Pay yourself first is an often-repeated personal finance rule that encourages saving before you pay bills or spend anything. You can build a positive money habit by moving cash to savings as soon as your paycheck hits your bank account.

The question is, how much of your paycheck should you save?

You might aim for a set dollar amount or a percentage of your take-home pay. Regardless, figuring out how to save money can be challenging when you have bills and other expenses that need your attention.

Let’s look at some saving strategies to help you hang on to more of your money.

How much you should save from every paycheck?

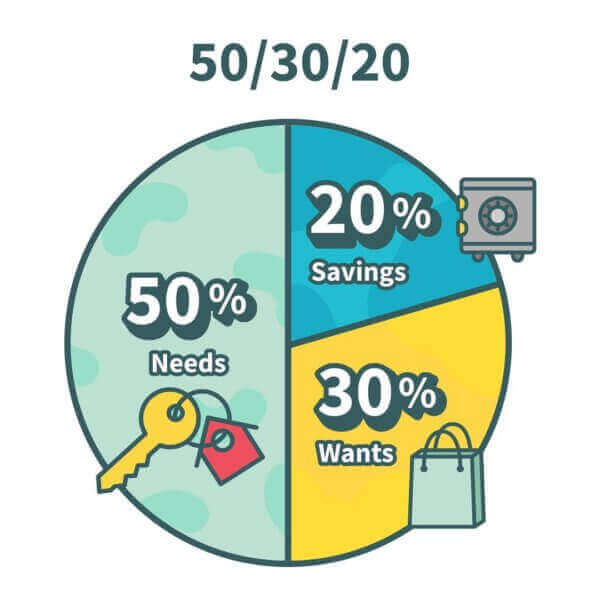

Everyone’s paycheck and bills are different but there’s a universal rule you can apply to decide how much to save monthly. It’s called the 50 30 20 rule, a simple way to divide your paychecks to include room for saving.

Here’s how it works:

- 50% of your income goes to essential expenses

- 30% of your income is earmarked for spending

- 20% of your income is dedicated to saving (and debt repayment, if that applies to you)¹

You can use the 50 30 20 rule to budget any amount of money.

For example, how much should you save a month if your take-home pay is $5,000? According to the 50/30/20 budget plan, you’d save $1,000 ($5,000 x 0.20).

It’s that easy to set a savings target. You can also apply the same principle using other percentage-based budget systems, including:

- 80/20 method: 80% to expenses; 20% to savings and investments

- 70/20/10 method: 70% to needs; 20% to savings; 10% to wants

- 60/30/10 method: 60% to needs; 30% to wants; 10% to savings

Each of these budget systems can be used alongside the zero-based method, which requires you to assign every dollar of income a job with nothing left over. You can use a budget calculator to determine how much money should go into each bucket.

How to save money while living paycheck to paycheck

Living paycheck to paycheck can leave little room for savings if money goes out as quickly as it comes in. These saving strategies can help you find a little extra in your budget to save.

- Cut down on spending where possible. Reducing spending can instantly add money back to your budget that you could save. Review your expenses and consider what you can reduce or eliminate. For example, if you pay for any streaming services could you cancel one or all of them? Even if you free up just $10 a month, that’s an extra $10 you have to build a savings cushion.

- Manage your debt. Debt can drain your ability to save if you’re juggling multiple payments to credit cards or loans. If you can’t pay your debt off in full right now, ask yourself what you could do to make it less expensive. Refinancing student loans, for example, can help you get a lower interest rate. This can also lower your monthly payment and save you money in the long run, ultimately giving you more money in your budget to save. The same is true for transferring high-interest credit card debt to a balance transfer card with a 0% introductory promotional rate.

- Enroll in automatic savings. Saving is a learned habit for most people and setting up automatic transfers can help to reinforce it. Use direct deposit to separate your paycheck into multiple bank accounts if that’s an option to automatically grow your emergency fund. If your job doesn’t offer direct deposit consider an automatic savings transfer from checking to savings each payday.

- Improve your financial knowledge. Learning more about money can help you develop the skills and strategies you need to save consistently. For example, if you have a retirement plan at work do you contribute enough to get the full match from your employer if they offer one? If you want to open a savings account, do you know how to compare rates and fees to find the right one? Those are just some of the ways financial know-how can benefit you.

How to divide your savings

When you’re talking about how much of your paycheck you should save, it’s also important to think about where that money goes. If you have multiple financial goals you’re saving for, then it makes sense to separate those funds into distinct pots.

Your savings account

A savings account is designed to hold money that you don’t plan to spend right away. Savings accounts are a good place to store your sinking funds if you include them in your budget.

Sinking funds are savings funds for designated uses. So, for example, you might have sinking funds for:

- Home maintenance or vehicle maintenance

- Holidays and birthdays

- Insurance premiums you pay biannually or annually

- Pet care

- New furniture

You can use sinking funds to plan for one-time expenses or recurring expenses that you only pay a few times a year. You can open a savings account for each of your sinking funds or choose one savings account that allows you to set up subaccounts for different goals.

Your retirement account

Retirement accounts help you save money for the future while enjoying some tax benefits. Those benefits may include tax-deductible contributions or tax-free withdrawals when you retire.

Here are some ways to maximize retirement plan savings, even on a small budget.

- If you have a 401(k) or similar retirement plan at work, contribute enough to get the full company match if one is offered.

- Get an annual raise? Increase your 401(k) contribution annually by the same amount each year.

- Consider opening a traditional or Roth Individual Retirement Account (IRA) and setting up automatic contributions monthly. You can save up to $7,000 in an IRA for 2024 and 2025, or $8,000 if you’re 50 or older.²

Your emergency fund

An emergency fund is money you save for emergencies only. Examples of emergency expenses include:

- Unexpected vet bills

- A car repair you didn’t plan for

- Temporary loss of income due to a layoff

- Unplanned home repairs

Where to keep your emergency fund? Ideally, you keep this money in a savings account that’s separate from your sinking funds but still linked to your checking account for easy transfers.

How much to save for emergencies? Three to six months’ worth of expenses is a common rule of thumb but if you’re just getting started, you might aim smaller.

For instance, you could set a goal to save a $500 emergency fund. Once you hit that, you can bump it up to $1,000 and continue raising the target until your emergency savings is fully funded.

Slow and steady wins the savings race

How much of your paycheck should you save? The simple answer is as much as you can comfortably set aside, while still having money to pay bills, cover expenses, and repay debt.

If you struggle with budgeting, using an app can simplify expense and income tracking. Learn which budgeting apps rate the best for managing your money.

FAQs

What if I can’t save 20% of my paycheck?

For those living paycheck to paycheck, saving 20% of their salary sounds impossible, and this might well be the case. If you can’t reach the industry benchmark, you might feel like giving up completely. But remember: Saving something is better than saving nothing.

If saving is a struggle, commit to setting aside 1% of your paycheck after taxes. Yes, just 1%. For example, if your paycheck after taxes is $2,300, you’d save $23 each month. Even this relatively small amount will, over time, help you break the cycle of living paycheck to paycheck and provide a financial cushion in case of an emergency or unexpected expense.

Where should I keep my savings?

Different savings goals may fit different savings accounts. For short-term savings goals, consider keeping your money in a high-yield savings account to help maximize your contributions while remaining flexible, if you need the funds in a pinch.

How much money should I put toward investing each month?

If you find yourself with some extra dollars left over after your expenses and savings are taken care of, you may consider investing those funds. For example, a low-risk investment option may be a simple way to make your money work for you. Before investing, consider all your investment options, and choose the opportunity that best meets your needs.

There’s no specific amount you should worry about putting toward investing. Focus on your savings goals first, and then add investing once you feel comfortable with what you have put away.

How much does the average American have in savings?

According to the Federal Reserve, the typical American family has approximately $62,500 in savings. But the median savings per family is $8,000. Again, don’t take these numbers too seriously, as every individual’s financial circumstances differ, and it’s best to concentrate on the money you are bringing in and the steps you can take to save it each month.³