If you’ve applied for a credit card and discovered your credit limit isn’t as high as you’d like, you can request a credit limit increase. A higher credit limit can come in handy when facing an unexpected expense or wanting to finance a large ticket expense.

A higher credit limit could also boost your credit score if you manage your credit responsibly. But how do you get a credit limit increase?

Below, we’ll cover how to make the request and what to consider to increase your approval odds.

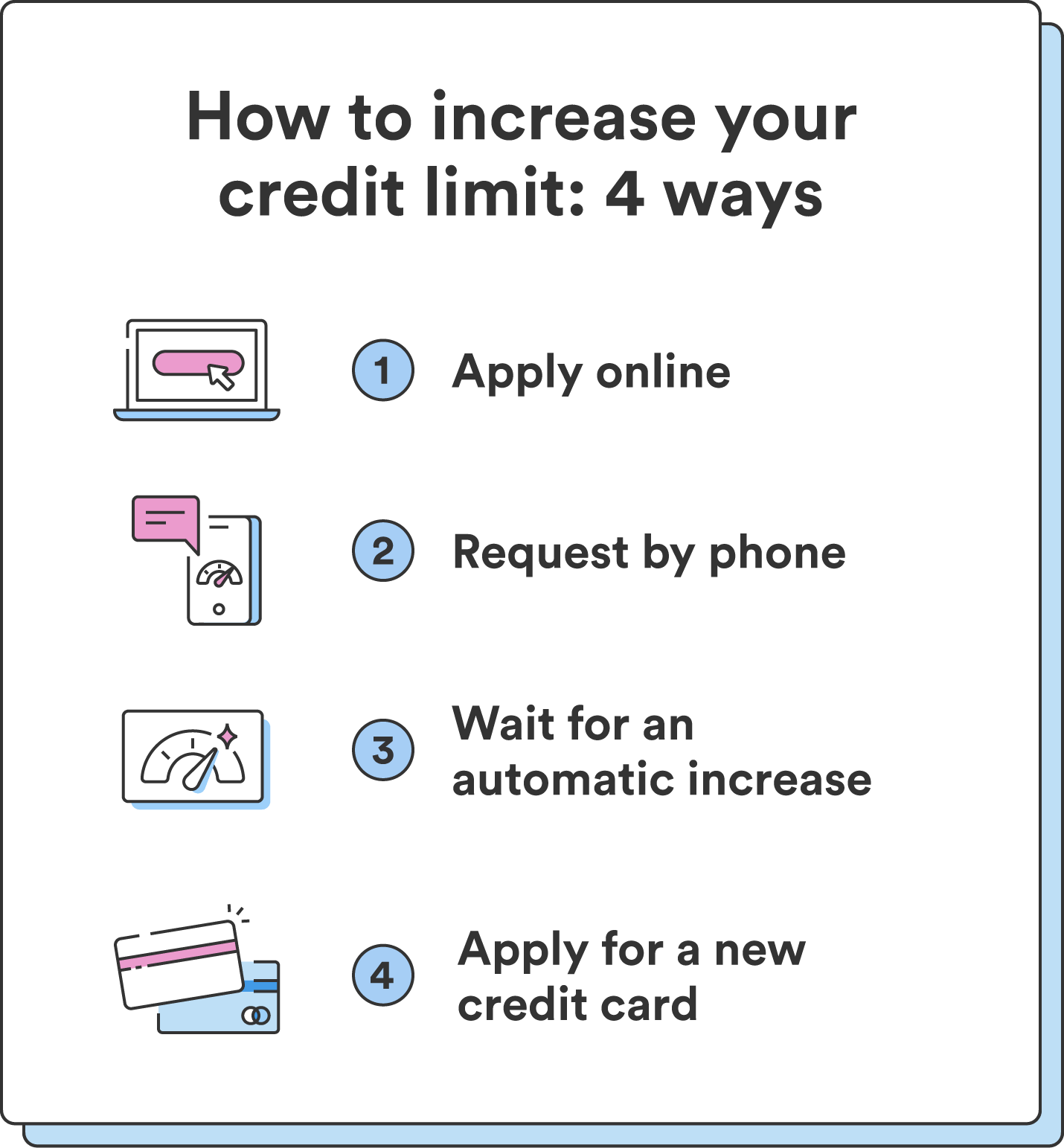

4 ways to increase your credit limit

You have a few options for requesting a credit limit increase:

- Make a request online: Many credit card issuers allow you to quickly request increases online. Log in to your account and submit your request.

- Request by phone: Alternatively, you can call your card issuer using the customer service number on the back of your credit card. Ask the representative if you are eligible for a credit increase, and be prepared to answer some follow-up questions.

- Wait for an automatic credit limit increase: Your issuer may automatically increase your credit limit if you’ve been responsible and had your credit card open for a long time. You should receive an email or letter letting you know. Lenders may also invite you to increase your credit limit through email or a message on your account portal.

- Apply for a new credit card: If you’ve been steering clear of bad credit habits, you might be able to get approved for a new credit card with a higher credit limit. Even if the limit on the new card isn’t higher than the current one, opening a new line of credit will still increase your total available credit. This approach may lead to a hard inquiry on your credit report and could impact your credit score temporarily.

Speaking of hard inquiries, ask your lender about their policy regarding hard inquiries. Some lenders may conduct a hard inquiry as part of the credit limit increase process, while others may perform a soft inquiry that does not impact your credit score.

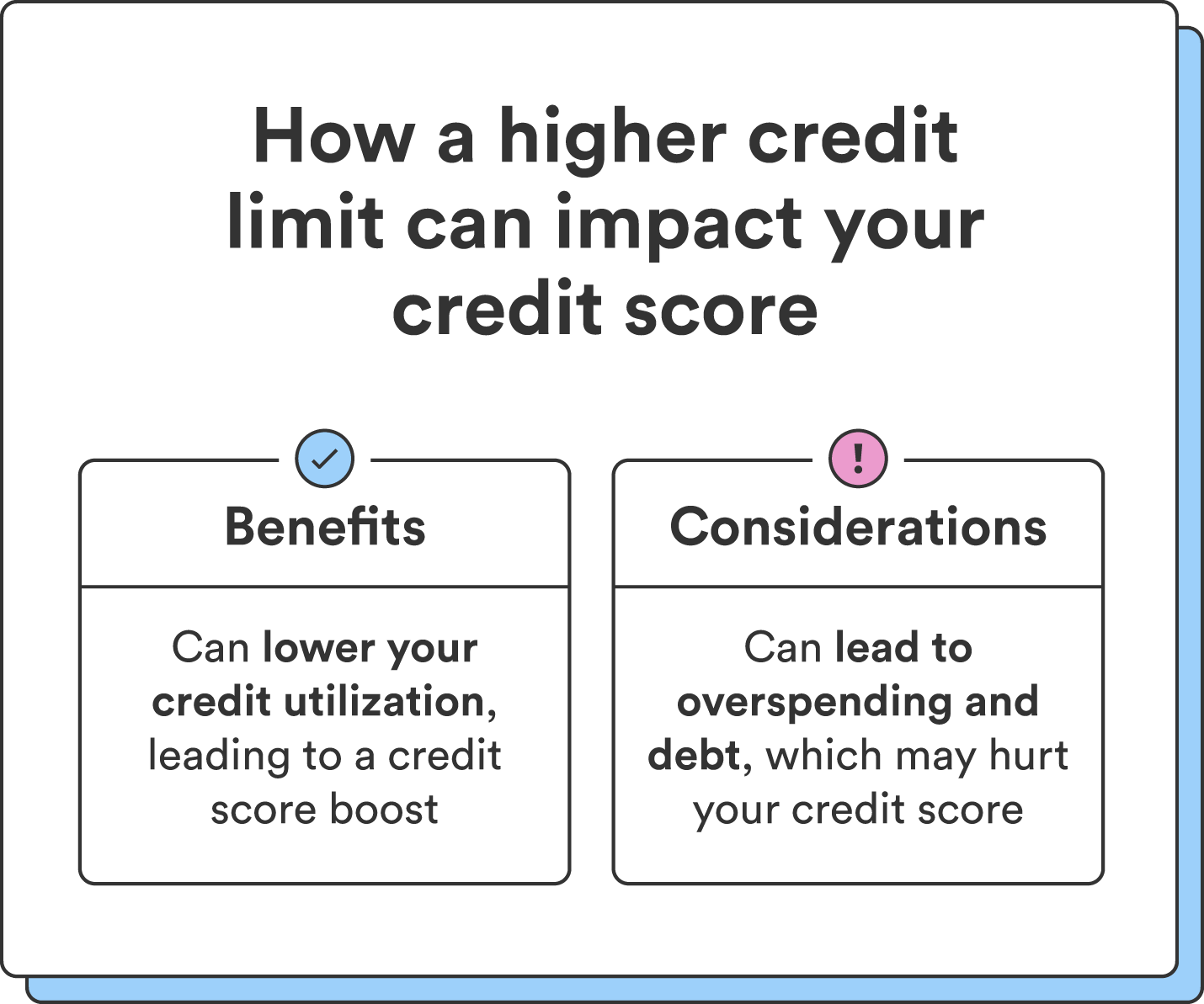

Pros and cons of increasing your credit limit

Increasing your credit limit can both positively and negatively affect your finances depending on your habits. One clear benefit of a higher credit limit is increased financial flexibility for unexpected expenses, managing debt, or making larger purchases.

Increasing your credit limit can also reduce your credit utilization ratio, which can improve your credit score. Credit utilization is the percentage of your credit limit that you’re using compared to your total credit limit, and it plays a significant role in your credit score. A lower credit utilization ratio is ideal, as it shows you’re not overly reliant on credit and can manage credit responsibly.

On the other hand, a higher credit limit can present the potential to overspend. While there are benefits to an increased credit limit, they only apply if you manage your credit responsibly. Misusing an increased credit limit can lead to acquiring more debt than you can manage, high interest charges, and financial strain.

Finally, requesting a credit limit increase may result in a hard inquiry on your credit report, which can impact your credit score. The effect of a single hard inquiry diminishes over time and may not cause significant damage. But if you’ve already applied for other types of credit in the last year, your score could drop.

Chime tip: If you’re planning to apply for a major loan, like a mortgage loan, in the near future, avoid multiple hard inquiries from credit limit increase requests. Credit increase requests could lower your credit score and impact your chances of approval.

| Pros | Cons |

|---|---|

| More financial flexibility | Temptation to overspend |

| Improved credit utilization | Potential for debt |

| Potential credit score boost | May come with a hard credit inquiry |

How are credit limits determined?

Your credit card issuer sets your credit limit according to their policies, which may differ from other lenders. But generally, here’s what they might consider:

- Credit score: Lenders use your credit score to assess how you’ve managed credit in the past and if you pose any risk as a borrower. A higher credit score often leads to a higher credit limit, as it shows responsible credit behavior.

- Income: Lenders often look at your income to determine if you can reliably repay the credit you borrow.

- Current accounts: Lenders may review the number of credit accounts you have open, including car loans, personal loans, or mortgages, and whether you’re managing them responsibly.

- Payment history: Lenders may review your payment history to confirm if you have a track record of making on-time payments on existing loans or credit accounts.

- Debt: Lenders may assess your current debt relative to your income.

Your information during the application process typically determines your initial credit limit when you open a new account. Over time, credit limits can increase based on your credit behavior, payment history, and income changes.

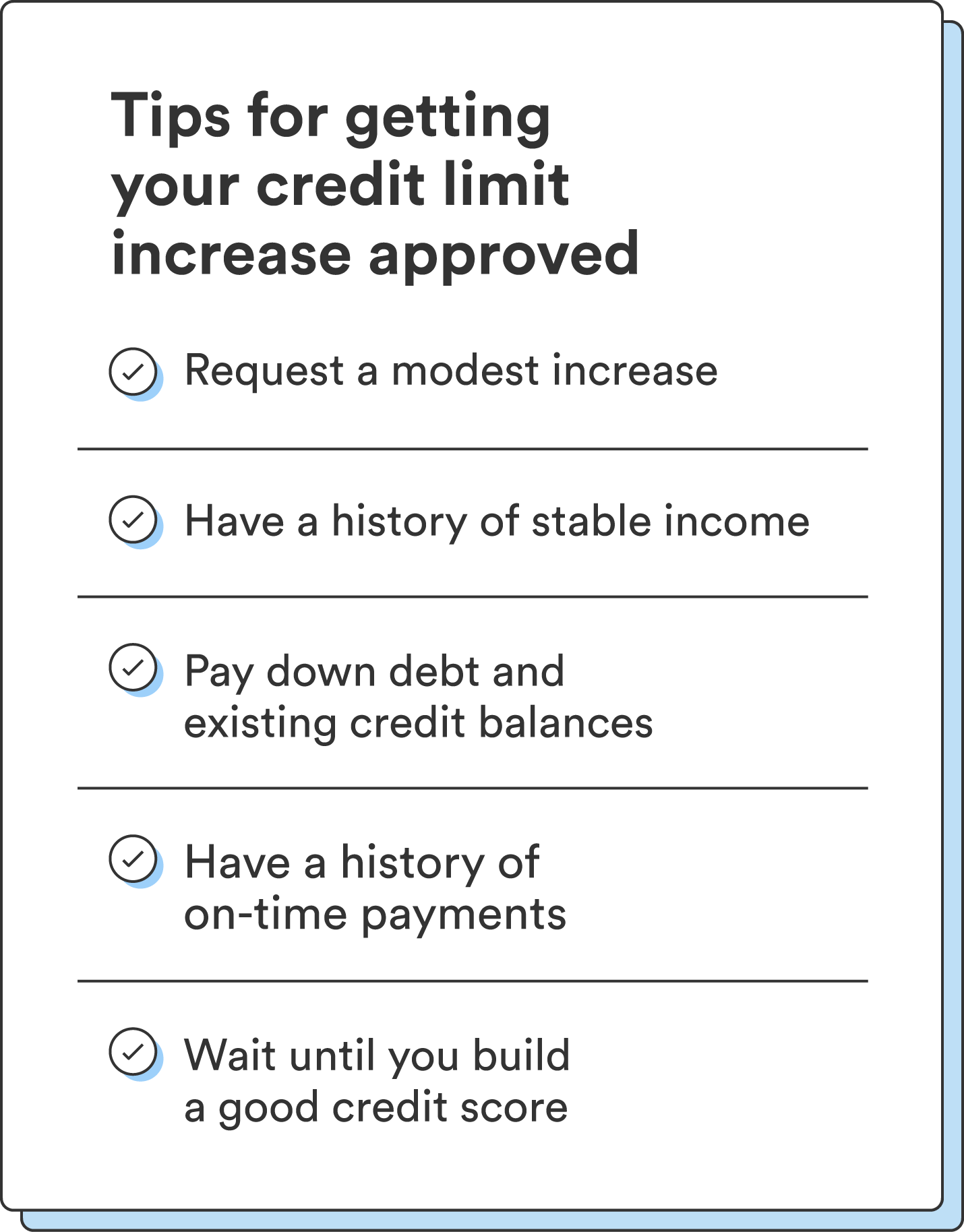

5 best tips to increase your credit limit

Your approval for a credit limit increase depends largely on your lender and your financial situation. Still, try these tips to increase your odds:

- Request a modest increase initially: To demonstrate your responsibility as a borrower, consider asking for a moderate increase initially.

- Demonstrate a consistent payment history: Maintaining a history of on-time payments lets lenders know you’re a reliable borrower, making lenders more confident that you can manage a credit limit increase responsibly.

- Pay down existing debt and balances: Lowering your existing credit card balances can reduce your credit utilization ratio, and paying down existing debt can assure lenders you have a handle on your finances.

- Have a history of reliable income: Proof of steady income shows lenders that you can manage a higher credit limit and pay your balance on time. If you’ve recently had an increase in income, let the lender know.

- Consider the timing of your request: Wait until a period of financial stability and positive credit activity before requesting a credit limit increase.

Try to build responsible credit usage and a good credit score before requesting a credit limit increase. If you’re not there yet, take the time to build up your credit history and practice smart credit habits to increase your chances of being approved.

Find financial flexibility with increased credit limits

Increasing your credit limit can offer financial flexibility and long-term credit score benefits. Avoiding bad credit habits, having a steady income, and building a history of on-time payments can all increase your chances of getting a higher credit limit.

Now that you understand how to increase your credit limit, learn more about how to improve your credit score to improve your approval odds.

FAQs about how to increase your credit limit

Still have questions about how to increase your credit limit? Find answers below.

Can I request a credit limit increase if I have a limited credit history?

Yes, you can request a credit limit increase with a limited credit history, but approval is less likely. Demonstrating responsible credit behavior, like on-time payments and a low credit utilization ratio, can increase your chances of approval.

When is the right time to request a credit limit increase?

The right time to request a credit limit increase is when you’ve established a positive credit history with on-time payments and responsible credit utilization. Waiting several months after opening the card and demonstrating consistent financial responsibility increases your likelihood of approval.

How long does it take for a credit limit increase request to be processed?

The processing time for a credit limit increase request varies depending on the credit card issuer. In some cases, you might receive a decision within a few days, while for others, it could take a few weeks. Check with your issuer for specific timelines.

What if my credit limit increase request is denied?

If the issuer denies your credit limit increase, request feedback to understand their reasons. Focus on improving your credit behavior and consider reapplying in the future.