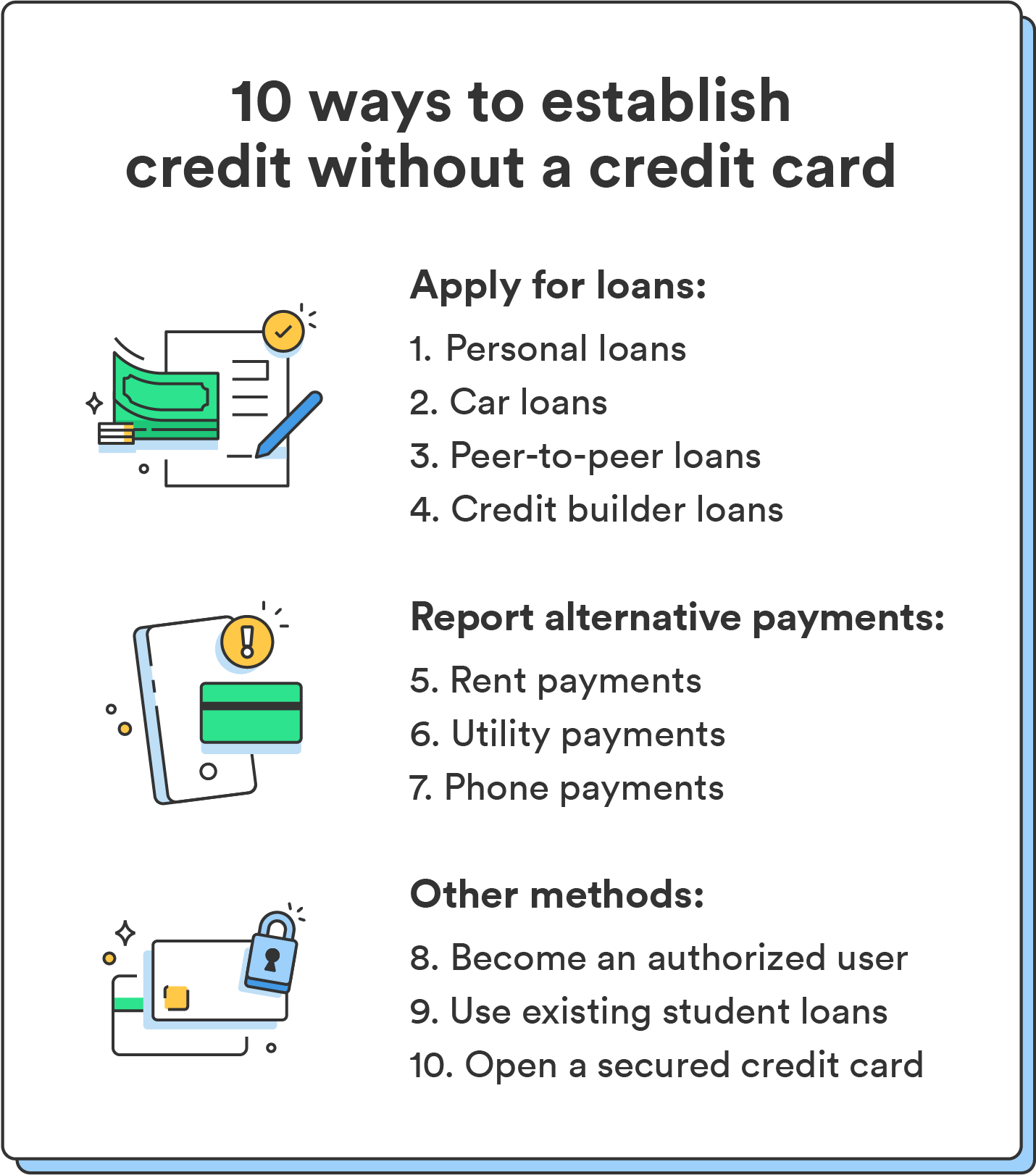

Not everyone can qualify for a standard credit card despite it being the most common way to build and improve credit. Whether your credit score is too low to qualify or you don’t have a credit history yet, there are alternative ways to build credit without a credit card, including:

- Taking out a personal loan

- Using a car loan

- Repaying existing loans

- Using a rent-reporting service

- Reporting alternative payments

- Keeping up with student loans

- Having a phone plan

- Becoming an authorized user

- Taking out a credit builder loan

- Utilizing peer-to-peer lending platforms

Below, we’ve covered the top options to consider if you want to improve or establish your credit for the first time.

1. Take out a personal loan

Personal loans are one way you can build credit without a credit card. Personal loans are a type of unsecured loan that can fund goals like consolidating debt, covering unexpected expenses, or kickstarting personal projects.

When you make on-time payments toward your personal loan, the lender reports this payment history to credit bureaus. This positive credit history demonstrates your ability to manage debt responsibly. Over time, consistent payments on your personal loan can lead to an improvement in your credit score.

If you have little or no credit, you may only be able to get approved for a personal loan with higher APRs compared to someone with a solid credit history. Shop for lenders to compare your options and get the best terms.

Chime tip: Choose a loan amount you can comfortably repay on time to avoid hurting your credit.

2. Use a car loan

Similar to personal loans, responsibly managing a car loan is another way to establish and build your credit. Making consistent, on-time car loan payments demonstrates your ability to manage debt. It can help you build a positive payment history that gets reported to credit bureaus.

Car loans are available through banks, credit unions, and dealerships, and they can be an effective tool for acquiring a vehicle and building credit. If you use a car loan to build credit, choose a vehicle that fits your budget and find a loan with terms that match your financial situation – mainly, a loan you can comfortably repay.

Chime tip: Use our auto loan calculator as you compare available rates to estimate your car loan costs.

3. Repay existing loans

Repaying existing loans can also contribute to building credit without relying on a credit card. Student loans are a common example of installment loans that many people have. Repaying existing loans on time is a chance to build a positive payment history since lenders report your payment activity to credit bureaus.

To build credit, ensure you’re consistently making payments on time. Late payments or defaults can negatively impact your credit history. If you have multiple loans, prioritize making timely payments. Consider setting up automatic payments to avoid missing due dates.

4. Use a rent-reporting service

If you don’t have any existing loans or don’t want to take out a personal loan, you can use a rent-reporting service as an alternative way to build credit without a credit card. This method can be particularly beneficial if you’re brand new to credit or have limited credit history.

While landlords don’t traditionally report rent payments, rent-reporting services can verify rent payments and report this information to credit bureaus, offering another way to build a positive credit history.

Choose a rent-reporting service that reports to all three major credit bureaus to maximize the impact on your credit history, and confirm that your landlord is willing to participate in the reporting process.

5. Report alternative payments

In addition to rent payments, you can report other payments to credit bureaus to help you build credit without a credit card. If you pay certain bills on time every month, you can use those recurring payments to build your credit score.

To report alternative payments, you can use a service like Experian Boost®. When your Chime account is connected to Experian and you use Experian Boost,² you may be able to improve your FICO® Score³ simply by paying your bills on time. Qualifying bills include utilities like gas, electricity, and water; your phone, internet, or trash bill; and certain streaming services including Netflix, Hulu, and Disney+.

6. Keep up with student loans

Student loans are often one of the first types of credit that young adults encounter, and they offer an opportunity to establish a credit history early on. If you have student loans, whether federal or private student loans, making consistent, on-time payments towards your student loans demonstrates your ability to manage debt responsibly and contributes to your credit profile.

When managing student loans to build credit, create a budget for your payments. If you have multiple student loans, prioritize making payments on them to maintain a positive payment history across all accounts.

7. Have a phone plan

If you have your own phone plan, you may be able to reflect your payment activity on your credit report depending on your contract and phone company. While phone bills don’t typically appear on traditional credit reports, some phone providers offer the option to report your payment history to credit bureaus.

If you want to use your phone plan to build credit without a credit card, ask your phone provider about their credit reporting policies. Confirm whether they report payment history to all three credit bureaus and if there are any fees for this service. If they do, make monthly payments on time to maintain a positive payment history.

8. Become an authorized user

You can request to become an authorized user without having to apply for a credit card of your own. As an authorized user, you gain access to someone else’s credit card account but are not legally responsible for the debt.

Instead, you receive a physical card tied to their credit card line and can piggyback off their credit card activity. The credit card company then reports the activity to the credit bureaus, which can positively impact your credit if used responsibly.

To benefit you, the primary account holder should be responsible and have on-time payments and low credit utilization. Any negative account information can also damage your credit. Only become an authorized user if you and the account holder can practice healthy financial habits.

Chime tip: Verify that the credit card company reports authorized user activity to all three credit bureaus, which is needed for the method to work.

9. Take out a credit builder loan

If you have bad credit or no credit, you may have trouble getting approved for a standard loan. Instead, you might consider a credit builder loan – a secured loan designed to establish or improve your credit.

Unlike regular loans, the funds borrowed in a credit builder loan aren’t immediately available. Instead, the lender puts the loan funds into a separate account, and you make monthly payments toward the loan until you pay it off.

Your monthly payment activity gets reported to the credit bureaus, helping to build a positive credit history. Once the loan term is complete and you’ve made all payments, you receive the funds in the account.

10. Use peer-to-peer lending platforms

Peer-to-peer lending platforms are online marketplaces connecting people seeking loans with potential lenders. You can borrow funds without the involvement of traditional financial institutions.

When you sign up, you provide information about your financial goals and borrowing needs. Then, lenders assess your profile, review your loan request, and determine whether to provide you with a loan. You repay the loan over time just like a bank loan, and your payment activity gets reported to credit bureaus to help build your credit.

Other ways to build credit without a traditional credit card

Below are a few more considerations for building up your credit score:

- Open a secured credit card: Secured credit cards are a helpful option if you can’t qualify for a traditional credit card. They require a security deposit as collateral, which is also typically your credit limit. Using a secured credit card responsibly by making small purchases and paying them off in full and on time can gradually boost your credit score.

- Keep your credit utilization low: Your credit utilization ratio is the proportion of your available credit that you’re using. Keeping this ratio low – typically below 30% – can positively impact your credit score. Even if you don’t have a credit card, you can apply this principle to other forms of credit, like installment loans.

- Make on-time payments: Regardless of the type of credit you’re using, whether it’s a loan or a utility bill, consistently making on-time payments is crucial for building credit. Late payments can negatively impact your score. Set up reminders, automate payments, and stay organized to ensure your payments are made on time and in full every month.

Even if you don’t opt for a secured credit card, managing your credit utilization and prioritizing timely payments go a long way in building your credit.

Make the most of your credit-building journey

While credit cards are one of the most common credit-building tools available, there are plenty of other ways to build your credit. Whatever method you choose, maintain smart credit habits to build your credit score over time. With time and consistency, you can eventually qualify for a standard credit card.

Learn what a good credit score is in your 20s and beyond.

FAQs about how to build credit without a credit card

Still have questions about how to build credit without a credit card? Find answers below.

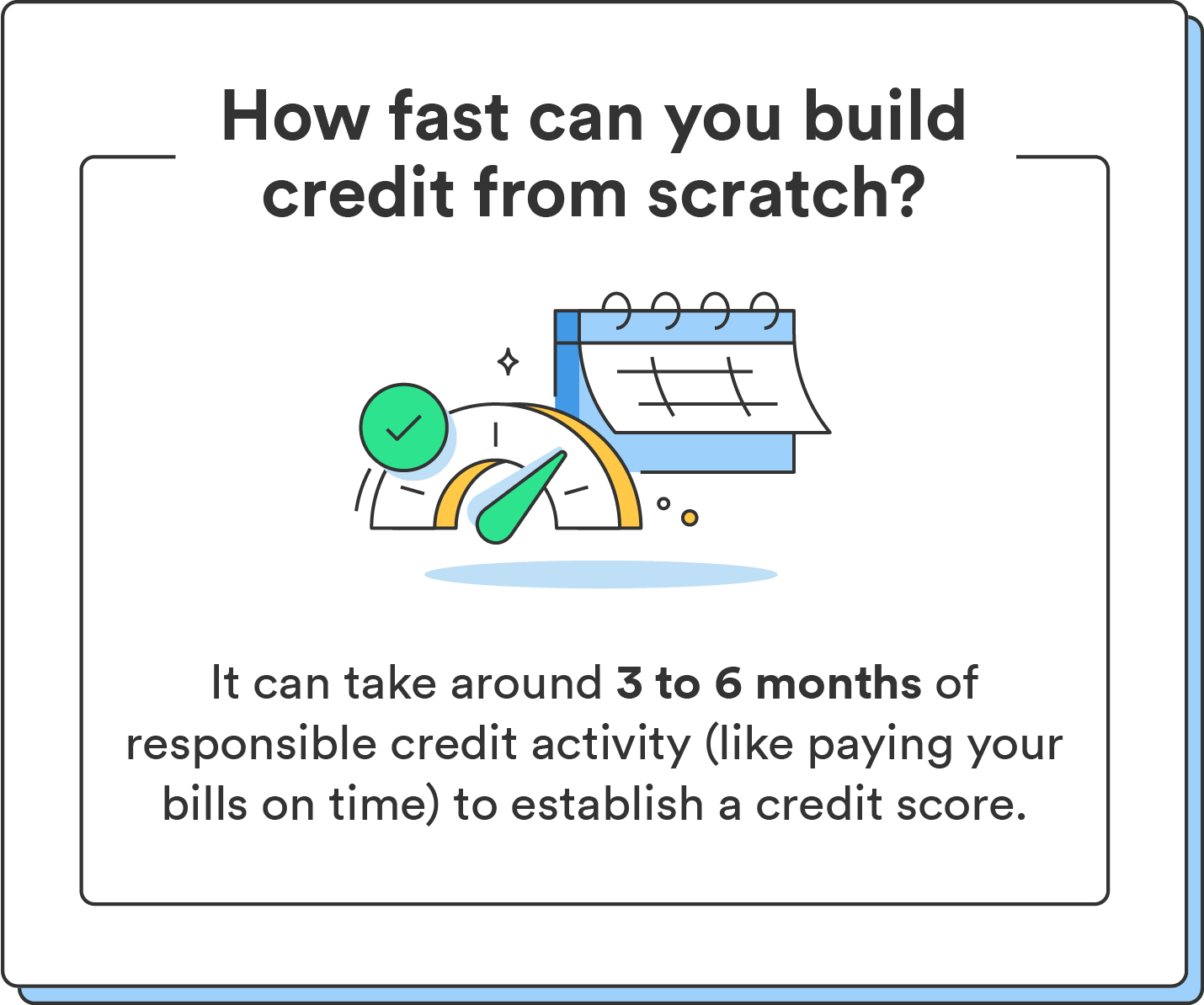

Is it easy to build credit from scratch?

Building credit from scratch isn’t necessarily difficult, but it is a gradual process that requires patience and discipline. Generally, credit scoring models require at least three to six months of credit activity before generating your credit score. If you’re starting from scratch, prioritizing on-time payments can steadily pave the way to establishing your credit history.

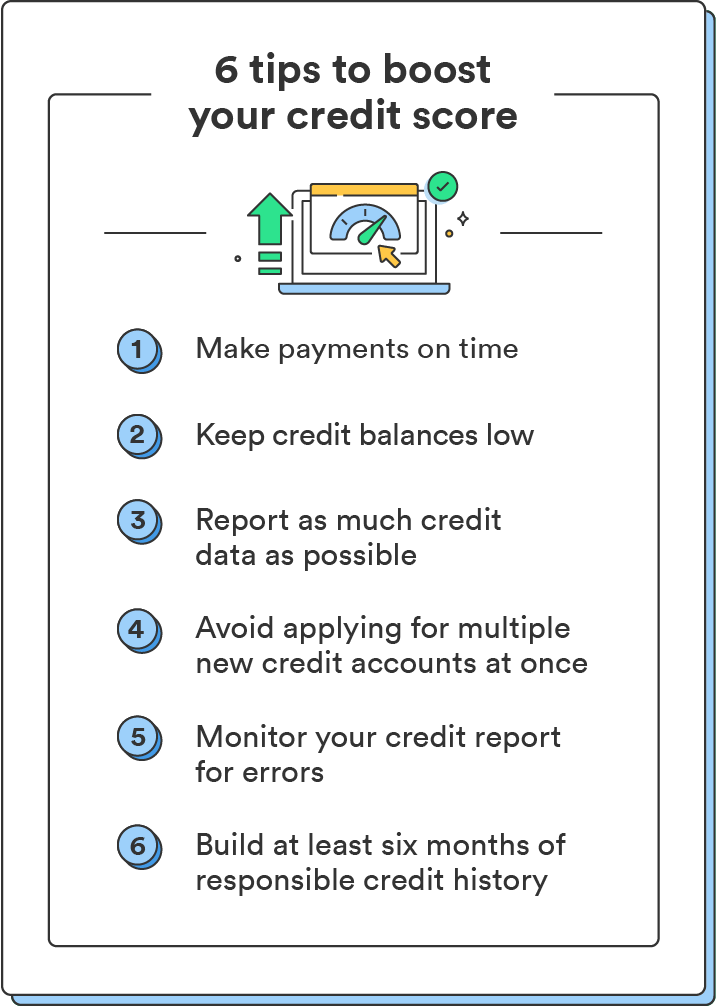

What is the fastest way to build credit?

You’ll need to maintain smart credit habits to raise credit quickly. Pay bills on time, keep your balances low, and ensure you have as much credit data as possible being reported to all three credit bureaus.