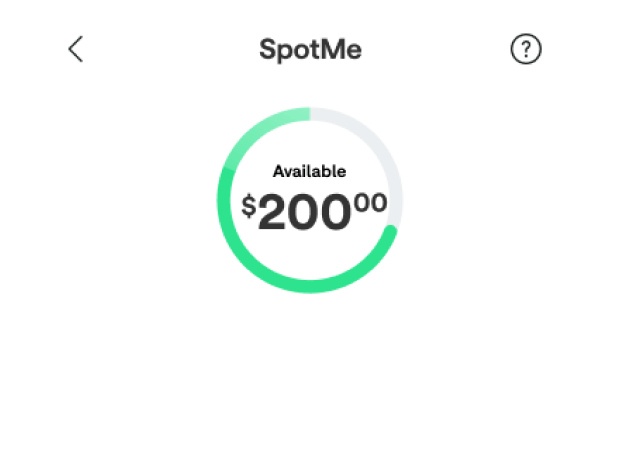

- Get overdraft coverage of up to $200¹ with SpotMe®

- We’ll spot you on your Chime Visa® Debit Card transactions

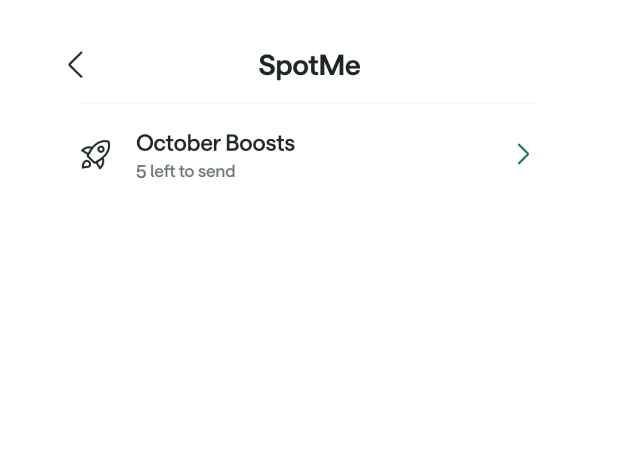

- Send Boosts^ to friends to temporarily increase their SpotMe limits

Learn how we collect and use your information by visiting our Privacy Notice

What people are saying about Chime’s overdraft coverage.

Member testimonials.

Real members. Paid testimonials.

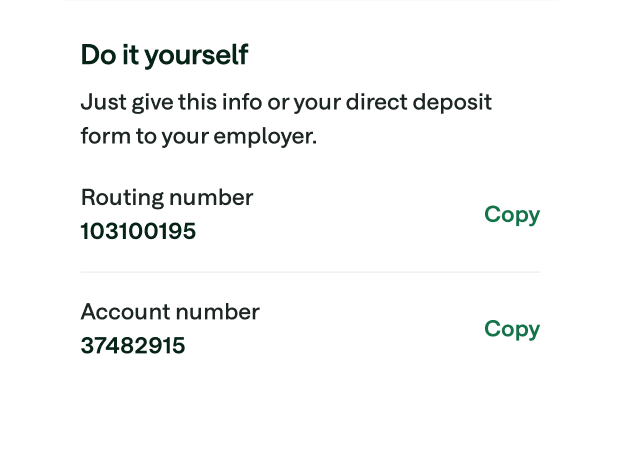

Direct deposit unlocks SpotMe® and more, with Chime+

Unlock even more of Chime plus exclusive benefits, for free with your qualifying direct deposit‡.

How much do others charge in overdraft fees?

No overdraft fees.

Chime will spot you up to $200 – with no overdraft fees.

FAQs

What is an overdraft fee?

An overdraft fee is a charge when you spend more money than you have in your account. The cost of the transaction may be covered for you in the meantime, but they’ll charge you an overdraft fee for the convenience.

Often, you must have opted into overdraft coverage for the transaction to go through. Otherwise, the transaction may be declined. In some instances, you may still be charged a non-sufficient funds fee for declined transactions – one of many fees that can make it more challenging for those living paycheck to paycheck.

Can I get overdraft fees waived?

Wondering how to get overdraft fees waived? It depends. If this is your first overdraft and you have a long account history, it’s worth calling customer service to see if the fee can be waived.

The fee may also be waived if you’re able to get your balance back over $0 in a certain timeframe (like a single day).

How do I not get charged an overdraft fee?

To avoid overdraft fees, always check your account balance before spending money. If there’s not enough money in your account to cover the purchase, transfer funds into the account or use an alternate payment method. Remember to monitor your account regularly so you have enough money to cover automatic bill payments throughout the month, too.

If you truly want to know how to avoid overdraft fees, especially for those occasional accidents, the answer is simple: Switch to an account that doesn’t charge overdraft fees. There are many accounts that now offer fee-free overdraft up to a certain amount, which means your card won’t get declined and you won’t have to pay a fee.

Chime, for instance, offers fee-free overdraft coverage called SpotMe. Here’s how to use SpotMe and get covered up to $200 on debit card transactions and cash withdrawals with no overdraft fees.

Will an overdraft hurt my credit?

An overdraft won’t hurt your credit directly. Instead, issues with a checking account may be reported to ChexSystems, which monitors deposit accounts. Negative marks on your ChexSystems report could make it harder to get an account in the future, though there are several second-chance accounts offered.

If you don’t get your balance back above $0 after the overdraft, the account could be sent to collections. In that case, your credit score would be affected. That’s why you should always get your checking account back in good standing as quickly as possible.