Your money,

with less fees

A checking account with $0 monthly fees, $0 overdraft fees, and no opening deposit.

Learn how we collect and use your information by visiting our

Your account shouldn’t cost you money

no monthly fees

no overdraft fees

no minimum balance requirement

no foreign transaction fees

no transfer fees

Get paid up to 2 days earlyˆ with direct deposit

Over 50k fee-free ATMs˜

Fee-free overdraft up to $200*

24/7 live support, with a real human

Safe, secure & trusted by millions

Your funds are FDIC insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC† and we keep your money safe and secure with periodic security tests of our systems.

Make the switch today

FAQs

What is Chime®?

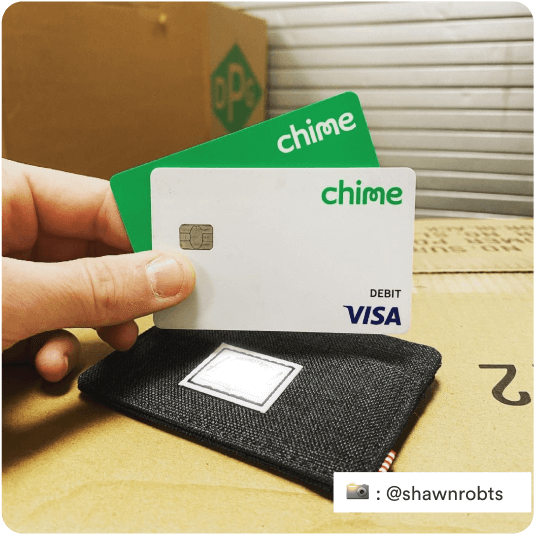

At Chime, we’ve created a new approach to online banking that doesn’t rely on fees~, gets you your paycheck up to 2 days early with direct deposit^ , and helps you grow your savings automatically. When you open a bank account through Chime, you get a Visa® Debit Card and a Checking Account that can be managed entirely from your smartphone, plus an optional Savings Account that helps you grow your savings automatically! The Chime mobile banking app is available on both Android and iOS.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC.

What is Chime's mission?

Our mission is to unite everyday people to Unlock Financial Progress™. We’re doing that by changing the way people feel about banking. Chime’s business was built on the principle of protecting our members and making managing your money easy. We’ll never profit from your misfortune or mistakes and everything we build is focused on improving our member’s lives.

Who can use Chime?

U.S. Citizen or legal resident of the United States 18 years and older are welcome to apply! While Chime cards work all over the world, currently we can only offer accounts to members with a valid SSN, living in the United States and District of Columbia.

How does Chime make money?

Chime makes money from the interchange fee charged on card transactions. Every time you use your Chime Visa® Debit Card or Credit Builder Secured Credit Card for purchases and paying bills, Visa processes the transaction and charges an interchange fee to merchants for the service. Chime receives a portion of this fee. This is how Chime can continue building new and better products that help members get the most from their money.

When do I receive my Chime Visa® Debit Card after I open a Chime Checking Account?

After you open a Checking Account, we get started on personalizing your new Chime Visa Debit Card. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Checking Account. It can take 5 to 10 business days for your Chime Visa Debit Card to arrive at your home address.

If you don’t have your Chime Visa Debit Card within 10 business days after opening your Checking Account, please contact our Member Services team at 1-844-244-6363.

Does Chime charge any fees?

We have no fees to sign up, no overdraft, no monthly service fees, no minimum balance fees, and no card replacement fees either. We do charge one fee ($2.50) when you get cash from either an over the counter withdrawal, or an out-of-network ATM that is not part of Chime’s fee-free network of 50,000+ ATMs.

How many ATMs accept the Chime debit card?

You can get cash at more than 50,000+ fee-free ATMs* – more than the top 3 national banks combined¹! Including ATMs at popular retail stores like Walgreens®, CVS®, 7-Eleven®, Circle K®, and Target®.

Get fee-free transactions at any Moneypass® ATM in a 7-Eleven location and at any Allpoint® or Visa® Plus Alliance® ATM. Otherwise, out-of-network ATM withdrawal fees may apply.

Will I ever be charged an overdraft fee?

No. If you do not have sufficient funds in your Chime® Checking Account, or have reached your SpotMe² limit (if enrolled), then your Chime Visa® Debit Card will be declined. There is no fee for declining transactions or for utilizing SpotMe®.