Overdraft fees can drain your checking account, but SpotMe® gives you a way to avoid them when you open an account through Chime. If you need funds to cover a purchase, Chime spots you, up to your limit, until your next payday.~

If you’re a fan of SpotMe, you might wonder: How do I get a higher SpotMe limit?

We’ll walk you through how limits work for our SpotMe feature and when they can be increased.

What is SpotMe?

SpotMe is Chime’s fee-free overdraft feature.~ It’s available when you activate your Chime Visa® Debit Card or Secured Chime Credit Builder Visa® Credit Card* and receive a qualifying direct deposit of $200 or more each month.

How does SpotMe work on Chime? It’s pretty simple:

- Chime spots you money fee-free when you overdraw your account by up to $200.~

- The next time you deposit money into your Chime account, Chime applies it automatically to your negative balance.

- If you attempt a transaction that exceeds your balance and SpotMe limit, the transaction is simply declined. No fees!

In other words, SpotMe helps you cover purchases that would exceed your balance without charging fees. That includes debit card purchases, secured credit card purchases, ATM withdrawals, cash-back transactions, and over-the-counter withdrawals.

Find out more about what overdraft fees are and how to avoid them.

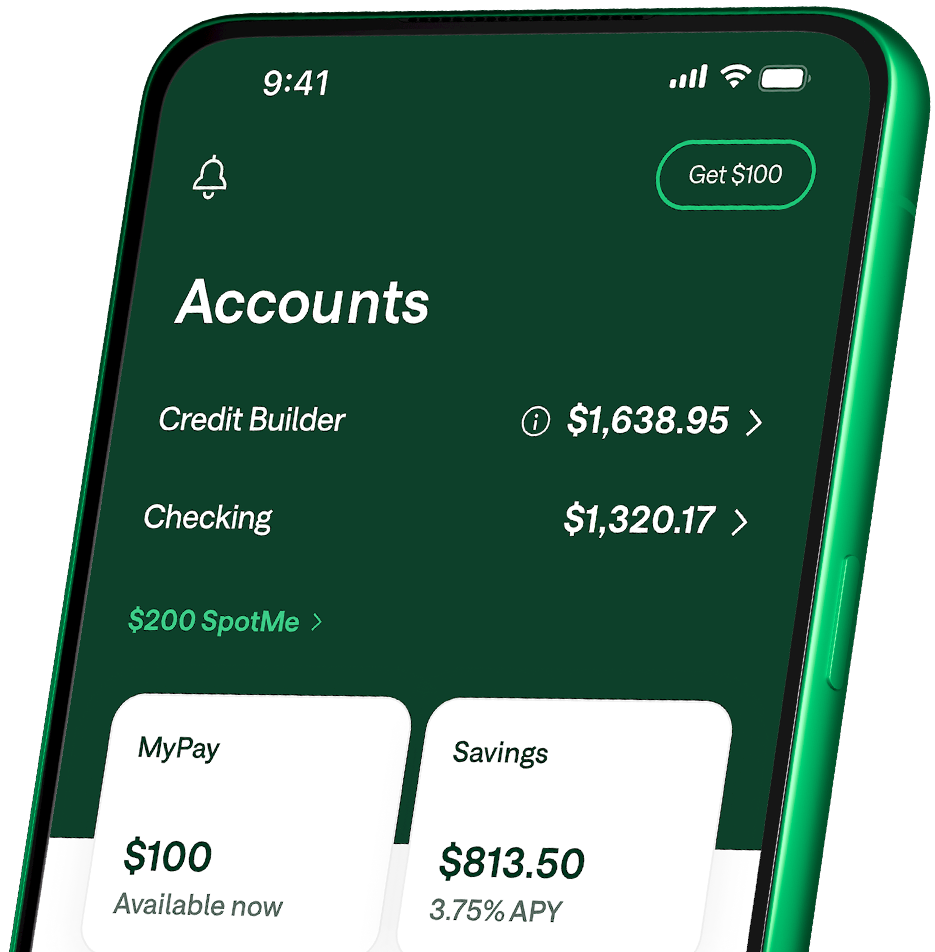

Direct deposit and get Chime+ for free.‡

- SpotMe® up to $200~

- MyPay® up to $500†

- 3.75% Savings APY§

How is my SpotMe limit decided?

Chime SpotMe limits are based on several factors, including:

- How long you direct deposit. The longer you direct deposit, the better.

- How much you direct deposit to your account. Keep your amount consistent or bump it up if you can.

- How much you use Chime.

What happens if you reach your SpotMe limit?

If you have reached your SpotMe limit, we will simply decline the transaction, but there’s no fee for declined transactions.

Chime tip: While you can’t raise your SpotMe limit, you can set your own personal max in the Chime app to a limit you prefer.

What can I do to improve my SpotMe limit?

If you’re looking for tips on how to increase your SpotMe limit on Chime, these actions may help your SpotMe limit go up over time.

- Keep up your direct deposit. The longer you direct deposit, the better. Keep your amount consistent or bump it up, if you can.

- Use your account regularly. Your account activity and history can influence your SpotMe limit. Along with maintaining direct deposits, you can keep your Chime account active by paying bills online and using your Chime Visa® Debit Card for purchases.

A quick note: our customer support team cannot raise your SpotMe limit.

Chime will notify you if and when you qualify for a higher limit. While you use Chime, receiving direct deposit and regularly paying bills may help your SpotMe limit go up over time.

What are SpotMe Boosts?

SpotMe Boosts temporarily increase eligible member’s SpotMe limit by $5.^ You can both send and receive Boosts! There are a few things to know:

- You’ll get four Boosts at the beginning of the month to send to other people. You can also receive up to 4 boosts per month!

- Boosts last until the end of the month.

- Your SpotMe limit will return to your base limit when Boosts expire.

- You can only send one Boost to each friend per month.

How to use SpotMe Boosts

SpotMe Boosts give you – and your friends and family who use Chime – the opportunity to raise your SpotMe limit. There’s no fee to send or receive a Boost.

If you want to increase your SpotMe limit temporarily, ask for Boosts. Chime has a strong “Boost 4 Boost” community on our social channels, and we love how this feature creates lasting friendships between members. To request a Boost, you can comment something like “boost 4 boost” under our posts and sharing your Chime handle.

There are three steps to using Boosts on the Chime app:

- Open the Chime app and look for “Boosts” on the home screen.

- Search for the person you want to send a Boost to from your contact list.

- Tap “Send $5 Boost” next to their name.

Once you send a Boost, the recipient will have $5 added to their SpotMe limit. They can do the same for you!

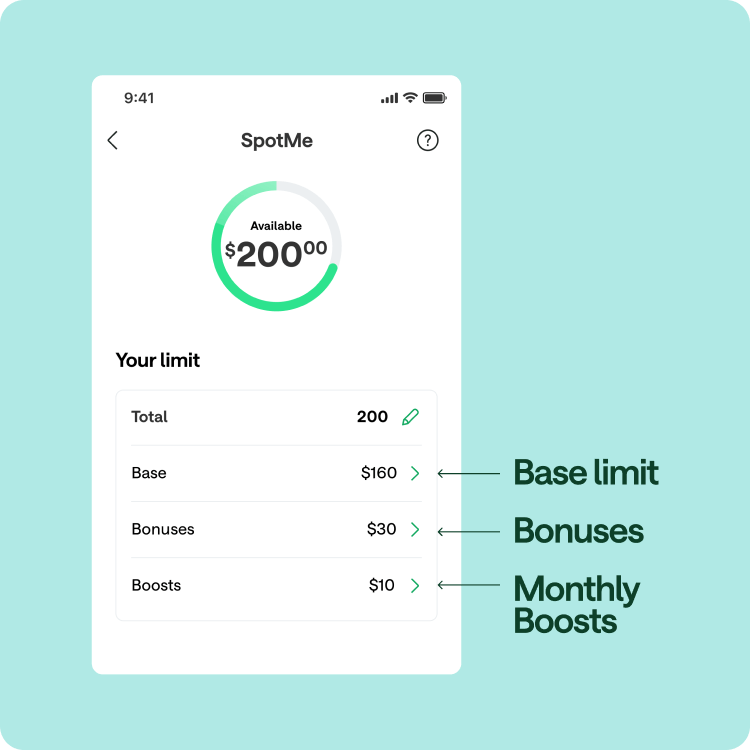

Three parts of your SpotMe limit

Your monthly SpotMe limit is made up of three different parts:

- Your base limit: this is your account’s default SpotMe limit, the consistent amount you can count on every month.

- Your Boosts: Receiving a SpotMe Boost by another member temporarily increases your SpotMe limit by $5 for the month.

- A bonus: Another way to receive a temporary increase to your SpotMe limit is to receive a bonus given to you by Chime, usually for participating in a promotional campaign.

SpotMe helps you breathe easier

Chime’s SpotMe has been life-changing for some of our members and it can help you avoid overdraft fees.

It’s easy to enroll with qualifying direct deposits and there are no fees to use SpotMe, ever. Boosts are a nice bonus to add padding to your SpotMe limit.

Ready to make the most of SpotMe? Learn how Chime SpotMe has your back.