Pay periods determine when employees get paid. They can also affect employee budgeting, financial planning, and tax withholdings.

Choosing the most reasonable pay period for your business requires a clear understanding of what pay periods are, the various types available, and how they affect your organization and your employees.

This guide can help you find out how many pay periods are in a year and the best pay period options to make informed decisions on how and when your employees will be paid.

What are pay periods?

A pay period is a recurring schedule determining how often workers receive their paychecks. In other words, pay periods represent the length of time between one payday and the next.¹ For example, a pay period might be weekly, biweekly, or monthly based on the company’s payment model.

While pay periods can have different lengths, they all track the number of hours employees work within a set time frame. Selecting the right pay period involves balancing administrative needs and goals with employee needs.

Some industries require frequent payments to accommodate hourly workers, while others prioritize simplified payroll processes for salaried employees.

Types of pay periods

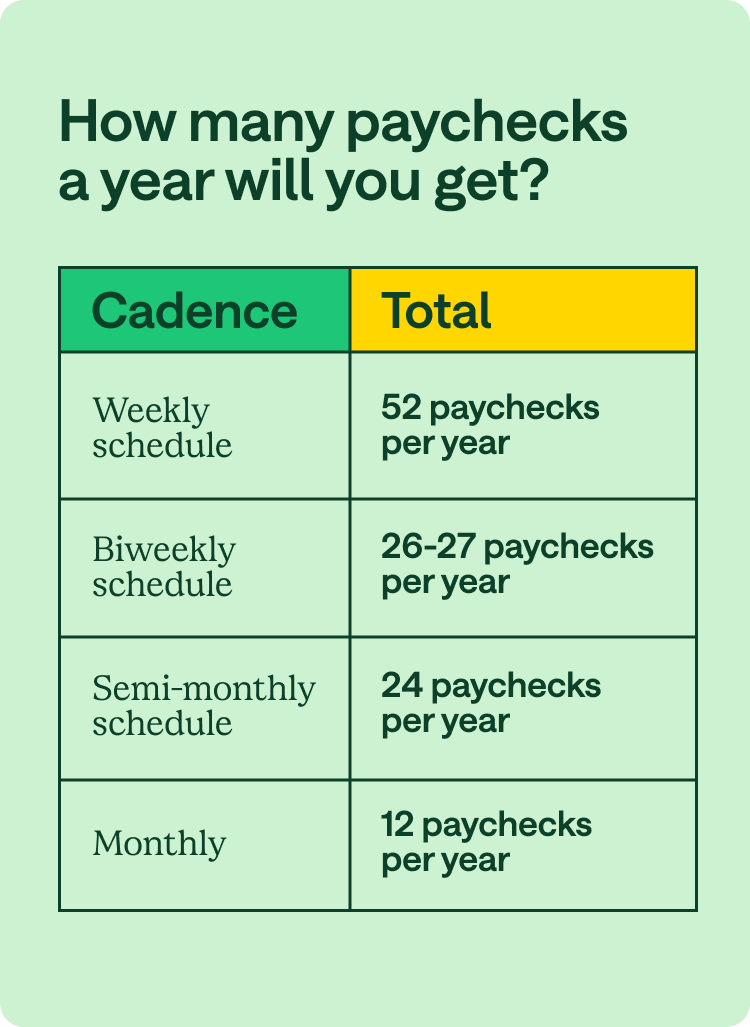

There are four main types of pay periods, with pay schedules varying based on company size, preferences, and industry standards. Different pay periods will change how many paychecks are in a year for employees.

Weekly pay periods

Employees are paid once a week with a weekly pay period, typically on the same day, such as Friday. Weekly pay periods track an employee’s hours worked over seven days.² Once the week concludes, employers process payroll and issue payments shortly after. This results in 52 paychecks per year.

One perk of being paid weekly is that employees have a steady cash flow of more frequent paychecks, making it easier to budget for immediate expenses. However, due to frequent calculations and processing, weekly pay periods can also be labor-intensive for payroll teams.

Biweekly pay periods

A biweekly pay period is one of the most common payroll structures used today, particularly by mid to large-sized organizations. Biweekly pay periods typically cover 14 work days, and payments are issued based on this two-week block.² A typical example is a company processing payroll with paychecks received every other Friday.

So to know how many bi-weekly pay periods are in a year based on this model, remember that each year consists of 26 biweekly pay periods. However, in some cases, leap years yield 27 pay periods. Getting paid biweekly is common and streamlines the payroll processing process for employers, making it a potential win-win situation.

Also, employees who get paid biweekly will occasionally receive three payments in a month. While this can be a pleasant surprise for employees, employers must account for the additional payroll costs in their budgeting.

Semi-monthly pay periods

Employees are paid twice monthly with a semi-monthly pay period, leading to 24 regular payments annually. Standard pay dates fall on the 1st and the 15th of each month or the 15th and 30th.²

Unlike biweekly pay, semi-monthly pay is calendar-based. Each pay period spans roughly half a month, making this a structured and predictable option for employers and employees. If a payday falls on a weekend or holiday, most companies process payments on the nearest weekday.

Processing payroll for semi-monthly pay periods can easily fit with other financial obligations such as rent and vendor payments. However, calculating overtime for hourly employees can be more complex, as semi-monthly schedules do not always align neatly with standard work weeks.

Monthly pay periods

Employees are paid once a month during a monthly pay period, with payments processed at the end of each month.² With only 12 paychecks issued annually, this is the least frequent payroll calendar.

Monthly pay periods cover all the work days within a specific calendar month. For example, employees may receive their January paycheck on February 1st or the last Friday of January.

Monthly pay comes with the lowest administrative effort. And while this is a lower expense for employers, your employees may prefer more frequent pay.

Monthly pay may also cause budgeting challenges for workers who struggle to manage cash flow for frequent, ongoing expenses like rent or utilities.

How many pay periods are in a year?

In 2025, the number of pay periods your business will have depends on the type of pay schedule you follow. If you’re wondering how many paychecks in a year your employees will get, companies using a weekly pay period will have 52 pay periods per year, as there are 52 weeks in a year.

For businesses on a biweekly pay schedule, employees will receive 26 paychecks, with payments made every two weeks. Both schedules are common in industries with hourly workers who prefer more frequent pay.

For businesses that pay employees semi-monthly, there will be 24 pay periods in 2025. Employees will receive paychecks twice a month, typically on set dates such as the 1st and 15th or the 15th and last day of the month. For employers on a monthly pay period, 12 paychecks are issued yearly, as employees are paid monthly.

Not all pay periods run on the same schedule, so the number of pay periods per year may vary slightly at your company depending on which day the pay period ends and which day of the week paychecks are issued. All of these factors can impact how many pay periods in a year employees will have.

Years with extra pay periods

Since there are a little more than 52 full weeks (365/7) in any given year, if your company offers a weekly or biweekly pay schedule, your employees may occasionally experience an “extra” paycheck year. Over time, these extra days create a 53rd weekly paycheck or 27 biweekly paychecks.³

Extra pay periods are rare but may occur every few years, depending on how calendar weeks align. Typically, this affects employee paychecks distributed on Fridays.

For employees, extra pay periods can feel like a bonus—the same annual salary gets distributed in more payments, creating a little more income for the year.

Pay periods can significantly impact payroll budgets and cash flow, so employers must account for any additional payroll runs due to pay period scheduling.

Therefore, proactively plan for these instances to ensure your business can manage the financial implications without disruptions or delays that could inconvenience your employee workforce.

Which pay period type is right for your business?

Choosing the right pay period depends on your business’s operational needs, cash flow, and administrative workload. Here are a few questions you may want to ask yourself:

- Can your business handle frequent payouts without straining resources?

- Does your workforce prefer frequent payments, or are they comfortable with less frequent schedules?

- Do you have the tools and personnel to manage frequent payroll processing?

Also, consider industry norms. If you’re in retail, you may notice companies leaning toward weekly or bi-weekly payments, while offer-based sectors may favor bi-weekly and semi-monthly payment periods.

Weekly pay periods may be ideal for industries with hourly employees who rely on frequent payments, while biweekly schedules compromise between payment frequency and an efficient administrative process.

Semi-monthly schedules can be ideal for salaried employees since they align well with monthly expenses. Though less common, monthly schedules may work for businesses seeking to minimize administrative costs.

Making an informed decision on pay schedules

By selecting a pay schedule that aligns with your business needs and employee expectations, you can foster a positive workplace environment while ensuring financial stability.

Knowing how many pay periods in a year exist and how they align to a calendar year gives you better control over budgeting, savings, and tax planning.

When employees have clear pay period schedules and are paid on time and with minimal hassle, it promotes trust and reliability, which are essential for your company’s success.

Continue to plan and streamline your employees’ payment process by offering options like direct deposit which allows employees to access their paychecks faster and more securely.

FAQs

How many biweekly pay periods are there in 2025?

There will be 26 biweekly pay periods in 2025. As a typical 52-week year, 2025 will result in two paychecks per month for biweekly employees. However, this may vary depending on the company’s specific pay schedule.

Are there ever 27 pay periods in a year?

Yes, there can be 27 annual pay periods for employees who receive biweekly payments. Because calendar weeks align with the standard 365 days a year, this happens every 11 years—resulting in an extra employee payday. This income can be considered a bonus or additional income for budgeting purposes.³

Although uncommon, employers should still plan accordingly to avoid potential cash flow issues during these years.

What to do if an employee starts working in the middle of a pay period?

In this scenario, the employer can either prorate the employee’s pay for that period or wait until the next pay period to include their full wages.

It’s important to have clear communication with the employee regarding their start date and when they can expect their first paycheck. Employers should also follow applicable labor laws and company policies regarding new employees’ pay schedules.