Banking That Has Your Back

Scroll to the bottom for details on SpotMe¹, early pay day², fees³ & Annual Percentage Yield⁴.

Already have an account?Learn how we collect and use your information by visiting our Privacy Notice

Chime is an award-winning mobile banking app and debit card

350,000+ 5-Star app reviews

Fee-free Overdraft

Traditional banks took $11 Billion in overdraft fees in 2019.⁷ At Chime, we do things differently. We will allow you to overdraw up to $100¹ on debit card purchases without charging a fee.

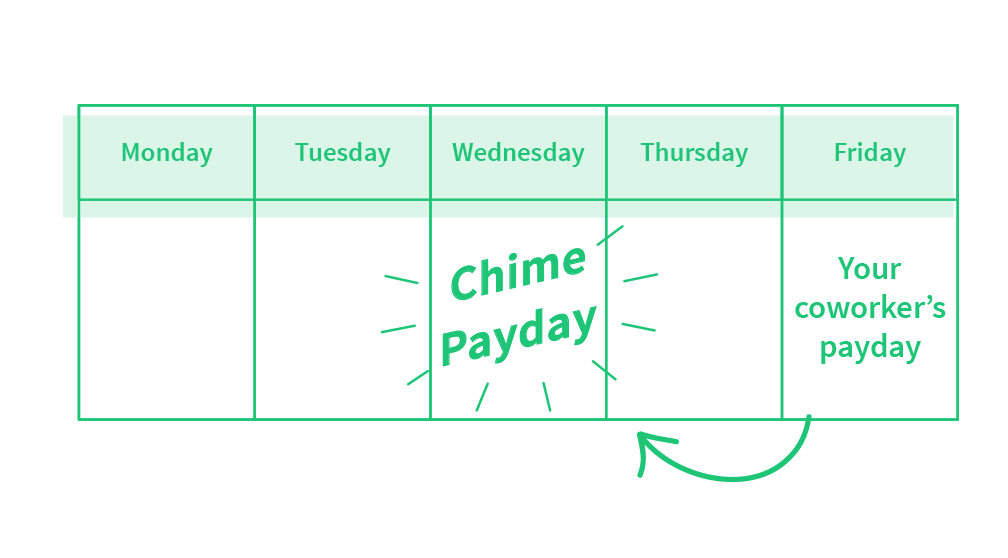

Get your paycheck early

Set up Direct Deposit and receive your paycheck up to 2 days earlier than your co-workers!²

Say goodbye to unnecessary bank fees.

No overdraft fees. No minimum balance requirements. No monthly service fees. No foreign transaction fees. No transfer fees. Over 38,000 fee-free MoneyPass® and Visa® Plus Alliance ATMs.³

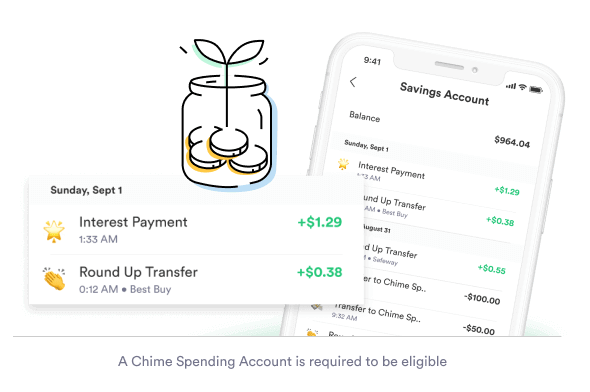

Make your money grow fast.

0.50% Annual Percentage Yield (APY)⁴. Set money aside with Automatic Savings features. And never pay a fee on your Savings Account.

Security and control on the go.

Chime’s mobile app makes branchless banking a breeze. Manage your money and account on the go, wherever you go.

Your funds are FDIC insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

Shop worry-free at millions of merchants. Chime debit cards are protected by the Visa Zero Liability.⁶ Policy to ensure that cardholders will not be responsible for unauthorized charges.

Over 38,000 fee-free ATMs and 30,000 cash-back locations.

Real-time alerts for every banking transaction.

Automatic Savings takes the effort out of saving.

No minimum, monthly, or overdraft fees.