Say hello to your new bank account.

Signing up takes less than 5 minutes.

Learn how we collect and use your information by visiting our Privacy Notice

Chime is a bank account built for your best interest.

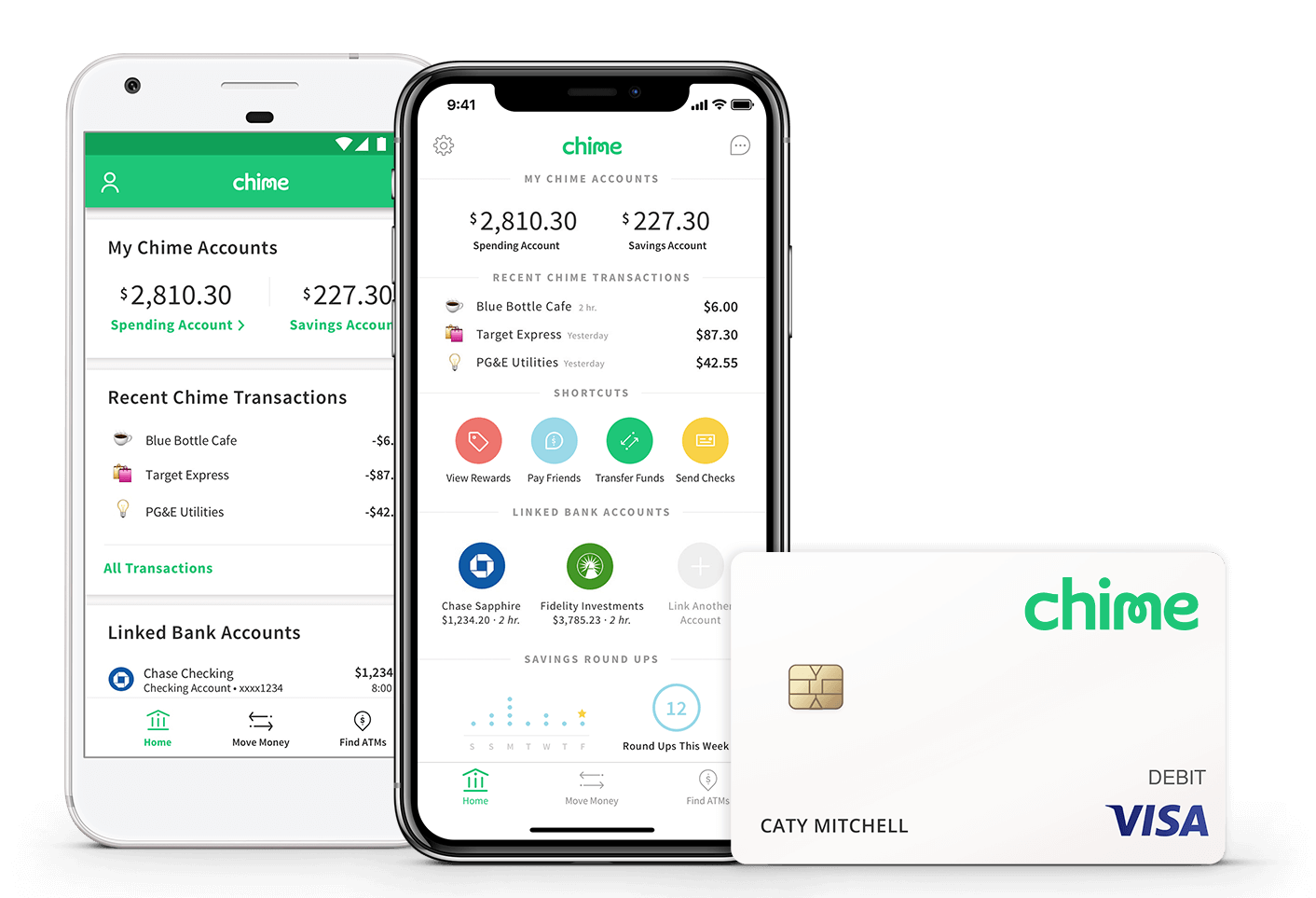

Chime is a bank account that helps you save money, automatically. Chime comes with a Chime Visa® Debit Card, no overdraft or monthly fees, a Checking Account, and a Savings Account.

Award-Winning Mobile Banking

Chime’s award-winning mobile banking app gives you complete control of your money and makes banking easy when your on-the-go. Chime’s iOS app has been featured as one of the top Money Management apps and the mobile banking app has an average rate of 4.8 stars with over 7,000+ five-star reviews across both the App Store and Google Play.

Save Money Automatically

Set money aside for a rainy day or a sunny vacation, automatically. Enroll in Automatic Savings, and save money every time you use your Chime card to make a purchase. You can also automatically deposit 10% of every paycheck into your Chime Savings Account.

Say Goodbye to Bank Fees

Chime has no monthly minimums or fees, no overdraft fees, and ATMs are fee-free at over 30,000 locations. You can also locate 30,000 fee-free cashback locations using the ATM Finder in the Chime mobile app

Chime Visa® Debit Card

Your Chime Visa Debit Card may be used everywhere Visa debit cards are accepted. The more you use your Chime card, the more you’ll save when you enroll in Automatic Savings.

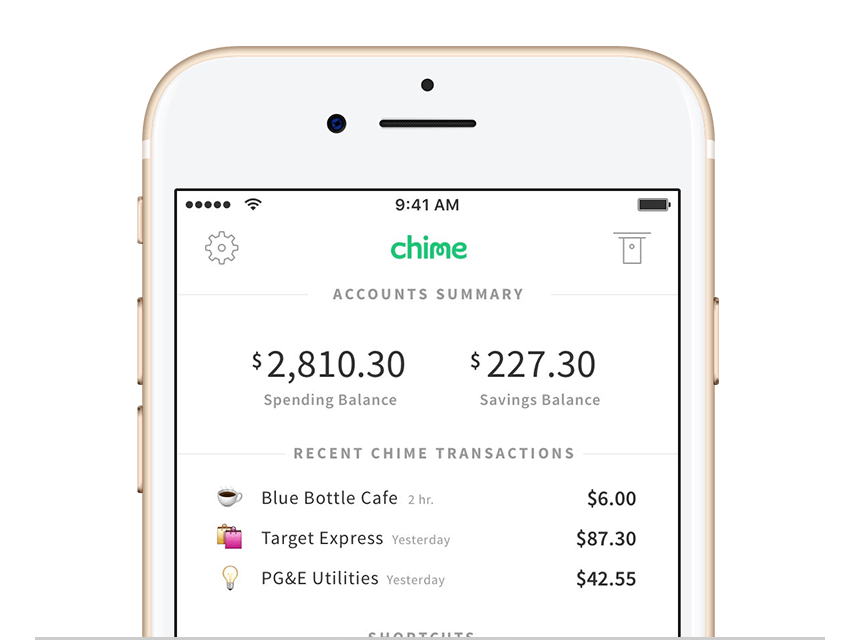

Spend and Save with Control

Your Chime Checking Account is an FDIC-insured bank account where you can easily deposit funds and handle all your finances on-the-go. Check your balance, view transactions, and analyze your spending.

Security and control on the go.

Chime’s mobile app makes branchless banking a breeze. Manage your money and account on the go, wherever you go.

The Chime Visa Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank; Member FDIC.

Visa Zero-Liability Policy protects all unauthorized purchases.

Over 30,000 fee-free MoneyPass ATM and 30,000 cash-back locations.

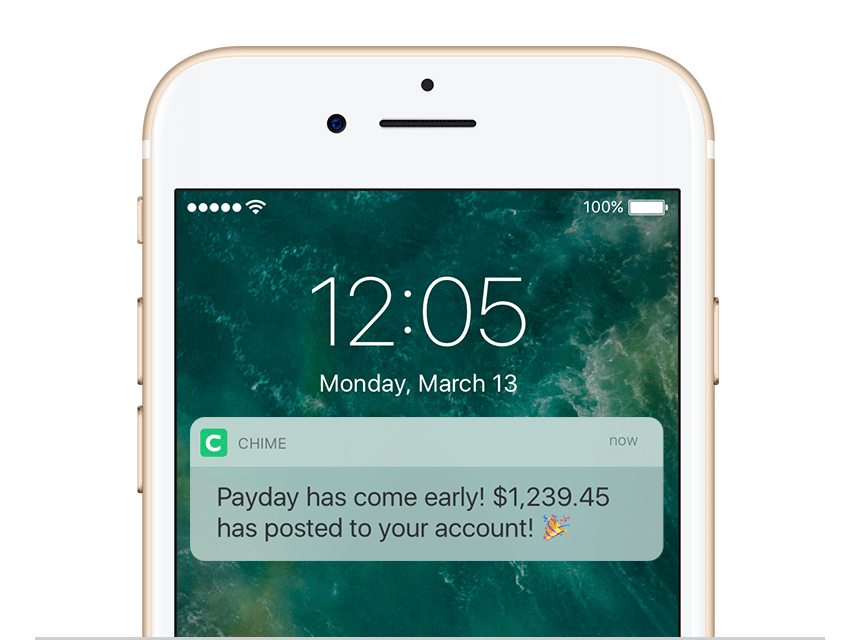

Real-time alerts for every banking transaction.

Automatic Savings takes the effort out of saving.

No minimum, monthly, or overdraft fees.