Chime® is a financial technology company, not an FDIC-insured bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply.The Chime Visa® Debit Card and the secured Chime Credit Builder Visa® Credit Card are issued by The Bancorp Bank, N.A. or Stride Bank, N.A., pursuant to licenses from Visa U.S.A. Inc. and may be used everywhere Visa debit or credit cards are accepted. Please see back of your Card for its issuing bank.

Chime Checkbook: While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere. See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.

By clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. The privacy practices of those third parties may differ from those of Chime. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices.

Third-party trademarks referenced for informational purposes only; no endorsements implied.

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. and Stride Bank, N.A. (“Banks”). Banks are not responsible for the accuracy of any content provided by author(s) or contributor(s).

This guide is for informational purposes only. Chime does not provide financial, legal, or tax advice. You should check with your legal, financial, or tax advisor for advice specific to your situation.

¹ Information from FICO's "The Perfect Credit Score: Understanding the 850 FICO score" as of May 15, 2024: https://www.fico.com/blogs/perfect-credit-score-understanding-850-fico-score

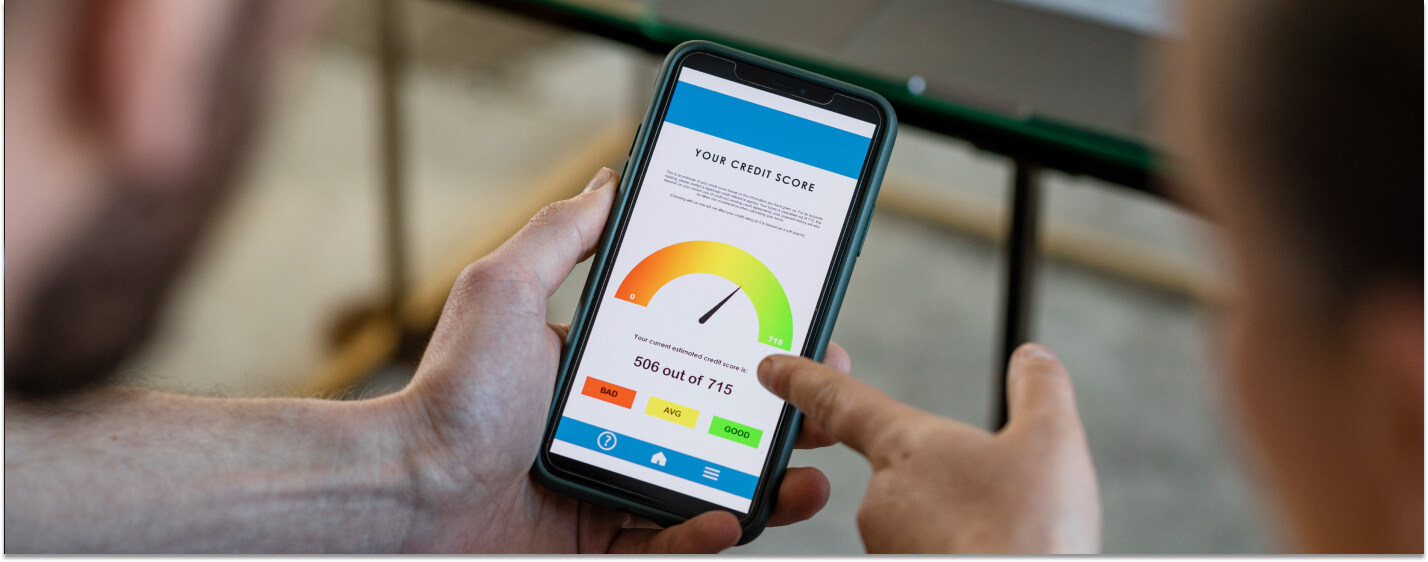

² FICO® Scores are developed by Fair Isaac Corporation. The FICO Score provided by ConsumerInfo.com, Inc., also referred to as Experian Consumer Services ("ECS"), in Experian CreditWorks℠, Credit Tracker℠ and/or your free Experian membership (as applicable) is based on FICO Score 8, unless otherwise noted. Many but not all lenders use FICO Score 8. In addition to the FICO Score 8, ECS may offer and provide other base or industry-specific FICO Scores (such as FICO Auto Scores and FICO Bankcard Scores). The other FICO Scores made available are calculated from versions of the base and industry-specific FICO Score models. There are many different credit scoring models that can give a different assessment of your credit rating and relative risk (risk of default) for the same credit report. Your lender or insurer may use a different FICO Score than FICO Score 8 or such other base or industry-specific FICO Score, or another type of credit score altogether. Just remember that your credit rating is often the same even if the number is not. For some consumers, however, the credit rating of FICO Score 8 (or other FICO Score) could vary from the score used by your lender. The statement that "90% of top lenders use FICO Scores" is based on a third-party study of all versions of FICO Scores sold to lenders, including but not limited to scores based on FICO Score 8. Base FICO Scores (including the FICO Score 8) range from 300 to 850. Industry-specific FICO Scores range from 250-900. Higher scores represent a greater likelihood that you'll pay back your debts so you are viewed as being a lower credit risk to lenders. A lower FICO Score indicates to lenders that you may be a higher credit risk. There are three different major credit reporting agencies — the Experian credit bureau, TransUnion® and Equifax® — that maintain a record of your credit history known as your credit report. Your FICO Score is based on the information in your credit report at the time it is requested. Your credit report information can vary from agency to agency because some lenders report your credit history to only one or two of the agencies. So your FICO Score can vary if the information they have on file for you is different. Since the information in your report can change over time, your FICO Score may also change.Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn More

³ Information from TransUnion's "What Is a Good Credit Score" as of May 15, 2024: https://www.transunion.com/blog/credit-advice/whats-considered-a-good-credit-score

⁴ Information from myFICO's "What's in my FICO Scores?" as of May 15, 2024: https://www.myfico.com/credit-education/whats-in-your-credit-score

⁵ Information from Equifax's "What are the benefits of knowing your VantageScore 3.0 credit score" as of May 15, 2024: https://www.equifax.com/personal/education/credit/score/articles/-/learn/benefits-of-knowing-vantagescore/

⁶ Information from U.S. Equal Employment Opportunity Commission's "Pre-Employment Inquiries and Financial Information" as of May 15, 2024: https://www.eeoc.gov/pre-employment-inquiries-and-financial-information

⁷ Information from FICO's "Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds" as of May 15, 2024: https://www.fico.com/blogs/average-us-fico-score-717-more-consumers-face-financial-headwinds

⁸ Information from Equifax's "What Is the Average Credit Score by State" as of May 15, 2024: https://www.equifax.com/personal/education/credit/score/articles/-/learn/average-credit-score-state/

⁹ Information from Experian's "Does Credit Utilization Matter if You Pay in Full?" as of May 15, 2024: https://www.experian.com/blogs/ask-experian/does-credit-utilization-matter-if-you-pay-in-full/

¹⁰ Information from Experian's "How Long to Wait Between Credit Card Applications" as of May 15, 2024: https://www.experian.com/blogs/ask-experian/how-long-to-wait-between-credit-card-applications/

¹¹ Information from the Consumer Report's "Consumer Reports Investigation Finds More Than One-Third of Consumers Found Errors in Their Credit Reports" as of May 15, 2024: https://www.consumerreports.org/media-room/press-releases/2021/06/consumer-reports-investigation-finds-more-than-one-third-of-consumers-found-errors-in-their-credit-reports/

Address: 101 California Street, Floor 5, San Francisco, CA 94111, United States.

No customer support available at HQ. Customer support details available on the website.

© 2013-2025 Chime Financial, Inc. All rights reserved.