If you’ve ever worried about your credit card information security while shopping online, virtual credit cards offer an easy way to stay secure. Here’s what you need to know about how virtual credit cards work, how to use them, and how to determine if you need one.

What is a virtual credit card?

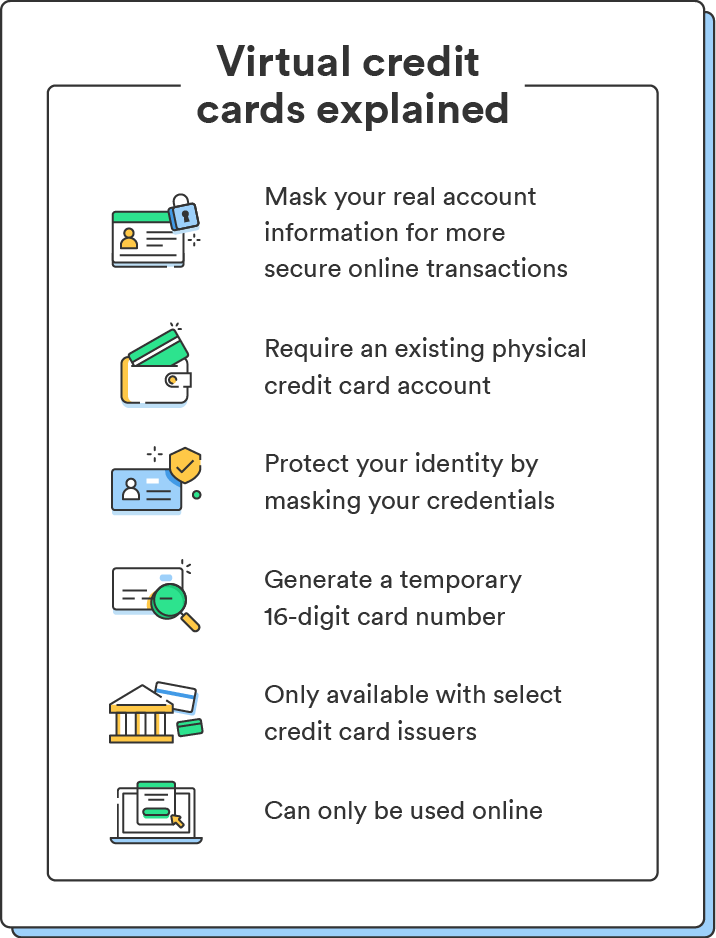

A virtual credit card is a unique temporary credit card number you can use for online purchases instead of your real credit card. They can provide an extra layer of security during purchases by protecting your real credit card information from data breaches, fraud, or identity theft.

How do virtual credit cards work?

Virtual credit cards don’t work the same way traditional credit cards work – instead, they link to your regular credit card account.

Along with your virtual credit card, you’ll receive a unique disposable credit card number, expiration date, and security code. This way, you can shop online without sharing your true credit card number. While it stays hidden from merchants, your transactions will still appear on your regular credit card account statement.

Many virtual credit cards allow users to set a maximum spend or charge limit on the card to prevent the account from being overcharged. You can also limit a virtual credit card number for use at a single merchant so that the card doesn’t work elsewhere if the merchant is breached.

Virtual credit cards vs. digital wallets and payment apps

Both virtual credit cards and payment apps secure your information to avoid theft, duplication, and misuse. The biggest difference between virtual credit cards and payment apps (like Pay Anyone and Apple Pay) is that virtual credit cards provide unique card numbers to mask your real account information, while payment apps like Google Pay complete transactions with a single-use verification token.¹

Digital wallets can also store a variety of payment methods on your mobile device, from boarding passes and event tickets to gift cards and coupons. You can use them online or in-store (if the retailer accepts mobile payments), while you can only use virtual credit cards online.

How to use a virtual credit card

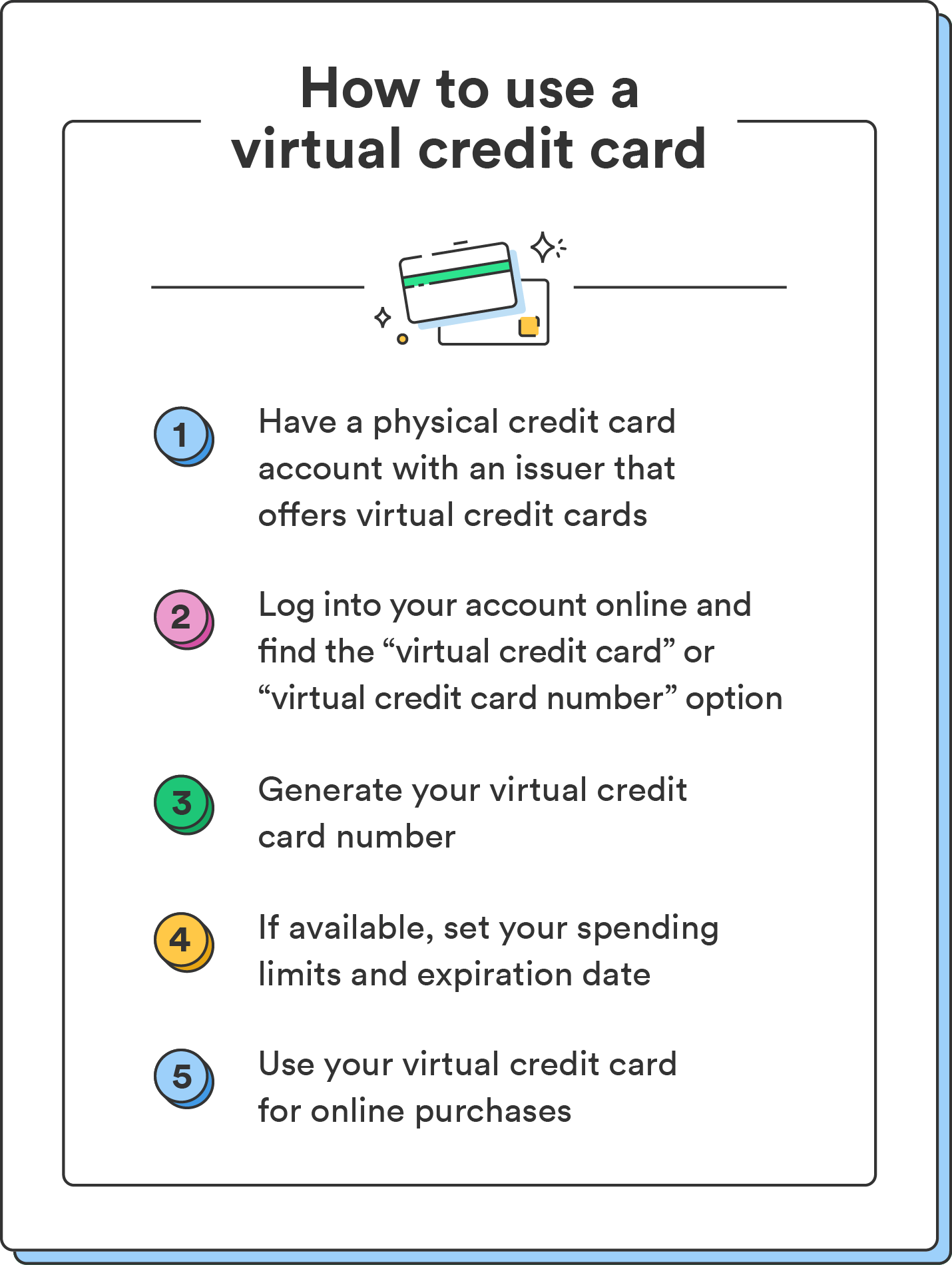

The process of getting and using a virtual credit card can vary depending on your credit card issuer, but it’s generally fast and simple. Most major credit card issuers now have virtual credit card options that you can add to your existing account.

Here’s how to use a virtual credit card:

- Log into your online credit card account and go to your account settings. Once in your account settings, search for “virtual card number” or “virtual credit card.”

- Find your generated virtual card number. Some card issuers will provide you with a single-use card number, meaning it can only be used for a one-time purchase with one merchant, while others will give you a multi-use card number you can use several times per merchant.

- Select or verify spending limits and the expiration date: To prevent any unwanted charges, you can customize the number of transactions on a daily, weekly, or monthly basis, as well as set the maximum amount you can spend per transaction. You can also choose how long you want the number to be valid.

- Create the virtual card number and delete it when you no longer need it. Once you’ve created your virtual credit card, you can use it like you’d use your physical credit card when making purchases online.

Benefits of virtual credit cards

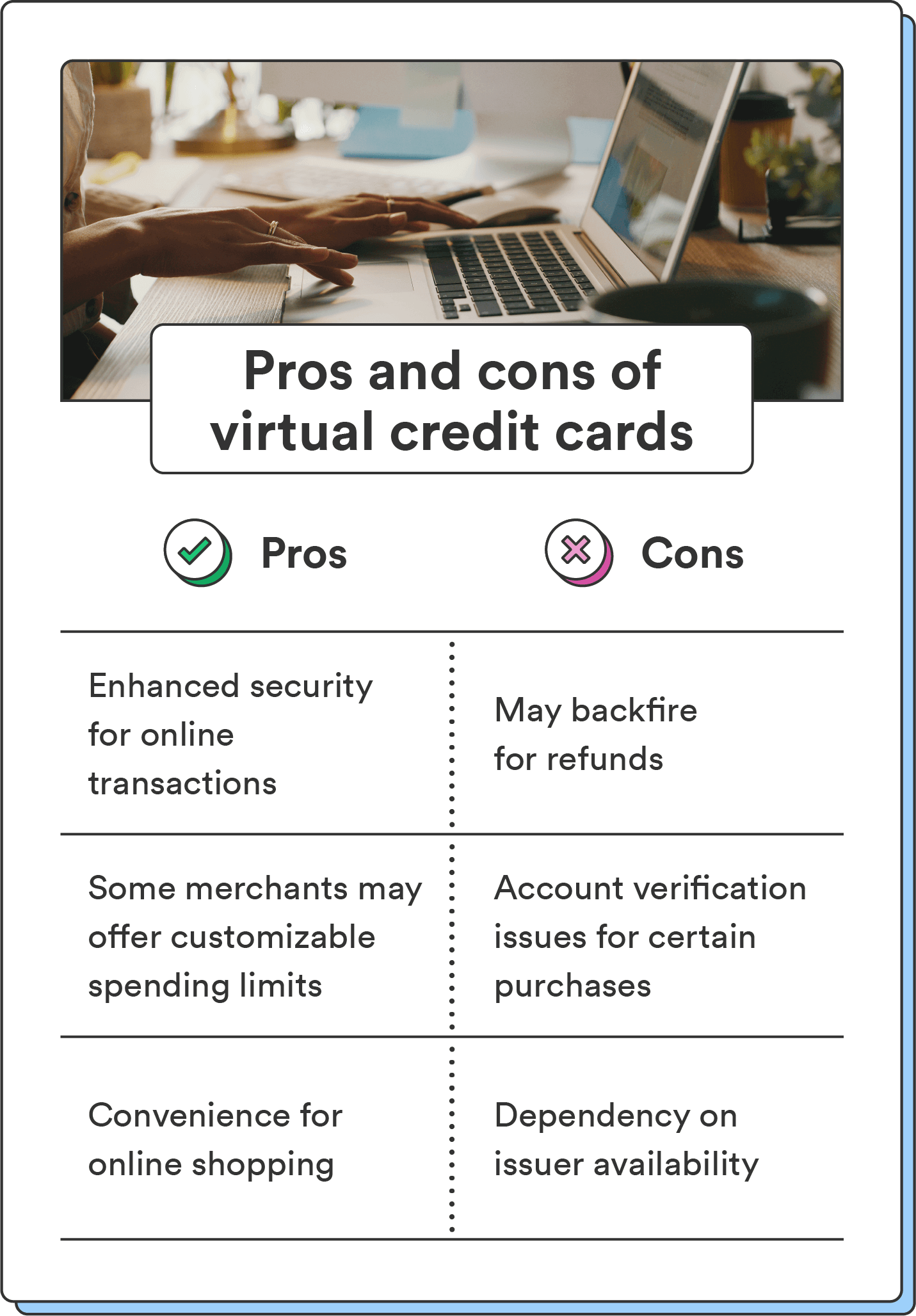

Virtual credit cards offer several benefits, including:

- Enhanced account security: Virtual credit cards hide your real credit card information from online merchants for an extra layer of security. Your identity and real credit card number won’t be traceable, even if your data was compromised in transaction.

- Customizable: You can control how much and where you use virtual credit cards since they’re temporary and have customizable spending limits. This minimizes the risk of unauthorized charges or misuse of your credit card information.

- Convenience for online shopping: You can use a virtual credit card for online purchases like a regular credit card. You can also add your virtual credit card number to your device’s auto-fill feature to shop without repeatedly entering your credit card details.

While virtual credit cards offer several benefits and enhanced security, there are drawbacks:

- May backfire for refunds: If a merchant issues a refund to the same account number used to make the purchase and your virtual credit card number has already expired, you may not be able to be refunded in your original payment method.

- Account verification issues: Some purchases or services, like hotel reservations, flights, or car rentals, may require verification upon arrival. If you have to show or swipe the same card you used to make the purchase, you may have issues verifying your identity since your real credit card number will be different from the virtual card number.

- Dependency on issuer availability: Not all credit card issuers offer virtual credit cards. Be sure to check whether your provider offers virtual credit card options and if there are any specific requirements or limitations to be aware of.

Weigh the pros and cons of virtual credit cards to decide whether they’re right for you, and when it makes sense to use them. Don’t forget to find out if your credit card issuer offers them.

Where to get a virtual card

Virtual credit cards are linked to an existing credit card account. To get one, you’ll need an account with an eligible credit institution. Not all credit card issuers offer virtual credit cards, and the ones that do may only be available to certain cardholders or with certain credit cards offered by the credit institution.

At Chime, we offer virtual cards for all of our members directly in the Chime app. To find yours, simply visit Settings and tap Cards. This virtual card can then be used for Tap2Pay transactions, online shopping, and recurring bill payments. Have questions? Learn more about Chime’s virtual cards.

Is a virtual credit card right for you?

Virtual credit cards offer a convenient and secure way to protect your financial information when shopping online. A temporary card number can hide your actual credit card details from merchants, reducing the risk of fraud.

Using a virtual credit card is just one of many ways you can prevent identity theft.

FAQs about virtual credit cards

Still have questions about virtual credit cards? Find answers below.

Do virtual credit cards affect your credit score?

Simply getting a virtual credit card won’t directly impact your credit score. Since they are linked to your existing credit card account, your regular credit card statement will reflect transactions you made with the virtual card. Depending on how you manage your payments and credit utilization, a virtual credit card could affect your credit score.

Can you get instant approval for a virtual credit card?

It depends on the policies and procedures of your credit card issuer, and instant approval may not always be a guarantee. Some issuers may offer immediate access to virtual credit cards, while others may require additional verification or processing time.

What is a temporary card?

A temporary card, also known as a virtual credit card, is a disposable credit card number you can use for online purchases instead of your real credit card number. It offers an extra layer of protection for more secure online transactions.

Can you use a virtual card in person?

No, virtual cards are typically designed for online use only. They are not meant to be used for in-person transactions as they lack physical cards associated with them. However, digital wallets, such as Apple Pay or Google Pay, can be used for both online and in-person transactions.

Who should get a virtual credit card?

Virtual credit cards can benefit anyone who frequently makes online purchases and wants to enhance their security. They are especially useful for protecting credit card information from potential data breaches or fraudulent activities during online transactions.

Are there liability protections for a virtual credit card?

While you should review your credit card’s specific terms and conditions , virtual credit cards typically have the same liability protections as traditional credit cards.