Disclaimer: The use of any Ally trademarks is for informational purposes only. Chime has no affiliation with Ally; neither Chime nor Ally sponsor or endorse the other. All information related to Ally within the article comes from publicly available sources.

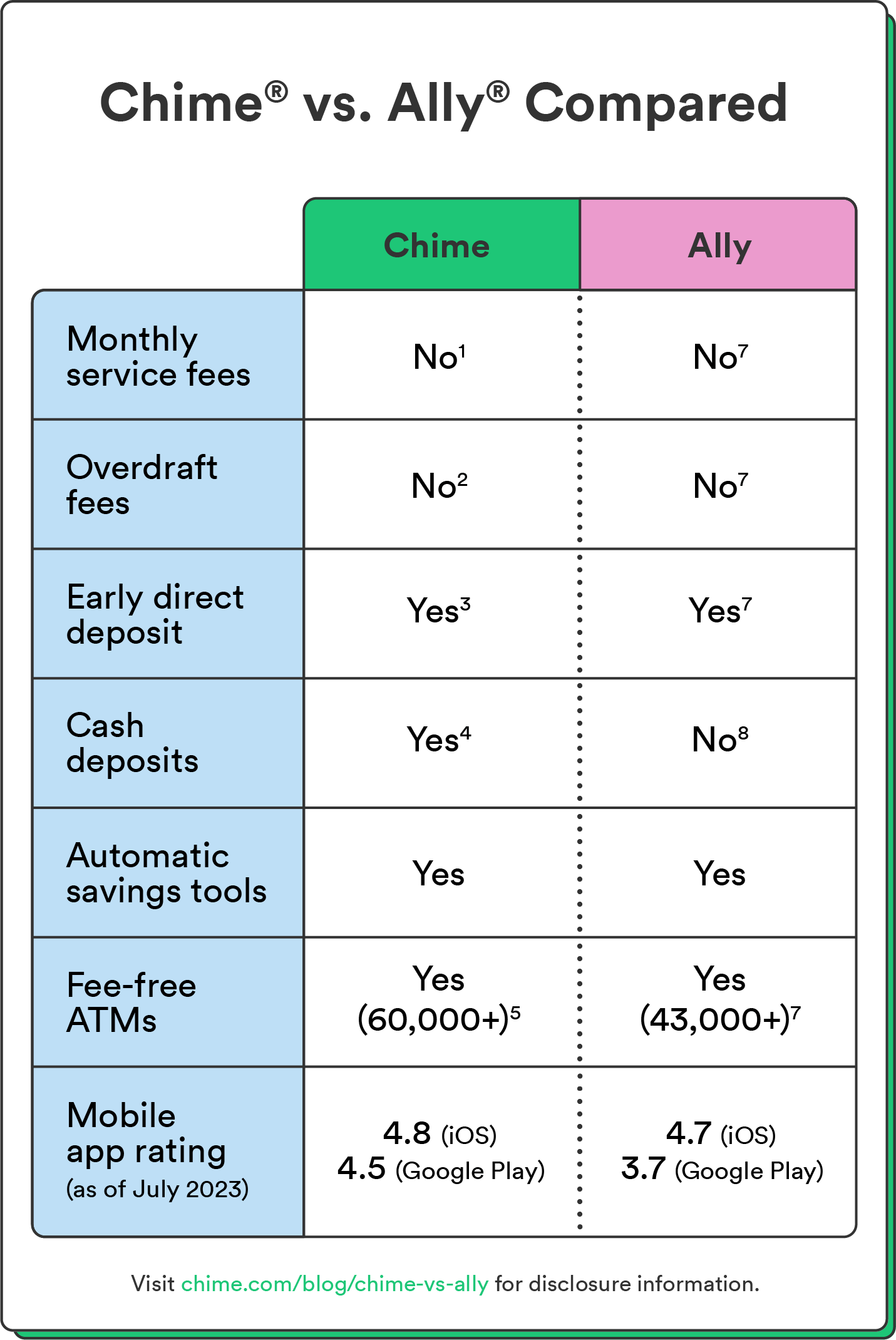

So, you’re ready to make the switch to an online banking platform but you don’t know which option is right for you? Chime and Ally are two popular choices with easy-to-use features and few fees, but how do they compare?

Chime and Ally differ in product offerings, rates, and unique features, and your choice will likely come down to what you want most in an online banking platform. Read on to learn more about Chime vs. Ally and what features to consider before you open a new account.

What is Chime®?

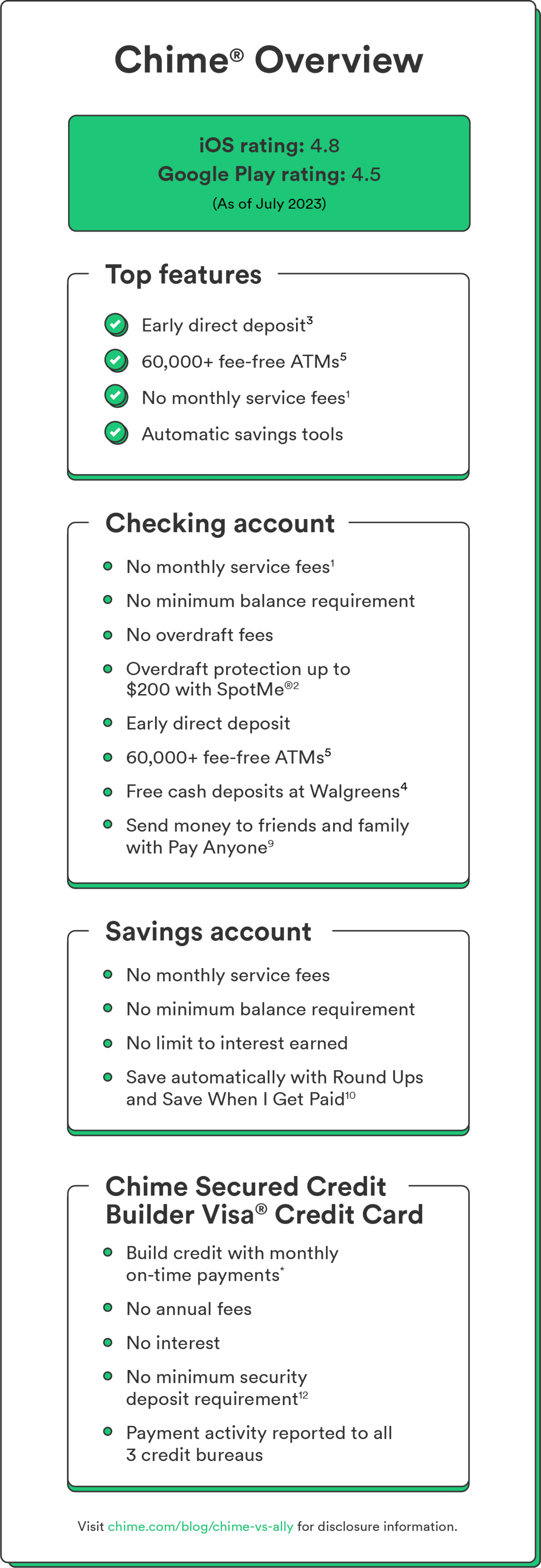

Chime is a financial technology company and app-based online banking platform that aims to make banking more accessible and affordable for everyone. With Chime, you can open a checking and savings account, deposit checks13 , send money to friends and family, and manage your finances all within the app.

Here’s a look at some of Chime’s top features:

- Access to paychecks up to 2 days early³ with direct deposit

- Fee-free overdrafts up to $200 with SpotMe®²

- Secured Chime Credit Builder Visa® Credit Card with no annual fees or interest6

- Automatic savings tools

- 50,000+ fee-free ATMs5

- Send money to family and friends with Chime Pay Anyone9

| Pros | Cons |

|---|---|

| Get paid up to 2 days early with direct deposit3 | No physical locations |

| No minimum balance requirements, ACH fees, or foreign transaction fees | No joint accounts |

| Free cash deposits at Walgreens®4 | Checking account required to open a savings account |

What is Ally®?

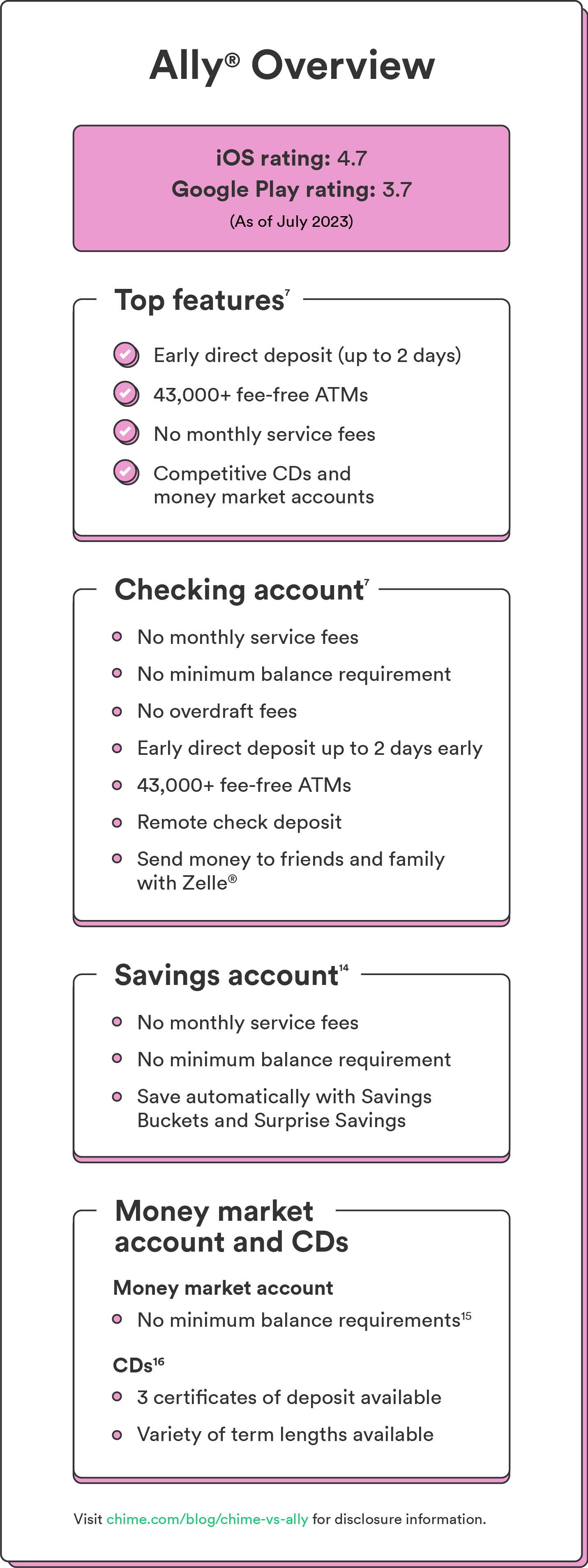

Ally is an online bank with easy-to-use online tools, low fees, and competitive interest rates. With Ally, you can open a checking and savings account, CDs, money market accounts, and investment accounts. Like Chime, everything Ally offers can be managed within the app.

Here’s a look at some of Ally’s top features:

- No minimum balance requirements for checking and savings accounts

- 3 high-yield CD options16

- Automatic savings tools like recurring transfers, Surprise Savings, roundups, and Savings Buckets and Boosters

- No overdraft fees and overdraft transfer service

- Access to paychecks up to two days early with direct deposit

- Remote check deposits

- 43,000+ fee-free ATMs

| Pros | Cons |

|---|---|

| Competitive savings and CD account APY | No cash deposits |

| No minimum deposit requirements7 | No physical locations |

| ATM fee reimbursement7 | International transaction fee7 |

Chime vs. Ally: Savings accounts

Both Chime and Ally offer low-cost savings accounts with competitive interest rates, and automatic savings tools, but there are a few differences to consider.

Chime offers a high-yield savings account with no minimum balance requirements or fees. Start saving to earn 2.00% Annual Percentage Yield (APY) on your deposits.17 It also offers built-in savings tools like the Round Ups feature, which automatically rounds up debit card purchases to the nearest dollar and transfers the difference to your savings account.18 Save When I Get Paid lets you automatically save a portion of each paycheck.19 You must open a Chime checking account to be eligible for a savings account.

Ally’s savings account currently offers a higher interest rate (4.00%) than Chime’s.14 There are also no minimum balance requirements, monthly maintenance fees, or overdraft fees.14

Ally offers built-in savings tools that function similarly to Chime. These include Round Ups, which round up purchases to the nearest dollar and transfer them to your savings account, and Surprise Savings, which monitors your checking account for extra funds and automatically transfers them to your savings account. Ally also offers a budgeting tool called Savings Buckets, which lets you organize your savings account into different categories (sort of like a digital envelope method).14

| Chime Savings Account20 | Ally Savings Account14 | |

|---|---|---|

| Annual percentage yield (APY) | 2.00% | 4.00% |

| Minimum opening deposit | $0 | $0 |

| Monthly service fees | $0 | $0 |

| Special features | Automatic savings tools like Round Ups and Save When I Get Paid | Automatic savings tools like Round Ups, Savings Buckets and Surprise Savings |

| Considerations | Must open a Chime checking account to enroll in a savings account | No way to deposit cash |

Chime vs. Ally: Checking accounts

Chime checking accounts are free to open, allow you to get paid up to 2 days early³ with direct deposit, and give you access to 50,000+ fee-free ATMs.5 You don’t have to worry about overdraft fees, as Chime doesn’t charge them – and if you enroll in the SpotMe feature, they’ll also cover the difference when you overdraft your account by up to $200.²

If you need to withdraw cash, you can get cash back when checking out at participating locations (including 7-Eleven, CVS, Walgreens, and Circle K), and you can deposit cash at any Walgreens location.4 Chime also doesn’t charge any foreign transaction fees.

Along with user-friendly features like the option to set up daily account balance updates and real-time transaction alerts, Chime also offers customizable security features to keep your account safe. You can block transactions if you lose your card and protect against unauthorized charges you don’t recognize.

Like Chime, Ally’s checking account is free to open, provides early direct deposit, and gives you access to 43,000+ fee-free ATMs.7 Ally also reimburses up to $10 in ATM fees per month. Ally’s checking account also earns 0.25% in interest.7

You can’t deposit cash directly into your Ally checking account.8 Instead, you’ll have to deposit cash in another account outside of Ally, then transfer the funds to your Ally account.

| Chime Checking Account1 | Ally Checking Account7 | |

|---|---|---|

| Annual percentage yield (APY) | None | 0.25% |

| Minimum opening deposit | $0 | $0 |

| Monthly service fee | $0 | $0 |

| Special features | Free cash deposits at Walgreens4 | Earns interest |

| Considerations | Doesn’t earn interest | Can’t deposit cash |

Chime vs. Ally: ATM access

Neither Ally nor Chime have physical bank locations, so ATM access is an important consideration when comparing Chime vs. Ally.

Chime has 50,000+ fee-free ATMs5 available for easy cash withdrawal. Withdrawal limits are up to $515 per day.21 In-network ATMs include any MoneyPass ATM in a 7-Eleven and any Allpoint or Visa Plus Alliance ATM in stores like CVS, Walgreens, Target, and Circle K. Members can also locate nearby ATMs in Chime’s app, making it easy to find a fee-free ATM wherever you are.

Ally has 43,000+ fee-free ATMs where users can withdraw cash.7 Withdrawal limits are up to $1,000 per day.22 Ally’s ATM network includes any Allpoint ATM, which you can find in stores like Costco, Walgreens, and Target. While you’ll have fewer ATM locations available with Ally, Ally does reimburse up to $10 at the end of the month for any out-of-network ATM fees you may accrue. Like Chime, Ally’s app allows you to locate nearby in-network ATMs.

| Chime | Ally | |

|---|---|---|

| In-Network ATMs | 50,000+5 | 43,000+7 |

| Withdrawal limits | Up to $515/day21 | Up to $1,000/day22 |

Chime vs. Ally: Customer service

Chime offers 24/7 customer support through phone and chat. Users can reach out for anything from technical issues to specific account questions. For broader questions, Chime’s FAQ page and Chime Guides serve as quick reference points for common questions.

Ally also offers 24/7 customer support through phone and chat. Their Help & FAQs page also covers common questions for different account topics.

| Chime | Ally | |

|---|---|---|

| Phone support: | Yes (24/7) | Yes (24/7) |

| Chat support: | Yes (24/7) | Yes (24/7) |

Chime vs. Ally: Other financial products

Chime and Ally also offer some different financial products that are worth considering.

For members looking to build credit, Chime offers a secured credit card called the secured Chime Credit Builder Visa Credit Card. Like Chime’s other accounts, there are no annual fees or interest.5 As well, there’s no credit check required to apply, giving those with poor credit an accessible way to possibly improve their credit.

Use Chime’s Credit Builder card for everyday purchases wherever Visa credit cards are accepted. Chime reports payments to all three major credit bureaus to help you build credit over time. Start building credit with everyday purchases and on-time payments.

Ally also offers certificates of deposit (CDs) and money market accounts (MMAs). Ally has three different CDs: High-yield CDs, Raise Your Rate CDs, and No Penalty CDs. Each comes with different APYs ranging from 3.75% to 5.00% and a variety of terms to choose from.16 As for Ally’s money market account, it comes with a 4.15% APY and no monthly fees.15 There are also no minimum balance requirements.

Find the best online platform for your banking

Both Chime and Ally are dependable choices if you’re after an online platform for your banking. Your choice between Chime vs. Ally ultimately comes down to personal preferences and the features that best align with your financial goals.

Chime may be best suited for those who want a simple, low-cost way to streamline their finances, improve or establish credit, and an easy way to save more money with automatic savings tools. Ally may appeal most to those interested in competitive interest rates and a wider range of financial products like money market accounts or CDs.

FAQs about Chime vs. Ally

Still have questions about Chime vs. Ally? Find answers below.

Is Chime or Ally better?

Whether Chime or Ally is better comes down to your individual needs. If your priority is finding an affordable online banking platform for everyday checking and savings, helpful savings tools, and credit-building resources, you may prefer Chime. If you want access to other financial products like money market accounts or CDs, you’ll likely favor Ally.

Is Chime FDIC insured?

Deposits in Chime accounts are FDIC insured up to $250,000 per depositor through its partner banks, Stride Bank, N.A. or The Bancorp Bank, N.A., Members FDIC.

How do I deposit cash with Ally?

Ally doesn’t accept direct cash deposits. Instead, you can make a deposit in your account through a remote check deposit or online transfers from another bank account.8

Where can you deposit cash for Chime?

You can find Chime deposit locations at over 8,500 Walgreens locations and 75,000+ retail locations overall, including 7-Eleven, Walmart, and CVS.

How long does Chime take to deposit a check?

Most mobile check deposits post within five business days.13 Direct deposits from your employer or payer, on the other hand, are posted to your Chime checking account as soon as they are received.

Why should I switch to Chime?

You may want to switch to Chime if you’re looking for an intuitive mobile-first banking experience with no monthly fees, access to your paycheck up to 2 days early with direct deposit³, and access to a secured credit card.

Will I ever be charged an overdraft fee through Chime?

No. If you do not have sufficient funds in your Chime Checking Account, or have reached your SpotMe® limit (if enrolled), then your Chime Visa Debit Card will be declined. There is no fee for declining transactions or for utilizing SpotMe.