Are you one of the 45 million adults without a credit score? Although having a solid credit history helps, you can still apply and get a loan with no credit or even bad credit.¹

That’s right – whether you’re a student or someone entering a new financial chapter, you still have loan options with no credit.

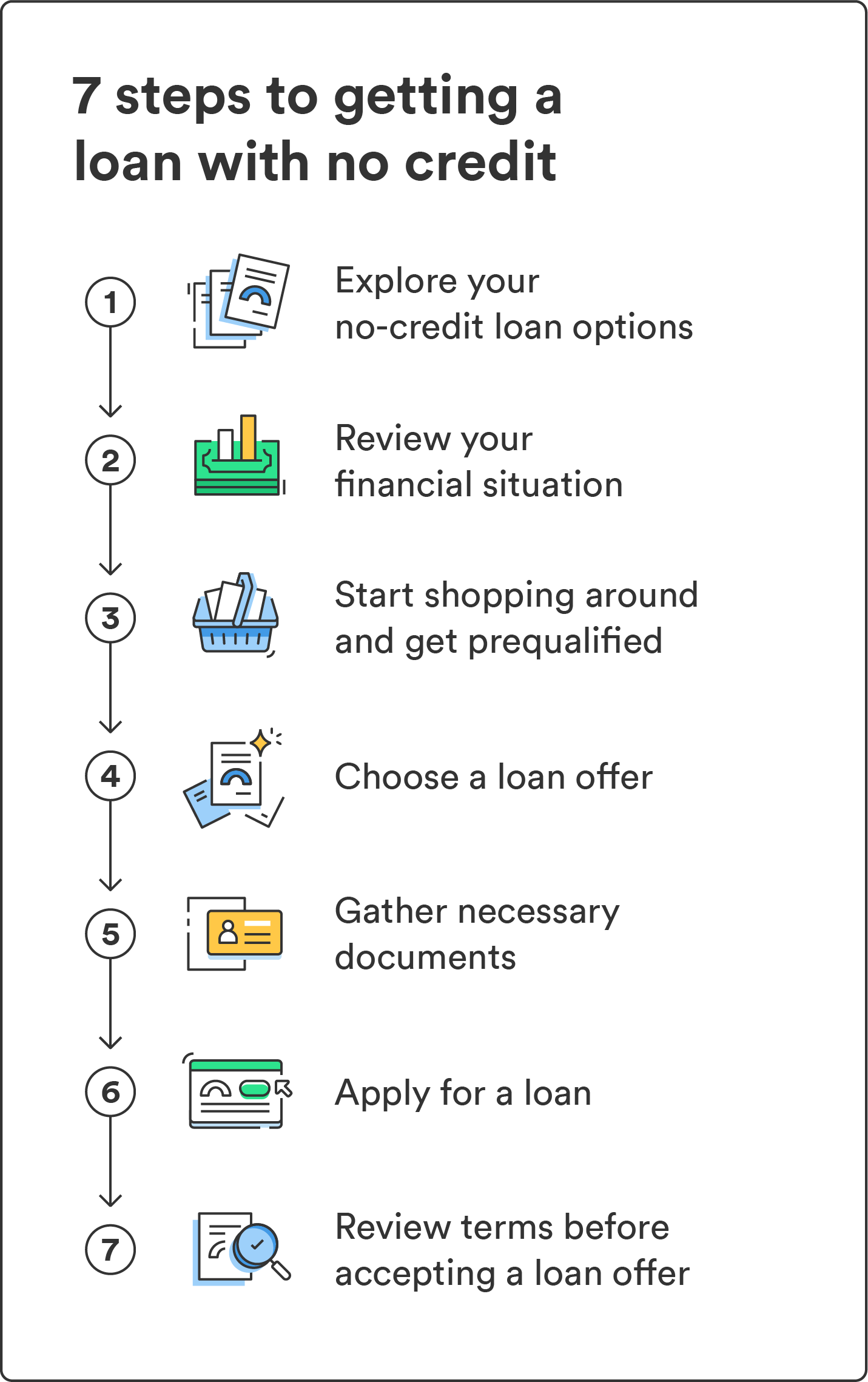

Ready to start exploring your options? Here’s how to get a loan with bad credit in seven steps.

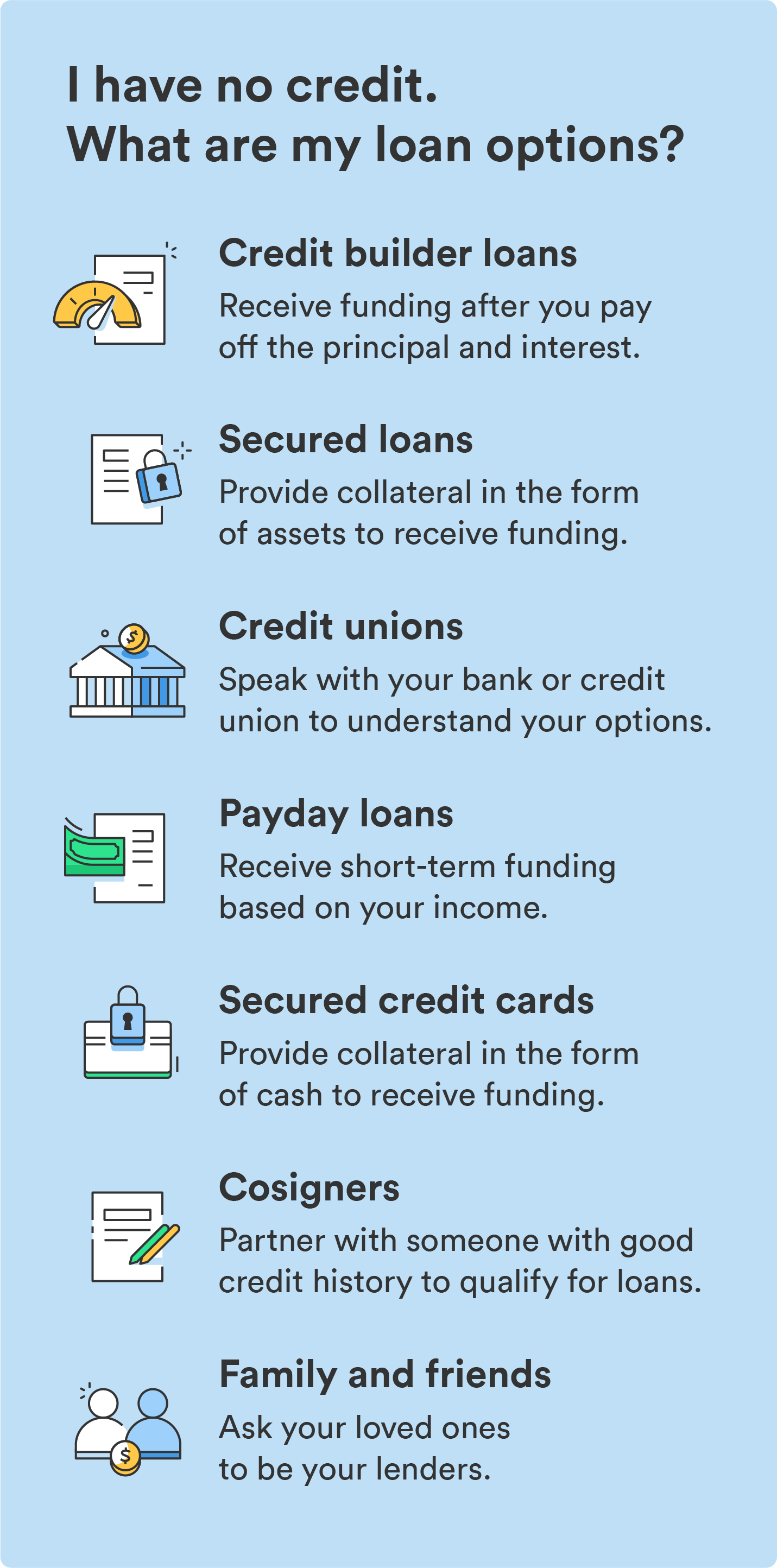

Loans that don’t require credit

The right loan strategy will depend on your financial health and why you want a loan in the first place. Not only can you get a loan with no credit, but you also have several options.

Credit unions

Financial institutions like credit unions and banks can offer tailored services to meet your funding needs. Even with no credit, a credit union can help you explore options and show you which loans you qualify for. They also often have financial advisors who can show you how to build credit to qualify for larger loans.

Payday loans

Payday loans are short-term loans that you can qualify for based on your income rather than your credit. These loans exist to help with emergency expenses, which you have to pay back by your next pay period. The big catch is that the interest can be as much as 400%, which is much higher than personal loans. For every $100 you borrow, you’ll usually pay an extra $15 to $30 in fees.²

Payday loans should be used as a last resort; even the best options can be expensive. Because of the cost, payday loans could lead to additional debt and financial strain if you can’t afford to pay back your loan.

They also aren’t available everywhere, as some states have outlawed payday loans.³

Family and friends

If you have a trustworthy relationship with family members and close friends, think about asking them to be your lender.

When asking for money from friends and family, consider drafting a loan proposal that includes details like how much you’ll borrow, when you’ll pay it back, how much interest you’ll pay, and whether you’ll put up an asset (like a car) as collateral.

Although you do not have to sign a contract, doing so protects you and your loved one.

Alternatives to bad credit personal loans

Credit builder loans

A credit builder loan is one way to slowly get secure financing. This type of loan helps people with no credit get access to funding. You match with a lender and can only access the funds after paying off the principal and interest. The lender will hold your funds in an account and report your payments to credit bureaus.

Secured loans

Instead of a credit score, a secured loan requires collateral to provide funding. Collateral can be real estate, vehicles, and stocks. Lenders get to keep your collateral if you can’t make loan payments. Secured loans are popular funding options for people with bad or no credit but have access to other assets.

Secured credit cards

Secured credit cards work similarly to secured loans. Instead of putting up assets as collateral, a secured credit card requires cash upfront as insurance against you defaulting on your loan payments. A secured credit card can also help you build credit while accessing an alternate funding source.

Co-signers

Partnering with a co-signer can potentially increase your approval odds when applying for a personal loan. The co-signer’s credit score can help you access loans that require a credit history. Whoever you apply with should understand that their credit score can be affected if you make late payments or default on the loan.

That said, you can build credit with a personal loan if you make on-time payments. And this could help you qualify for future loans on your own.

Tips for getting a loan with bad or no credit history

You can take the following steps to get a loan with poor credit or minimal credit history that best fits your unique financial circumstances.

1. Assess your financial situation

Consider your other debts, income, and monthly payment ability. To make things work, you might lower the amount you decide to borrow and cut expenses in other areas of your budget.

If you plan on using collateral for a secured personal loan, you don’t want to give up a valuable asset like a car. Getting the money you need is only half the battle – you also need to ensure you can repay the loan.

2. Compare different lenders and get preapproved

Browse for loans that meet your financial goals. Since applying for multiple loans can negatively impact your credit, try to only apply for one loan at a time.

Call local credit unions to see if they have any personal loan options with lenient requirements. Look at fees, borrowing amounts, and term lengths, and make sure the loan details meet your needs.

Ask these questions while shopping around:

- Does the lender have any prepayment penalties if you decide to repay your loan early?

- What is the minimum credit score requirement, and are there income requirements?

- Can you use a co-signer, or is there an option for a secured personal loan?

- How much would your monthly payment be, and is it affordable?

If you can move forward with these offers, see if you can get prequalified.

3. Select the best loan offer

After you get prequalified, you can choose a loan offer to apply for. Since the application process can negatively affect your credit report, consider applying for one loan at a time.

If you are partnering with a co-signer or loved one, now is the time to review your agreement’s structure and ensure everyone is on the same page. Knowing this information will help you understand which documents to gather next.

4. Collect all necessary documents

You should have your personal information nearby while completing the loan application. Source these documents before filling out the application:

- Proof of residency: Share recent rent or mortgage payments.

- Proof of income: Provide proof of consistent funds coming into your account.

- Driver’s license: Share a copy of your license or passport.

- Bank statement: Provide samples of recent bank statements.

Try to respond promptly to requests for additional documentation to speed up the loan process.

5. Submit your loan application

Now that you are confident in your loan option and have the necessary documents, you’re finally ready to complete your loan application. If you are working with a co-signer, apply while you are with them.

In general, you can apply for a loan online. Depending on your loan option, it is possible to apply and receive an answer on the same day.

A hard inquiry will have a temporary presence on your credit report even though you have no credit history. Consider factoring in loan payments into your monthly budget.

6. Carefully review loan terms before acceptance

Only complete a loan application with a full grasp of the agreement between you and the lender. Doing this ensures you fully understand and accept the loan terms.

Once you agree, the lender will fund your loan, and you’ll receive the money you borrowed in one lump sum within a few business days.

Now that you’ve learned how to get a loan with no credit, you know the funding options at your fingertips. If you’re ready to level up your funding opportunities, our credit-building guide can help you get started!

FAQs

What are the easiest loans to get?

The easiest loans to get approved for have the most lenient eligibility requirements. Some common examples include payday loans and no-credit-check loans. These loans could be considered income-based loans since your eligibility depends mainly on your income and not your credit.

Can I get an instant loan online?

Yes, some apps offer cash advances, which allow you to borrow a percentage of your next paycheck. Funding speeds vary, but you can usually pay a fee for an instant transfer.

Is it possible to get a loan with no credit?

Yes, it is possible to get a loan with no credit. Credit unions and traditional lenders are available to individuals with no credit. While co-signers and loved ones also serve as alternative options.

How big of a loan can I get with no credit?

The exact amount varies depending on the lender you apply with. Due to the applicant’s lack of credit history, however, the loan may have higher interest rates and shorter repayment terms.

How can low credit affect a personal loan application?

Some lenders won’t accept credit scores under a certain threshold, no matter the circumstances. You could miss out on benefits like low interest rates, higher loan amounts, and flexible loan terms.

Are there no-credit-check loans that won’t affect my credit?

There are no credit loans that will not check your credit score or affect your credit history. The major downside of no-credit-check loans is that they often include many fees.

These types of loans can be predatory, especially if lenders target bad-credit borrowers and charge high interest rates and fees.