When setting up direct deposit, automatic bill payments, and other transactions that go in or out of your bank account, you need two important numbers: your routing number and your account number.

Routing and account numbers may seem similar at first glance, but they serve different purposes when processing transactions. Understanding the difference can save you from a financial mix-up that could range from a minor inconvenience to a costly problem.

Let’s dive into the specifics of routing vs. account numbers to ensure your next financial transaction is as smooth as possible.

What is a bank routing number?

A routing number is a nine-digit number used to identify a bank or other financial institution. Routing numbers are sometimes referred to as ABA numbers, as they’re assigned by the American Bankers Association.¹ Think of them like the bank’s address in the financial system. They tell other banks where your money needs to go.

As the name implies, routing numbers tell banks where to route transactions. They’re used for many purposes, including electronic funds transfers, processing paper checks, and handling wire transfers.

ACH (Federal Reserve’s Automated Clearinghouse) is the primary system used to transfer funds to and from accounts at different banks nationwide. Most ACH transactions are completed within one or two business days. You may see electronic transactions using your routing and account numbers called ACH transfers.

The first four digits indicate which Federal Reserve region a bank is assigned to. The next four digits are a unique identifier for the specific bank. The final digit is a “check digit” used to verify that the routing number is authentic.²

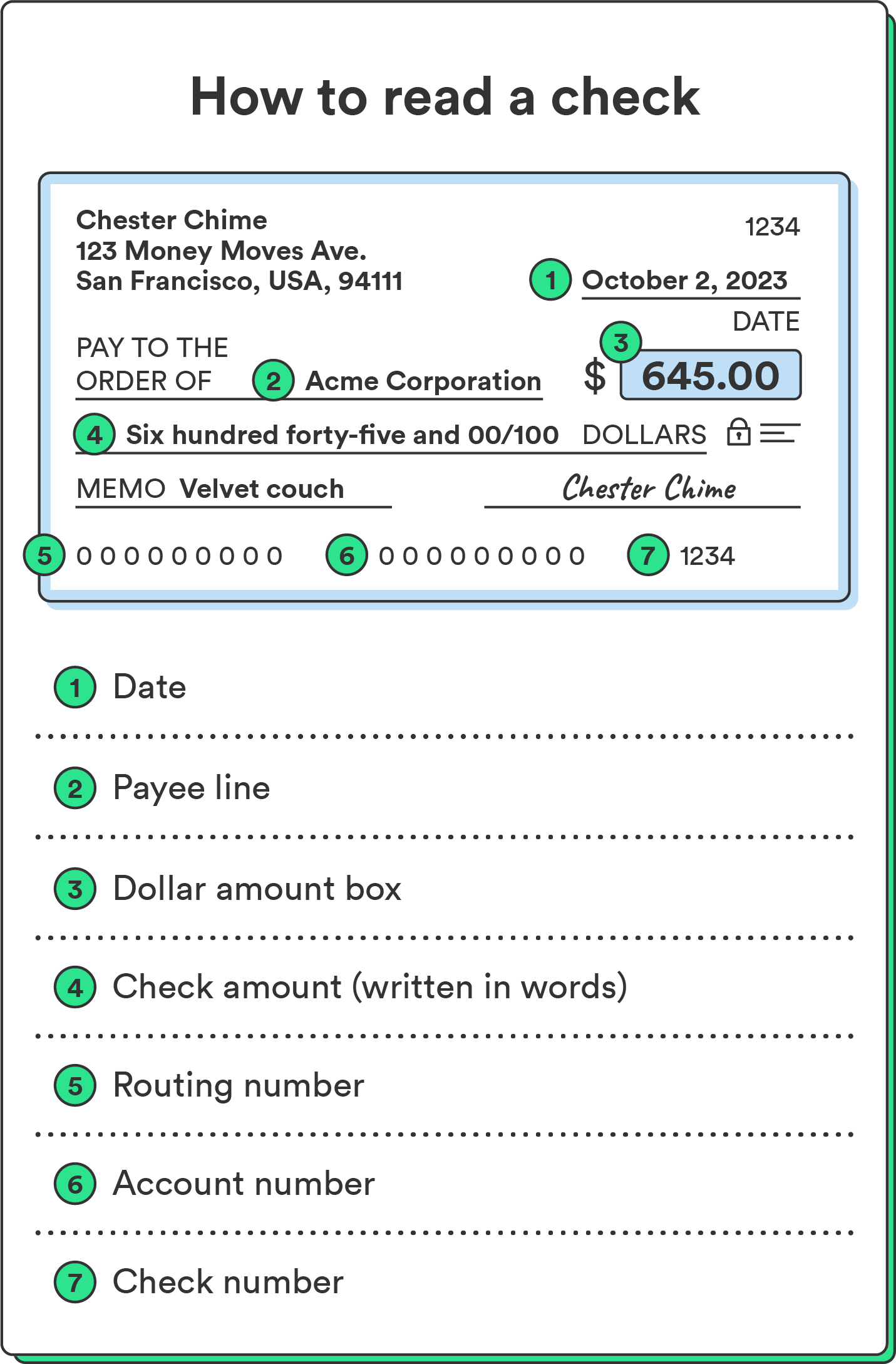

Typically, your bank’s routing number is on the bottom left of paper checks, or you can look it up online. Chime users can log into their Chime account and follow these steps to find your routing number.

If you have a paper check in hand, find out how to read a routing number on a check.

What is an account number?

Your account number is a unique identifier the bank uses to know which account to pull funds from or deposit into.

Unlike routing numbers, which are bank-specific, account numbers are unique to each customer. If you have multiple accounts at a financial institution, like a checking account and savings account, you would likely use the same routing number for both accounts, but each would have a unique account number.

Typically, account numbers are next to the routing number on checks. They may also be found in your online banking, mobile app, or account statements.

Chime users can find their account number when logged into their online account. If you just started a new job, you can set up direct deposit to ensure your funds appear in the correct account on payday.

Key differences between account and routing numbers

Understanding the primary differences between your account and routing number can help you more easily navigate your banking needs. Here’s a breakdown:

Account number:

- Unique to you: Your account number is unique to you and your personal account.

- Varies in length: Account numbers can vary in length, generally between eight to twelve digits.

- Assigned by your bank: Your financial institution generates and assigns your account number when you open an account.

Routing number:

- Identifies your bank: The routing number identifies your bank and tells other banks where your money should go.

- Always nine digits: Routing numbers in the U.S. always consist of nine digits.

- Indicates transaction paths: The routing number shows which Federal Reserve branch and bank processes the checks and other transactions.

Bank account and routing number example

To better understand your routing vs. account number, consider what happens when you pay a bill using a paper check. This bank account number example explains how it works behind the scenes.

When the biller gets your check in the mail, it’s deposited into a bank account. When the bank receives the check, it sends it to the Federal Reserve’s local check processing facility. The Fed then moves money from your bank to the company’s bank to add funds to the biller’s account. Your bank is also notified so it can deduct the cash from your bank account balance.³

Why routing and account numbers matter and when to use them

Both routing and account numbers are essential for conducting many types of banking transactions, from setting up direct deposit to receiving government benefits or tax refunds. These numbers ensure that the money you send and receive reaches the right destination without any hassle.

Here are several scenarios where you will need your routing and account numbers.

- Direct deposit: Receive your salary or government benefits directly into your bank account.

- Bill payments: Set up automatic payments for utilities and other regular expenses.

- Financial management: Link your accounts to personal finance apps for better money management, including transfers between your accounts.

- Online shopping: Some online purchases may require direct payment through your bank account.

- Money transfers: Send or receive money from friends or family.

To better understand how payments move from your employer’s bank account to yours, find out how direct deposit works.

Tips for managing routing and account numbers

Handling sensitive financial information requires caution. Here are some tips to manage your routing and account numbers safely:

- Keep them confidential: Always keep your banking details private to avoid fraud.

- Verify before you share: Double-check who is getting your banking details, especially in emails or over the phone.

- Secure your documents: Shred any documents containing your account number instead of tossing them in the recycle bin or trash.

Understanding the difference between routing and account numbers can enhance your financial management skills, making banking processes smoother and more secure.

Confidently control your transactions

If you’re looking to send money between accounts, paying close attention to your financial security is essential. Learn more about how to transfer money safely.