Better online banking

Online banking through Chime®

- No minimum balance requirement or monthly service fees

- Manage money 24/7 with the #1 Most Loved Banking App1

- Get paid up to two days early2 with direct deposit

- Deposit checks from anywhere3

Learn how we collect and use your information by visiting our Privacy Notice

Seamless online banking app.

No tellers, no lines, no buildings. Just a super-powered app. Chime makes managing your online bank accounts easy and empowering. Our beloved banking app delivers all the tools you need, right at your fingertips.

Online banking through Chime vs. traditional banks

Open an online bank account through Chime.

No credit check. No opening deposit requirement. No hassle. And did we mention it only takes 2 minutes?

Direct deposit and get Chime+ for free.

Unlock even more Chime benefits when youset up a qualifying direct deposit‡.

Online banking through Chime

Does Chime do online banking?

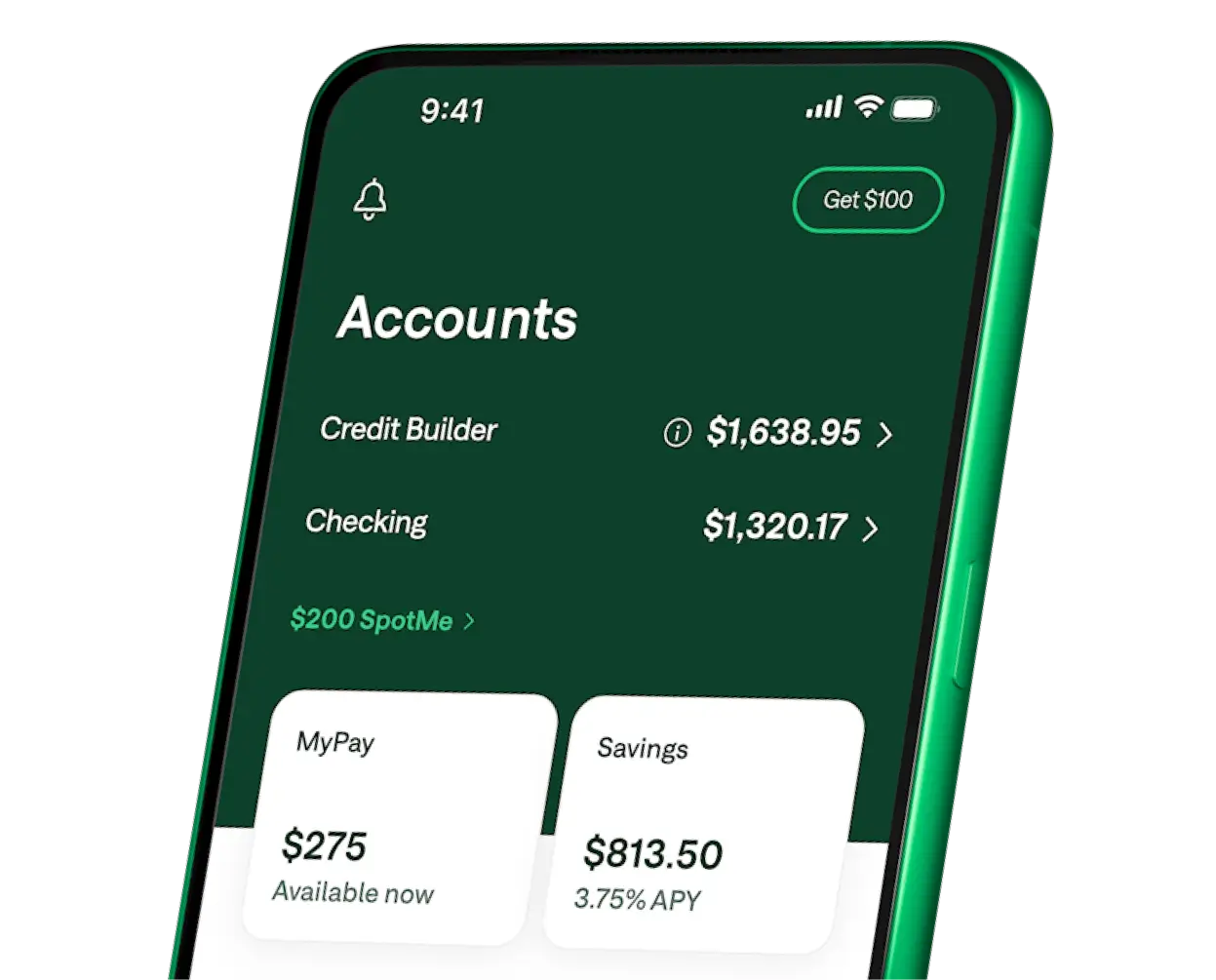

Chime offers online banking services through our partner banks, The Bancorp Bank, N.A. or Stride Bank, N.A.. Through Chime, you can open a checking account with no monthly fees and a high-yield savings account with automatic savings features. You can also apply for the Chime Credit Builder Secured Visa® Credit Card⁷ when you receive a qualifying direct deposit.

With Chime, you’ll manage your account online via a computer or through our mobile app. The mobile app is easy to use. It’s the #1 Most Loved Banking App.¹

How do you open a checking account online through Chime?

Apply in 2 minutes to start online banking through Chime. The process is straightforward as long as you have your email address and a valid physical home address. After Chime reviews and confirms your information, you’re in! Note: All members must be U.S. citizens and at least 18 years of age.

Chime offers online checking, savings, and secured credit card accounts along with a mobile banking app. You can download the app for free from the Google Play Store or Apple App Store. You can connect your existing bank account to transfer funds or set up direct deposit. You can also log in to online banking at chime.com when you need it.

Once enrollment is completed, we’ll send a Chime Visa® Debit Card in the mail to the address you provided. Your new debit card typically arrives in 7-10 business days.

Read our blog for more information on how to open your online bank account through Chime, manage your money with our mobile app, and take advantage of our user-friendly features.

What banks partner with Chime?

Chime is a financial technology company that offers banking services through two banking partners: The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC. Because Chime partners with these banks, deposits in your Chime accounts are FDIC-insured.6

How do I deposit money into my Chime account online?

When you sign up for Chime, you can easily move money into your account online. Just link an external bank account to set up a transfer. To continue to get money in your Chime account, set up direct deposit from your employer or payroll provider.

You can also deposit cash10 fee-free at thousands of Walgreens locations around the country – or at other retailer locations, including Walmart, CVS, and 7-Eleven, for a fee. The retailer that receives your cash will be responsible to transfer the funds for deposit into your Chime Checking Account.

Still have questions? Read our full guide on how to move money into Chime.

Can I transfer money between accounts using online banking?

Yes, with Chime you have a few options for transferring money using online banking.

- Transfer funds between your Chime accounts (like between your checking and saving accounts).

- Send money to other bank accounts using the Pay Anyone feature.

- Link external bank accounts to make transfers in and out of your Chime account.

These transfers are quick and can be completed via the Chime app or website.

How do I open a bank account online?

Many banks now allow new members to apply for checking, savings, and other types of accounts online.

The process can vary depending on where you choose to open an account. Decide what’s important to you: Access to in-person locations? 24/7 customer support? These answers can help you decide where to open a bank account and what type of account you would like to open.

Once you choose an account, collect whatever personal documents and identifying information the institution requires. Some online banking accounts require a copy of ID like a driver’s license.

For more information, find out everything you need to open a bank account.

Then, just follow the instructions on the online application, submit your personal information, and verify your identity. That’s it! You can then fund your account and start using your online bank account.

What do I need to open an online bank account?

Financial institutions that allow you to open accounts online will likely ask for the following information for you to open an account:

- Email address

- Valid home address

- Phone number

Some institutions may require a valid photo ID, such as a driver’s license, and proof of residence, such as a utility bill.

What is the best online bank account?

At the end of the day, you should choose an online bank account that has the services and features that are most important to you. For example, if access to fee-free ATMs or overdraft coverage are the main features you are looking for, prioritize online accounts that offer these features. There is no one “best” online bank account.

Is a credit check required to open a bank account online?

No, a credit check is generally not required to open standard checking or savings accounts online. Instead, it’s more likely that a financial institution might review your ChexSystems report, which will detail your banking history and include information about past overdrafts and fees.

How does online banking work?

Online banking means you manage your bank accounts using an online platform on your computer or an app on your mobile device. You can sign up for the account online, transfer funds from external accounts, set up direct deposit, and find ATMs near you to withdraw money when needed.

Common features of online banking include mobile check deposits and automatic savings tools. If you open a high-yield savings account online, you can typically expect an interest rate higher than the industry average. Online checking accounts often have no monthly fees and no minimum balance requirement.

Is online banking safe?

Yes, online banking is generally safe, but it’s important to take steps to protect yourself. When registering your online bank account, create a strong password and enable two-factor authentication. Additionally, always remember to log out of your account once you’re done and avoid accessing your account on public WiFi.

Chime takes your financial data seriously. Our security program follows a set of standard industry practices deployed by other leading companies to protect members and combat fraud.

What are the advantages of online banking?

Online banking has many advantages, including.

- Higher interest rates: Online banks and fintechs can often offer high APYs on checking and savings accounts.

- Low or no fees: Online banking accounts and services often have no monthly fees.

- 24/7 access: With a website and mobile app, you can access your account whenever and wherever you want. Many online banks and fintechs also offer 24/7 customer support.

- Unique features: Online banks and fintechs may offer automatic savings tools, mobile check deposits, and in-app peer-to-peer payments.

- Easy ATM access: Because online banks and fintechs don’t have physical branches, many join extensive ATM networks. These make it easier for customers to withdraw cash quickly and conveniently.

How do I do online banking on my phone?

To access your bank account on your phone, download and log into your account’s mobile app. Each financial institution’s mobile app works differently but typically offers features like mobile check deposit, instant transaction alerts, and ATM finders.

Chime’s mobile app allows you to set up two-factor and fingerprint authentication for added security. You can fully manage your Chime account within the app – everything from setting up direct deposit to opening a savings account.